Answered step by step

Verified Expert Solution

Question

1 Approved Answer

TED Spread in the Global Credit Crisis. During financial crises, short-term interest rates will often change quickly (typically up) as indications that markets are under

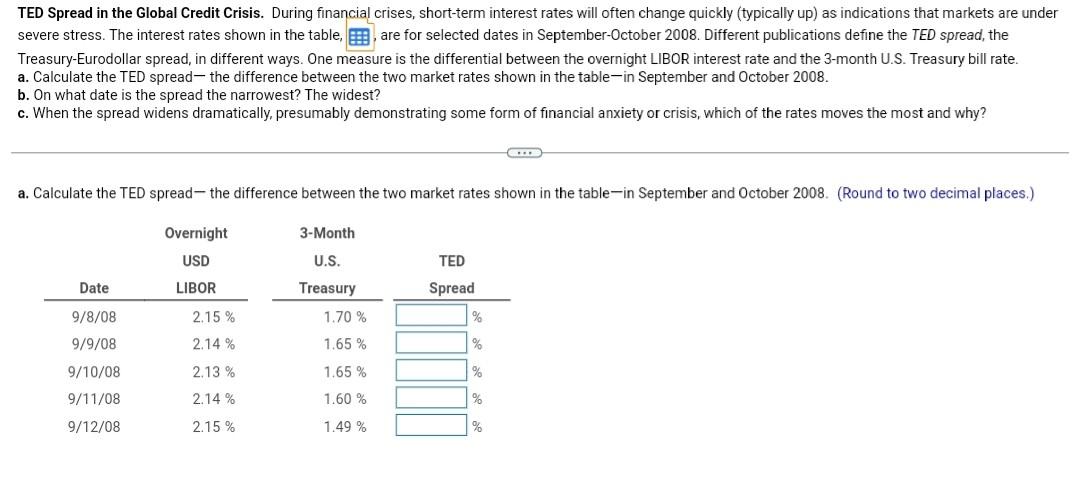

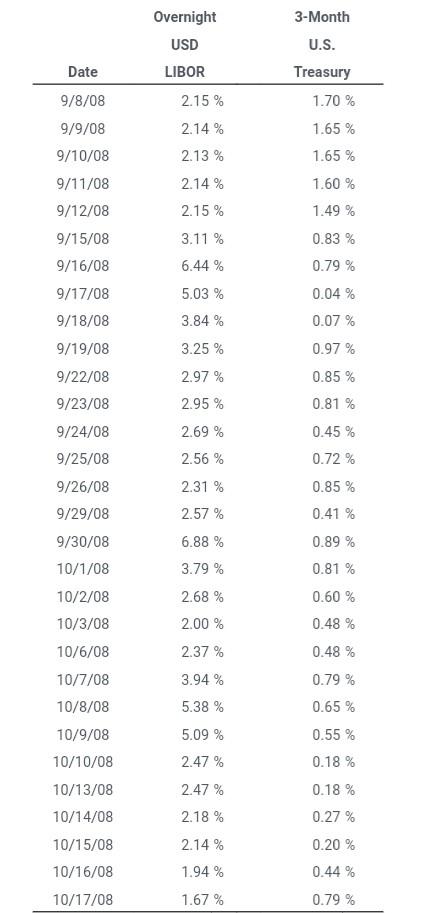

TED Spread in the Global Credit Crisis. During financial crises, short-term interest rates will often change quickly (typically up) as indications that markets are under severe stress. The interest rates shown in the table, E, are for selected dates in September October 2008. Different publications define the TED spread, the Treasury-Eurodollar spread, in different ways. One measure is the differential between the overnight LIBOR interest rate and the 3-month U.S. Treasury bill rate. a. Calculate the TED spread the difference between the two market rates shown in the table-in September and October 2008. b. On what date is the spread the narrowest? The widest? c. When the spread widens dramatically, presumably demonstrating some form of financial anxiety or crisis, which of the rates moves the most and why? a. Calculate the TED spread the difference between the two market rates shown in the table-in September and October 2008. (Round to two decimal places.) Overnight 3-Month USD U.S. TED Date LIBOR Treasury Spread 2.15% % 1.70 % 1.65% 2.14% % 9/8/08 9/9/08 9/10/08 9/11/08 9/12/08 2.13 % 1.65% % 2.14% 1.60 % % 2.15% 1.49 % % Overnight USD LIBOR 2.15% 2.14% 2.13% 3-Month U.S. Treasury 1.70 % 1.65 % 1.65 % 1.60 % 2.14% 2.15% 1.49 % 3.11 % 0.83 % 0.79% 6.44% 5.03% 3.84 % 0.04 % 0.07% 0.97% 3.25% 2.97% 0.85% 2.95% 0.81 % 2.69 % 0.45 % 0.72% Date 9/8/08 9/9/08 9/10/08 9/11/08 9/12/08 9/15/08 9/16/08 9/17/08 9/18/08 9/19/08 9/22/08 9/23/08 9/24/08 9/25/08 9/26/08 9/29/08 9/30/08 10/1/08 10/2/08 10/3/08 10/6/08 10/7/08 10/8/08 10/9/08 10/10/08 10/13/08 10/14/08 10/15/08 10/16/08 10/17/08 2.56 % 2.31 % 2.57 % 0.85% 0.41 % 0.89 % 6.88 % 3.79% 2.68 % 2.00% 2.37% 0.81 % 0.60 % 0.48 % 0.48 % 3.94% 5.38% 5.09 % 2.47 % 0.79% 0.65% 0.55 % 0.18% 0.18% 0.27% 2.47% 2.18 % 2.14 % 1.94% 0.20 % 0.44 % 1.67% 0.79%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started