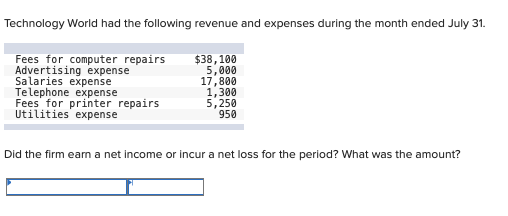

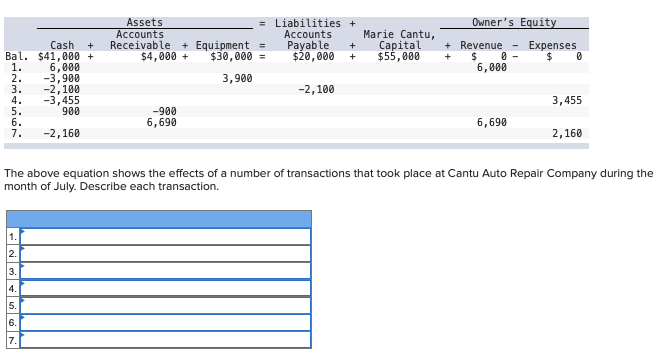

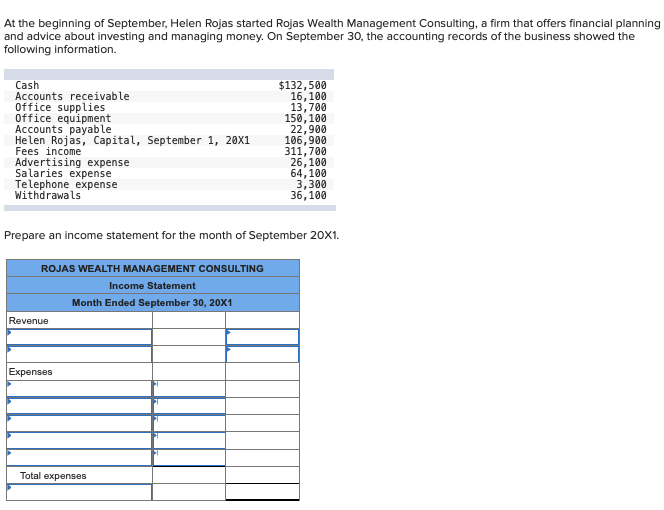

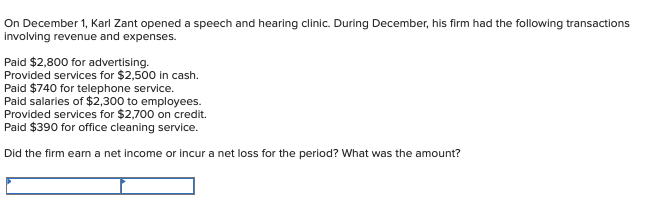

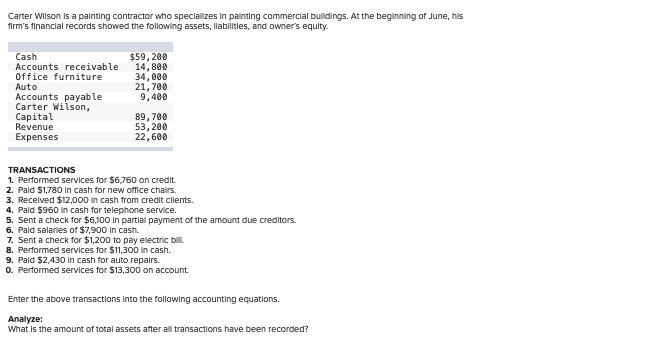

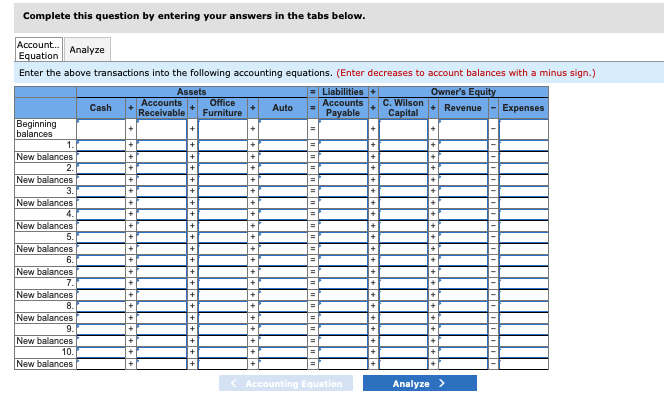

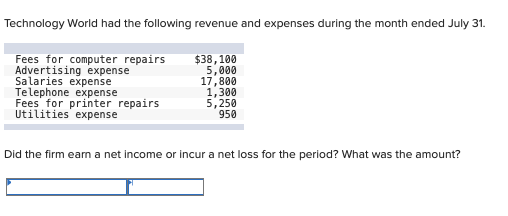

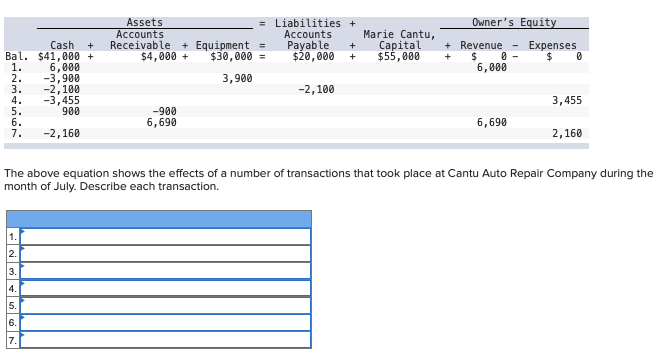

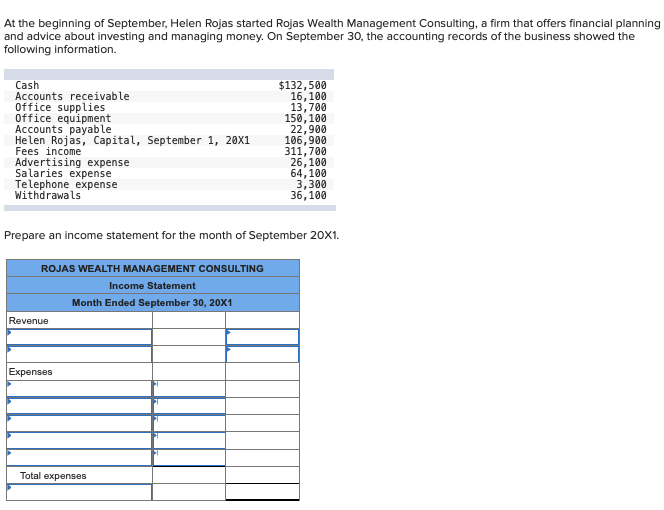

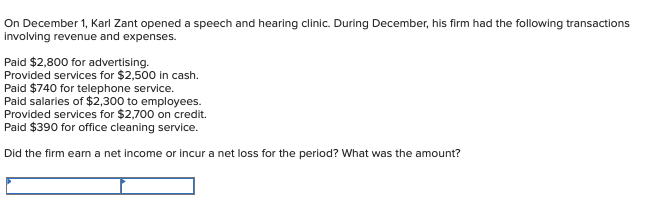

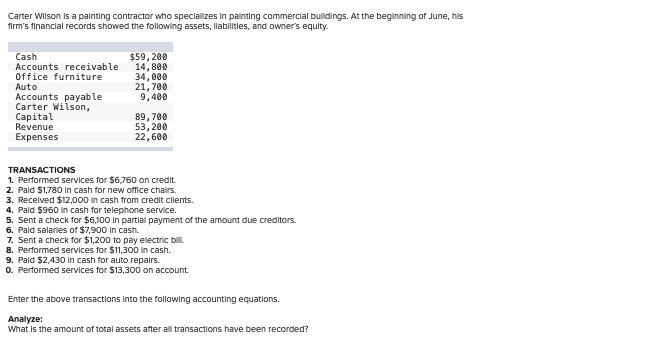

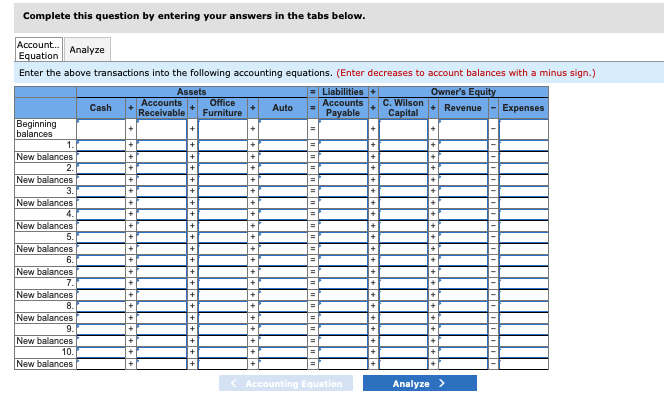

Technology World had the following revenue and expenses during the month ended July 31. Fees for computer repairs Advertising expense Salaries expense Telephone expense Fees for printer repairs Utilities expense $38, 100 5,000 17,800 1,300 5,250 950 Did the firm eam a net income or incur a net loss for the period? What was the amount? Owner's Equity Assets Accounts Receivable + Equipment = $4,000 + $30,000 = 3,900 Liabilities + Accounts Payable + $20,000 + Marie Cantu, Capital $55,800 Revenue $ 6,000 Expenses $ 0 Cash + Bal. $41,000 + 1. 6,000 2. -3,900 3. -2,100 4. -3,455 5. 900 6. 7. -2,160 -2,100 3,455 -900 6,690 6,690 2,160 The above equation shows the effects of a number of transactions that took place at Cantu Auto Repair Company during the month of July. Describe each transaction. 1. 2. 3. 4. 5. 6. 7. At the beginning of September, Helen Rojas started Rojas Wealth Management Consulting, a firm that offers financial planning and advice about investing and managing money. On September 30, the accounting records of the business showed the following information. Cash Accounts receivable Office supplies Office equipment Accounts payable Helen Rojas, Capital, September 1, 20x1 Fees income Advertising expense Salaries expense Telephone expense Withdrawals $132,500 16,100 13,700 150, 100 22,900 106,900 311,700 26,100 64,100 3,300 36,100 Prepare an income statement for the month of September 20X1. ROJAS WEALTH MANAGEMENT CONSULTING Income Statement Month Ended September 30, 20X1 Revenue Expenses Total expenses On December 1, Karl Zant opened a speech and hearing clinic. During December, his firm had the following transactions involving revenue and expenses. Paid $2,800 for advertising. Provided services for $2,500 in cash. Paid $740 for telephone service. Paid salaries of $2,300 to employees. Provided services for $2,700 on credit Paid $390 for office cleaning service. Did the firm earn a net income or incur a net loss for the period? What was the amount? Carter Wilson is a painting contractor who specializes in painting commercial buildings. At the beginning of June, his firm's financial records showed the following assets, llabilities, and owner's equity Cash Accounts receivable Office furniture Auto Accounts payable Carter Wilson, Capital Revenue Expenses $59,200 14,800 34,000 21,700 9,400 89,700 53,200 22,600 TRANSACTIONS 1. Performed services for $6,760 on credit. 2. Pald $1,780 In cash for new office chairs. 3. Received $12,000 in cash from credit clients. 4. Pald $960 in cash for telephone service, 5. Sent a check for $6,100 In partial payment of the amount due creditors. 6. Pald salaries of $7,900 in cash 7. Sent a check for $1,200 to pay electric bill 8. Performed services for $11,300 in cash. 9. Pald $2.430 in cash for auto repairs. O. Performed services for $13,300 on account Enter the above transactions into the following accounting equations. Analyze: What is the amount of total assets after al transactions have been recorded? Complete this question by entering your answers in the tabs below. + + = + + + + + + + + + Account... Analyze Equation Enter the above transactions into the following accounting equations. (Enter decreases to account balances with a minus sign.) Assets = Liabilities Owner's Equity Cash Accounts Office Auto Accounts C. Wilson Receivable Furniture Payable Capital Revenue Expenses Beginning balances 1. + New balances 2. + New balances 3. New balances 4. New balances 5. New balances 6. New balances 7. New balances 8. New balances 9. New balances 10. New balances + + + + + + + + + + + + + + + + + + Accounting Equation Analyze >