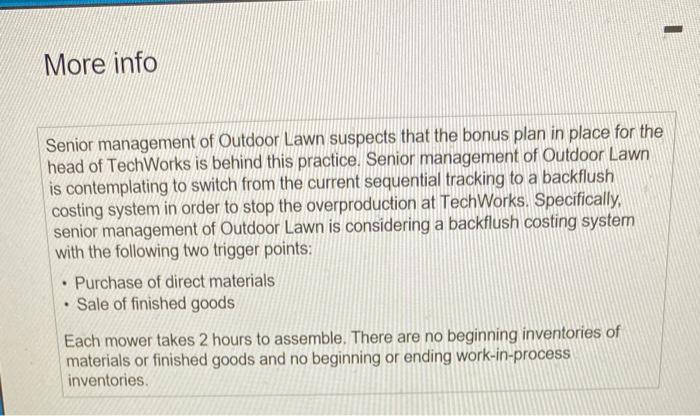

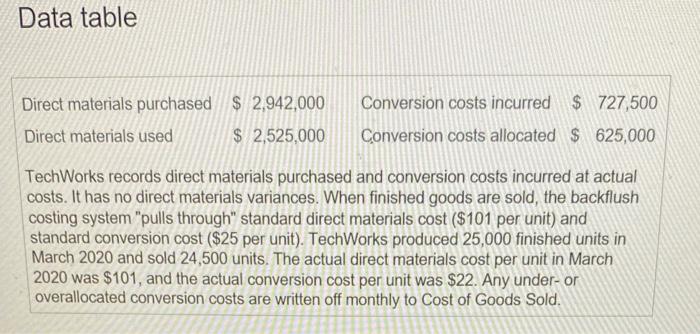

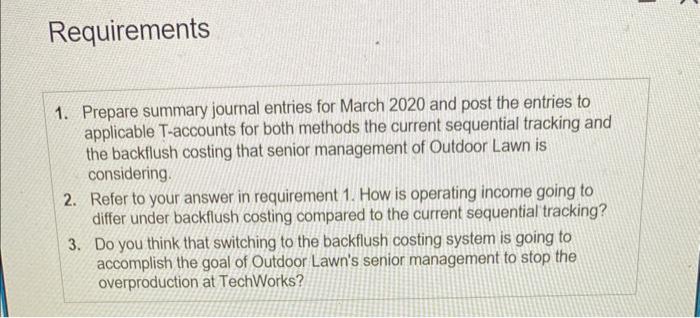

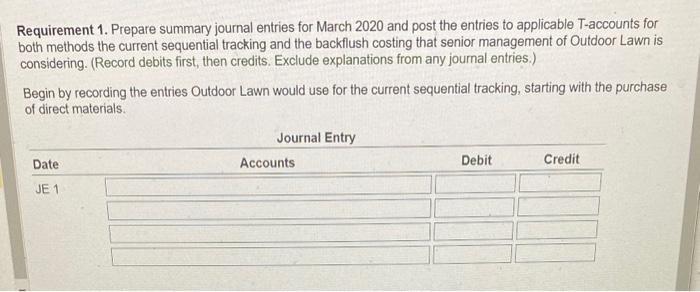

TechWorks, a unit of Outdoor Lawn, manufactures a line of electric, cordless, lawn mowers. Senior management of Outdoor Lawn has noticed that TechWorks has been producing more lawn mowers than it has been selling, and that the unit's inventory has been steadily increasing. (Click the icon to view additional information.) The following data are for TechWorks for March 2020: (Click the icon to view the March data.) Read the requirements. Senior management of Outdoor Lawn suspects that the bonus plan in place for the head of TechWorks is behind this practice. Senior management of Outdoor Lawn is contemplating to switch from the current sequential tracking to a backflush costing system in order to stop the overproduction at TechWorks. Specifically, senior management of Outdoor Lawn is considering a backflush costing system with the following two trigger points: - Purchase of direct materials - Sale of finished goods Each mower takes 2 hours to assemble. There are no beginning inventories of materials or finished goods and no beginning or ending work-in-process inventories. Data table TechWorks records direct materials purchased and conversion costs incurred at actual costs. It has no direct materials variances. When finished goods are sold, the backflush costing system "pulls through" standard direct materials cost (\$101 per unit) and standard conversion cost (\$25 per unit). TechWorks produced 25,000 finished units in March 2020 and sold 24,500 units. The actual direct materials cost per unit in March 2020 was $101, and the actual conversion cost per unit was $22. Any under-or overallocated conversion costs are written off monthly to Cost of Goods Sold. Requirements 1. Prepare summary journal entries for March 2020 and post the entries to applicable T-accounts for both methods the current sequential tracking and the backflush costing that senior management of Outdoor Lawn is considering. 2. Refer to your answer in requirement 1. How is operating income going to differ under backflush costing compared to the current sequential tracking? 3. Do you think that switching to the backflush costing system is going to accomplish the goal of Outdoor Lawn's senior management to stop the overproduction at TechWorks? Requirement 1. Prepare summary journal entries for March 2020 and post the entries to applicable T-accounts for both methods the current sequential tracking and the backllush costing that senior management of Outdoor Lawn is considering. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by recording the entries Outdoor Lawn would use for the current sequential tracking, starting with the purchase of direct materials. TechWorks, a unit of Outdoor Lawn, manufactures a line of electric, cordless, lawn mowers. Senior management of Outdoor Lawn has noticed that TechWorks has been producing more lawn mowers than it has been selling, and that the unit's inventory has been steadily increasing. (Click the icon to view additional information.) The following data are for TechWorks for March 2020: (Click the icon to view the March data.) Read the requirements. Senior management of Outdoor Lawn suspects that the bonus plan in place for the head of TechWorks is behind this practice. Senior management of Outdoor Lawn is contemplating to switch from the current sequential tracking to a backflush costing system in order to stop the overproduction at TechWorks. Specifically, senior management of Outdoor Lawn is considering a backflush costing system with the following two trigger points: - Purchase of direct materials - Sale of finished goods Each mower takes 2 hours to assemble. There are no beginning inventories of materials or finished goods and no beginning or ending work-in-process inventories. Data table TechWorks records direct materials purchased and conversion costs incurred at actual costs. It has no direct materials variances. When finished goods are sold, the backflush costing system "pulls through" standard direct materials cost (\$101 per unit) and standard conversion cost (\$25 per unit). TechWorks produced 25,000 finished units in March 2020 and sold 24,500 units. The actual direct materials cost per unit in March 2020 was $101, and the actual conversion cost per unit was $22. Any under-or overallocated conversion costs are written off monthly to Cost of Goods Sold. Requirements 1. Prepare summary journal entries for March 2020 and post the entries to applicable T-accounts for both methods the current sequential tracking and the backflush costing that senior management of Outdoor Lawn is considering. 2. Refer to your answer in requirement 1. How is operating income going to differ under backflush costing compared to the current sequential tracking? 3. Do you think that switching to the backflush costing system is going to accomplish the goal of Outdoor Lawn's senior management to stop the overproduction at TechWorks? Requirement 1. Prepare summary journal entries for March 2020 and post the entries to applicable T-accounts for both methods the current sequential tracking and the backllush costing that senior management of Outdoor Lawn is considering. (Record debits first, then credits. Exclude explanations from any journal entries.) Begin by recording the entries Outdoor Lawn would use for the current sequential tracking, starting with the purchase of direct materials