Answered step by step

Verified Expert Solution

Question

1 Approved Answer

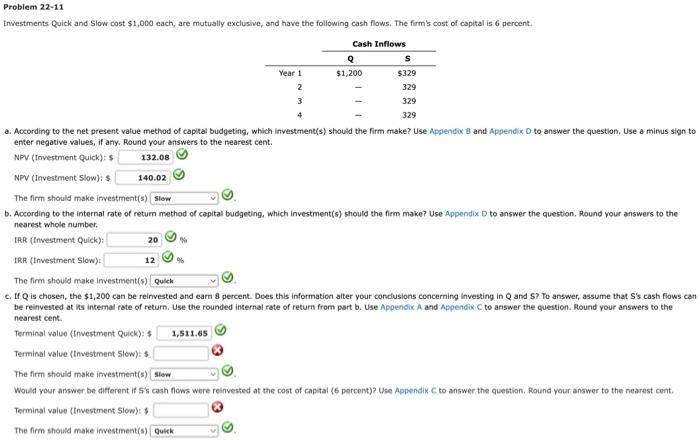

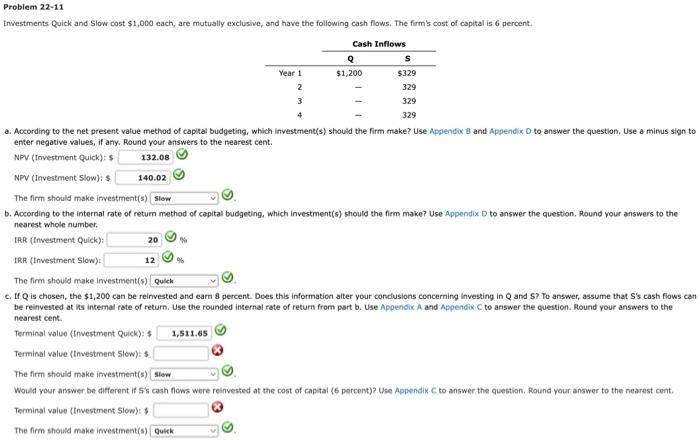

terminal values Problem 22-11 Investments Quick and Slow cost $1,000 each, are mutually exclusive, and have the following cash flows. The firm's cost of capital

terminal values

Problem 22-11 Investments Quick and Slow cost $1,000 each, are mutually exclusive, and have the following cash flows. The firm's cost of capital is 6 percent Cash Inflows Q Year 1 $1,200 $329 2 329 329 329 2. According to the net present value method of capital budgeting, which investment(s) should the firm make? Use Appendix B and Appendix D to answer the question. Use a minus sign to enter negative values, if any. Round your answers to the nearest cent. NPV (Investment Quick): 5 132.00 NPV (Investment Slow): 140.02 The firm should make investment(s) Slow b. According to the internal rate of return method of capital budgeting, which investment(s) should the firm make? Use Appendix D to answer the question, Round your answers to the nearest whole number. IRR (Investment Quick): 20 IRR (Investment Slow) 12 % The firm should make investment(s) Quick CIQ is chosen, the $1,200 can be reinvested and earn 8 percent. Does this information alter your conclusions concerning Investing in Q and S? To answer, assume that S's cash flows can be reinvested at its internal rate of return. Use the rounded internal rate of return from part b. Use Appendix A and Appendix to answer the question. Round your answers to the nearest cent Terminal value (Investment Quick): $ 1,511.65 Terminal value (trwestment Slow): The firm should make investment(s) Slow Would your answer be different if S's cash flows were reinvested at the cost of capital (6 percent)? Use Appendix to answer the question. Round your answer to the nearest cent. Terminal value (tnvestment Slow): 6 The firm should make investment() Quick

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started