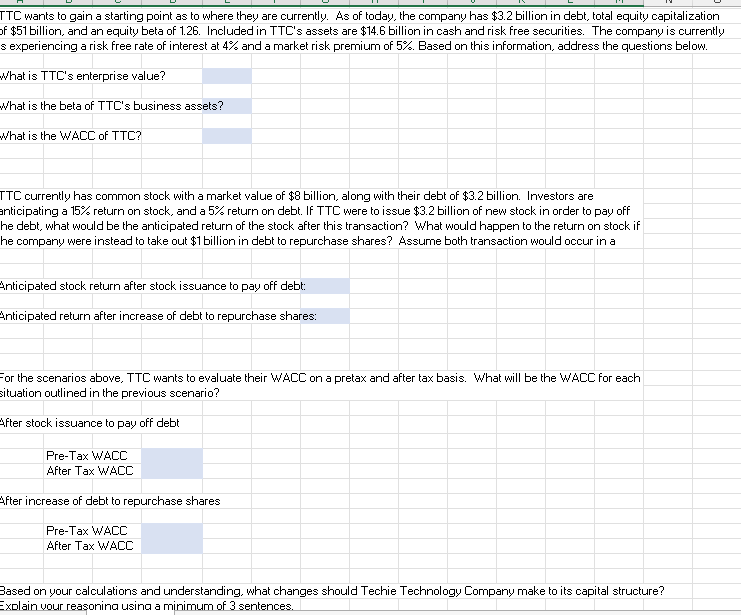

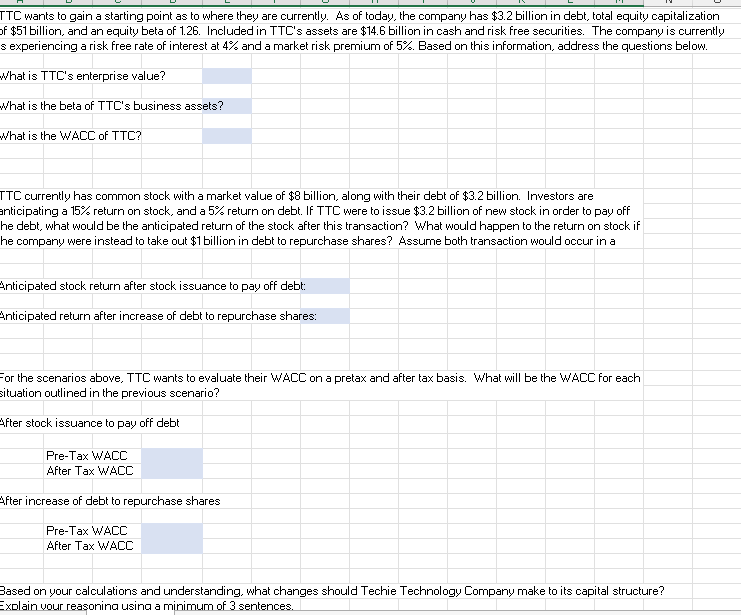

Techie Technology Company (TTC) is a publicly traded technology company that specializes in the creation and maintenance of finance and its capital structure. These changes include issuing new stock to pay back debt, attaining new debt to buy back stock equity, and the tax impacts of each decision. Information on the different scenarios is outlined below. of $51 billion, and an equity beta of 1.26. Included in TTC's assets are $14.6 billion in cash and risk free securities. The company is currently is experiencing a risk free rate of interest at 4% and a market risk premium of 5%. Based on this information, address the questions below. TTC wants to gain a starting point as to where they are currently. As of today, the company has $3.2 billion in debt, total equity capitalization of $51 billion, and an equity beta of 1.26. Included in TTC's assets are $14.6 billion in cash and risk free securities. The company is currently s experiencing a risk free rate of interest at 4% and a market risk premium of 5%. Based on this information, address the questions below. What is TTC's enterprise value? What is the beta of TTC's business assets? What is the WACC of TTC? TTC currently has common stock with a market value of $8 billion, along with their debt of $3.2 billion. Investors are anticipating a 15% return on stock, and a 5% return on debt. If TTC were to issue $3.2 billion of new stock in order to pay off he debt, what would be the anticipated return of the stock after this transaction? What would happen to the return on stock if he company were instead to take out $1 billion in debt to repurchase shares? Assume both transaction would occur in a Anticipated stock return after stock issuance to pay off debt: Anticipated return after increase of debt to repurchase shares: For the scenarios above, TTC wants to evaluate their WACC on a pretax and after tax basis. What will be the WACC for each situation outlined in the previous scenario? After stock issuance to pay off debt Pre-Tax WACC After Tax WACC After increase of debt to repurchase shares Pre-Tax WACC After Tax W/ACC Based on your calculations and understanding, what changes should Techie Technology Company make to its capital structure? Techie Technology Company (TTC) is a publicly traded technology company that specializes in the creation and maintenance of finance and its capital structure. These changes include issuing new stock to pay back debt, attaining new debt to buy back stock equity, and the tax impacts of each decision. Information on the different scenarios is outlined below. of $51 billion, and an equity beta of 1.26. Included in TTC's assets are $14.6 billion in cash and risk free securities. The company is currently is experiencing a risk free rate of interest at 4% and a market risk premium of 5%. Based on this information, address the questions below. TTC wants to gain a starting point as to where they are currently. As of today, the company has $3.2 billion in debt, total equity capitalization of $51 billion, and an equity beta of 1.26. Included in TTC's assets are $14.6 billion in cash and risk free securities. The company is currently s experiencing a risk free rate of interest at 4% and a market risk premium of 5%. Based on this information, address the questions below. What is TTC's enterprise value? What is the beta of TTC's business assets? What is the WACC of TTC? TTC currently has common stock with a market value of $8 billion, along with their debt of $3.2 billion. Investors are anticipating a 15% return on stock, and a 5% return on debt. If TTC were to issue $3.2 billion of new stock in order to pay off he debt, what would be the anticipated return of the stock after this transaction? What would happen to the return on stock if he company were instead to take out $1 billion in debt to repurchase shares? Assume both transaction would occur in a Anticipated stock return after stock issuance to pay off debt: Anticipated return after increase of debt to repurchase shares: For the scenarios above, TTC wants to evaluate their WACC on a pretax and after tax basis. What will be the WACC for each situation outlined in the previous scenario? After stock issuance to pay off debt Pre-Tax WACC After Tax WACC After increase of debt to repurchase shares Pre-Tax WACC After Tax W/ACC Based on your calculations and understanding, what changes should Techie Technology Company make to its capital structure