Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Temple Corporation is an accrual method, calendar year C corporation. Temple Corporation is 100% owned by Tim, who is also its president. Sally works as

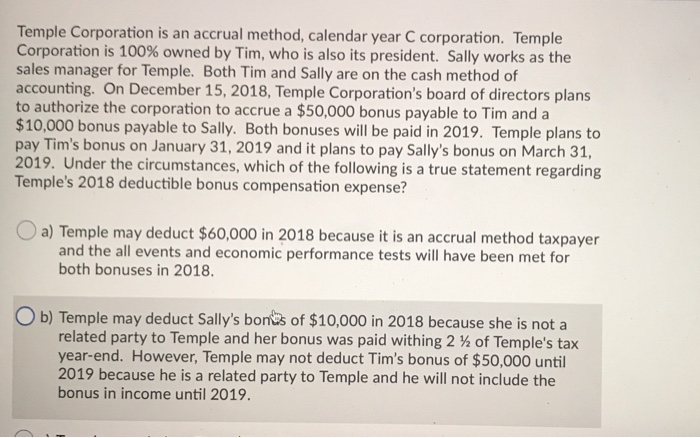

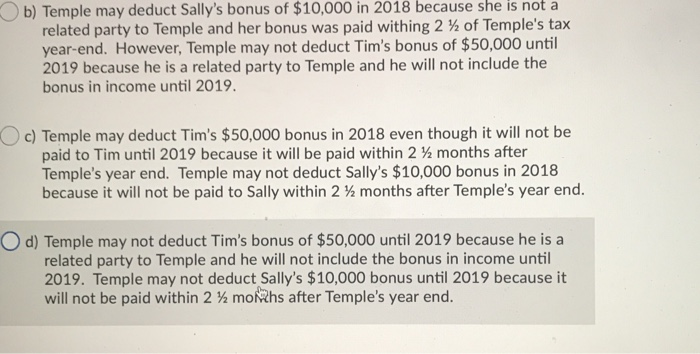

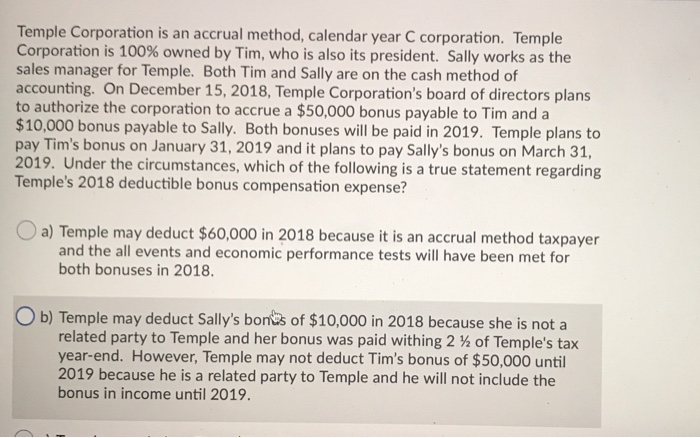

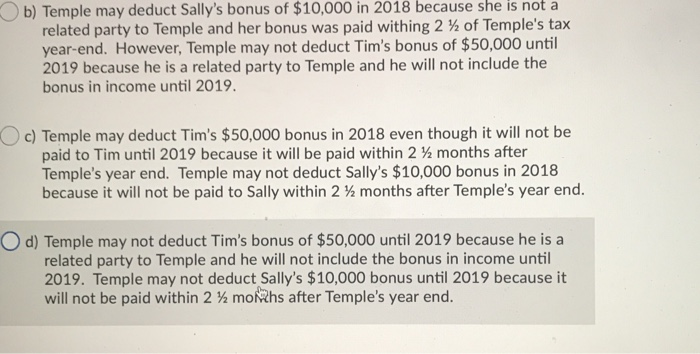

Temple Corporation is an accrual method, calendar year C corporation. Temple Corporation is 100% owned by Tim, who is also its president. Sally works as the sales manager for Temple. Both Tim and Sally are on the cash method of accounting. On December 15, 2018, Temple Corporation's board of directors plans to authorize the corporation to accrue a $50,000 bonus payable to Tim and a $10,000 bonus payable to Sally. Both bonuses will be paid in 2019. Temple plans to pay Tim's bonus on January 31, 2019 and it plans to pay Sally's bonus on March 31, 2019. Under the circumstances, which of the following is a true statement regarding Temple's 2018 deductible bonus compensation expense? a) Temple may deduct $60,000 in 2018 because it is an accrual method taxpayer and the all events and economic performance tests will have been met for both bonuses in 2018. Ob) Temple may deduct Sally's bones of $10,000 in 2018 because she is not a related party to Temple and her bonus was paid withing 2 % of Temple's tax year-end. However, Temple may not deduct Tim's bonus of $50,000 until 2019 because he is a related party to Temple and he will not include the bonus in income until 2019. Ob) Temple may deduct Sally's bonus of $10,000 in 2018 because she is not a related party to Temple and her bonus was paid withing 2 % of Temple's tax year-end. However, Temple may not deduct Tim's bonus of $50,000 until 2019 because he is a related party to Temple and he will not include the bonus in income until 2019. c) Temple may deduct Tim's $50,000 bonus in 2018 even though it will not be paid to Tim until 2019 because it will be paid within 2 % months after Temple's year end. Temple may not deduct Sally's $10,000 bonus in 2018 because it will not be paid to Sally within 2 months after Temple's year end. O d) Temple may not deduct Tim's bonus of $50,000 until 2019 because he is a related party to Temple and he will not include the bonus in income until 2019. Temple may not deduct Sally's $10,000 bonus until 2019 because it will not be paid within 2 months after Temple's year end

Temple Corporation is an accrual method, calendar year C corporation. Temple Corporation is 100% owned by Tim, who is also its president. Sally works as the sales manager for Temple. Both Tim and Sally are on the cash method of accounting. On December 15, 2018, Temple Corporation's board of directors plans to authorize the corporation to accrue a $50,000 bonus payable to Tim and a $10,000 bonus payable to Sally. Both bonuses will be paid in 2019. Temple plans to pay Tim's bonus on January 31, 2019 and it plans to pay Sally's bonus on March 31, 2019. Under the circumstances, which of the following is a true statement regarding Temple's 2018 deductible bonus compensation expense? a) Temple may deduct $60,000 in 2018 because it is an accrual method taxpayer and the all events and economic performance tests will have been met for both bonuses in 2018. Ob) Temple may deduct Sally's bones of $10,000 in 2018 because she is not a related party to Temple and her bonus was paid withing 2 % of Temple's tax year-end. However, Temple may not deduct Tim's bonus of $50,000 until 2019 because he is a related party to Temple and he will not include the bonus in income until 2019. Ob) Temple may deduct Sally's bonus of $10,000 in 2018 because she is not a related party to Temple and her bonus was paid withing 2 % of Temple's tax year-end. However, Temple may not deduct Tim's bonus of $50,000 until 2019 because he is a related party to Temple and he will not include the bonus in income until 2019. c) Temple may deduct Tim's $50,000 bonus in 2018 even though it will not be paid to Tim until 2019 because it will be paid within 2 % months after Temple's year end. Temple may not deduct Sally's $10,000 bonus in 2018 because it will not be paid to Sally within 2 months after Temple's year end. O d) Temple may not deduct Tim's bonus of $50,000 until 2019 because he is a related party to Temple and he will not include the bonus in income until 2019. Temple may not deduct Sally's $10,000 bonus until 2019 because it will not be paid within 2 months after Temple's year end

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started