Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Techsavy Itd. Has several independent divisions. The company's Tube division manufactures a picture tube used in television sets. The tube division's income statement for the

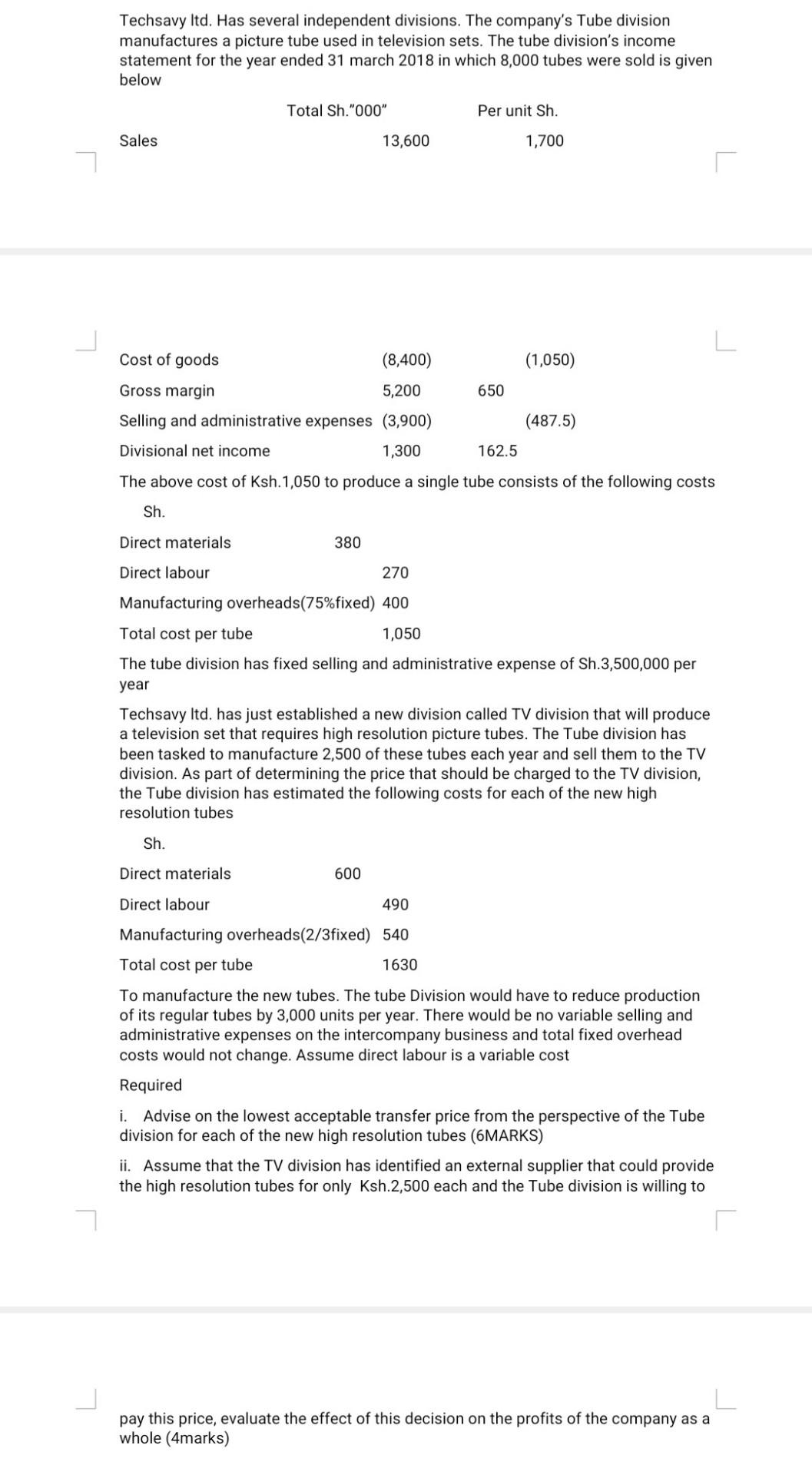

Techsavy Itd. Has several independent divisions. The company's Tube division manufactures a picture tube used in television sets. The tube division's income statement for the year ended 31 march 2018 in which 8,000 tubes were sold is given below The above cost of Ksh.1,050 to produce a single tube consists of the following costs Sh. The tube division has fixed selling and administrative expense of Sh.3,500,000 per year Techsavy Itd. has just established a new division called TV division that will produce a television set that requires high resolution picture tubes. The Tube division has been tasked to manufacture 2,500 of these tubes each year and sell them to the TV division. As part of determining the price that should be charged to the TV division, the Tube division has estimated the following costs for each of the new high resolution tubes To manufacture the new tubes. The tube Division would have to reduce production of its regular tubes by 3,000 units per year. There would be no variable selling and administrative expenses on the intercompany business and total fixed overhead costs would not change. Assume direct labour is a variable cost Required i. Advise on the lowest acceptable transfer price from the perspective of the Tube division for each of the new high resolution tubes (6MARKS) ii. Assume that the TV division has identified an external supplier that could provide the high resolution tubes for only Ksh.2,500 each and the Tube division is willing to pay this price, evaluate the effect of this decision on the profits of the company as a whole (4marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started