Answered step by step

Verified Expert Solution

Question

1 Approved Answer

test 1-6 Instruction: 1-1 Identifying Business Transactions Under the business entity concept which of the following are considered as business transactions and events. Place a

test

1-6

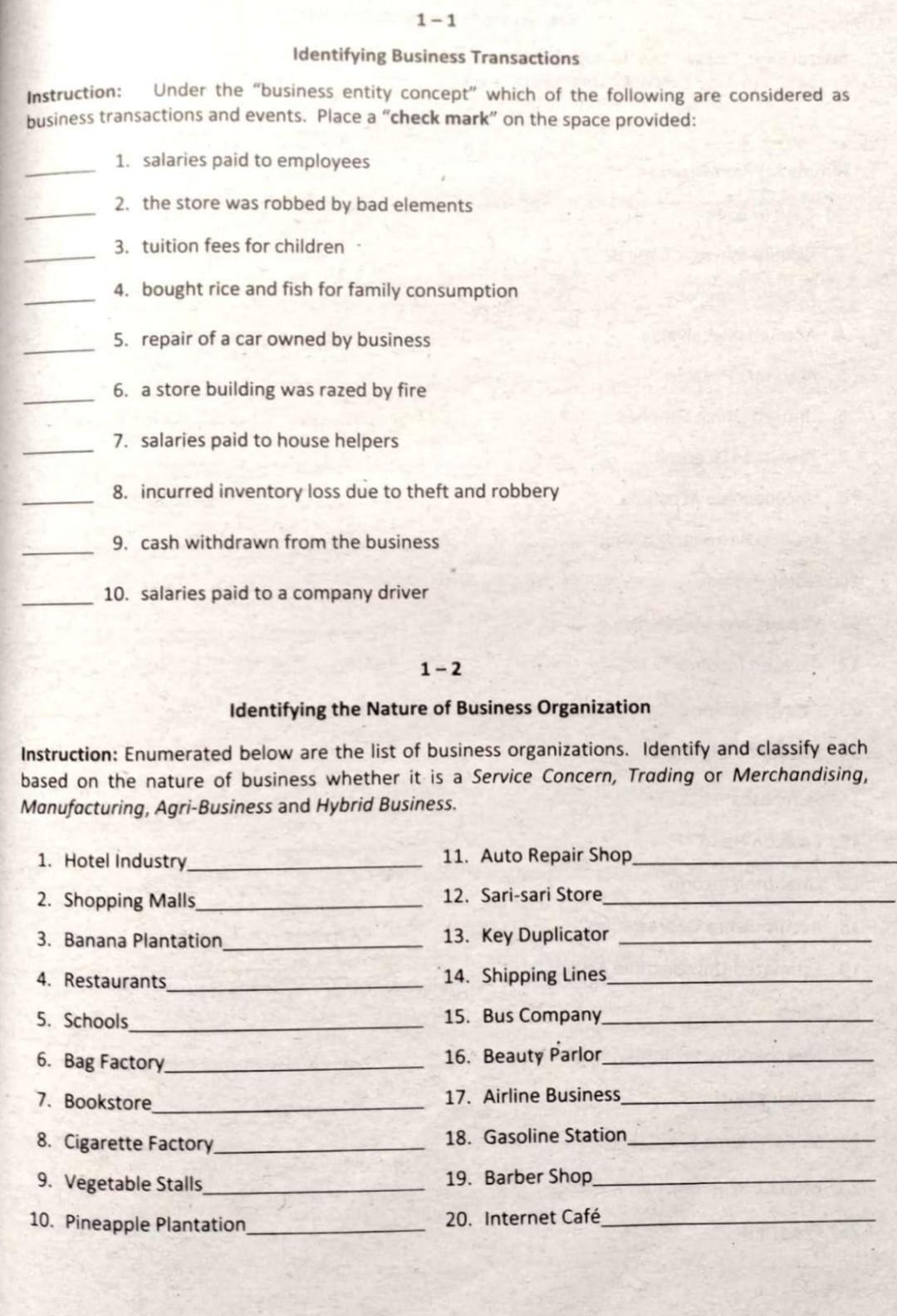

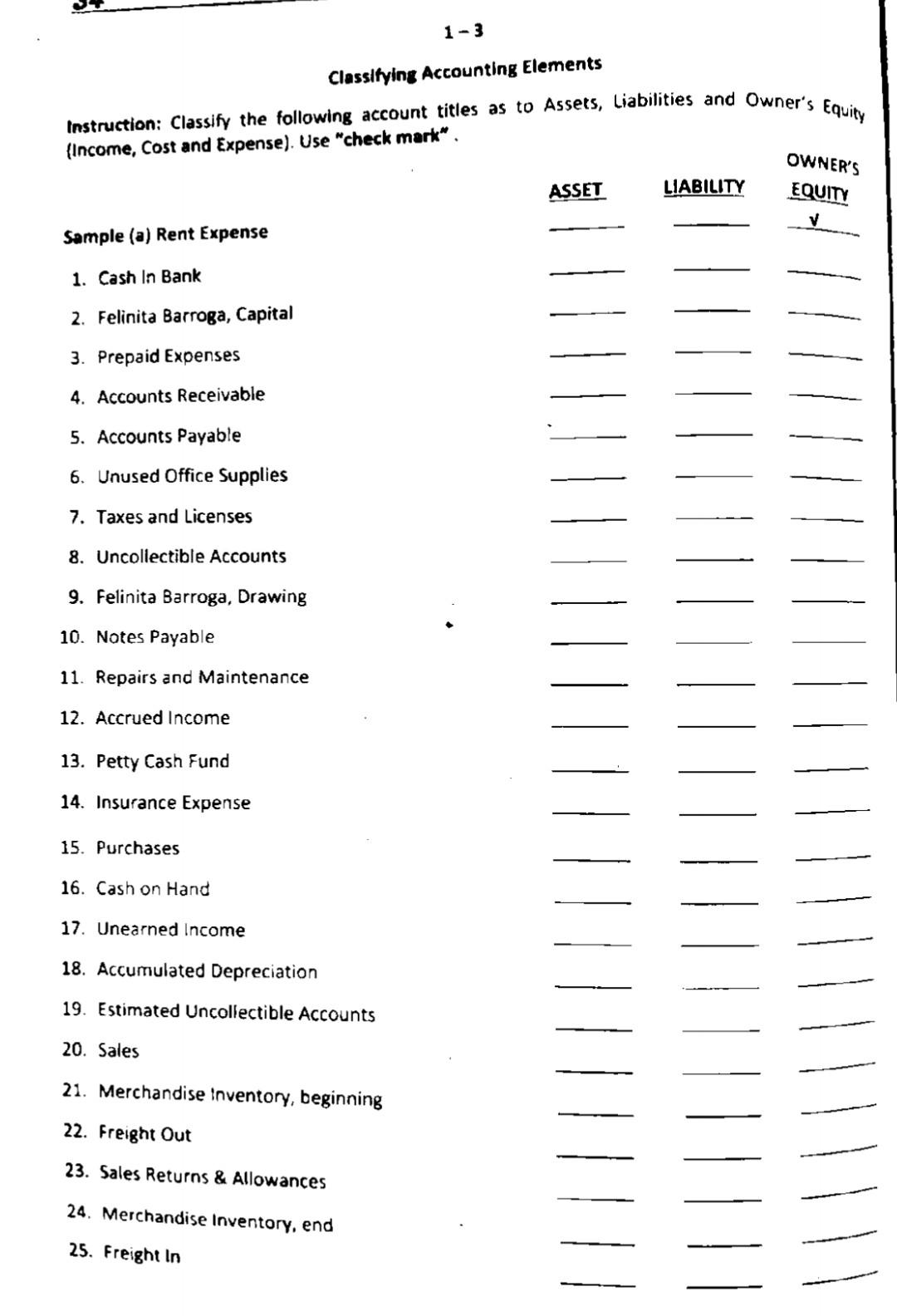

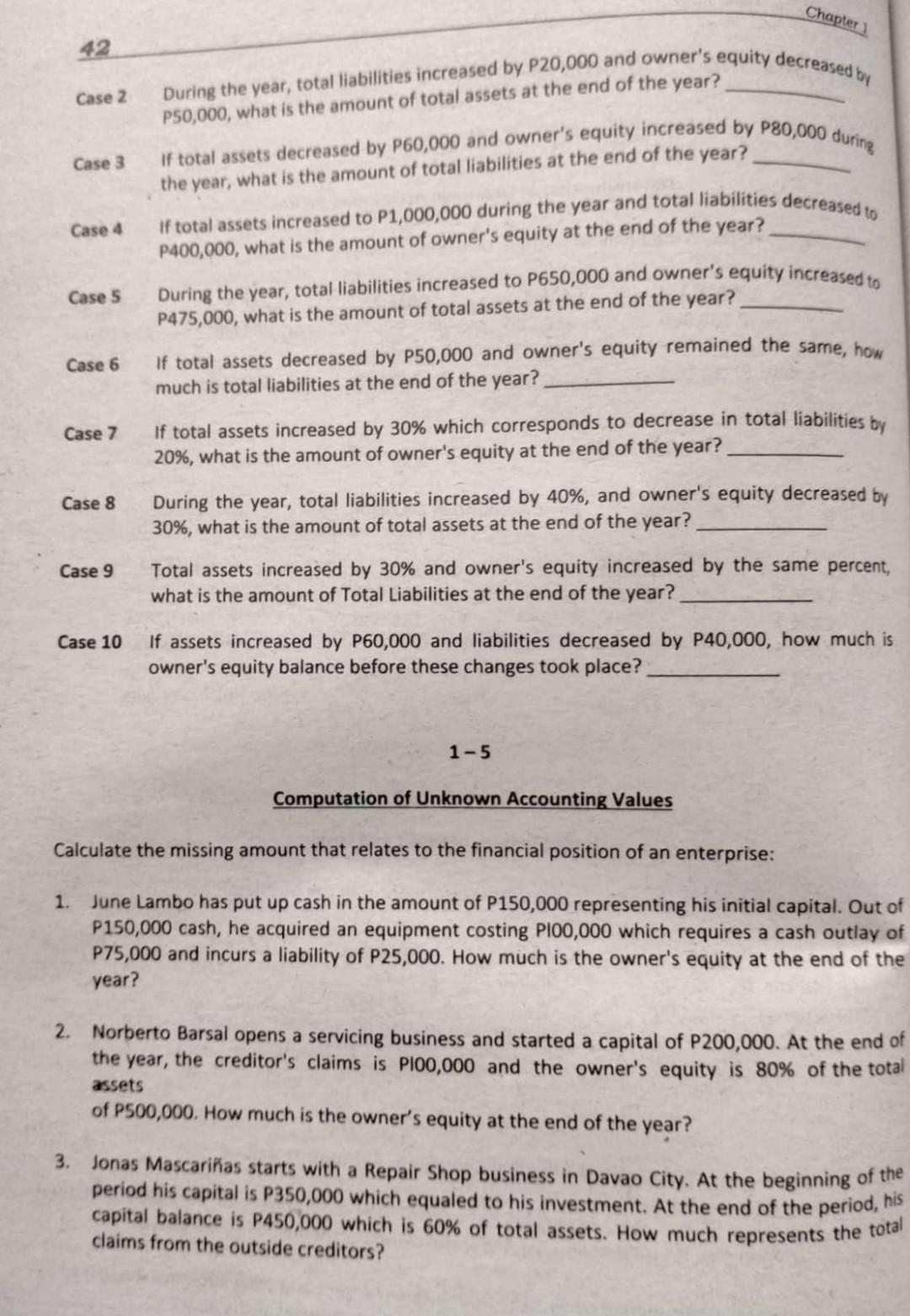

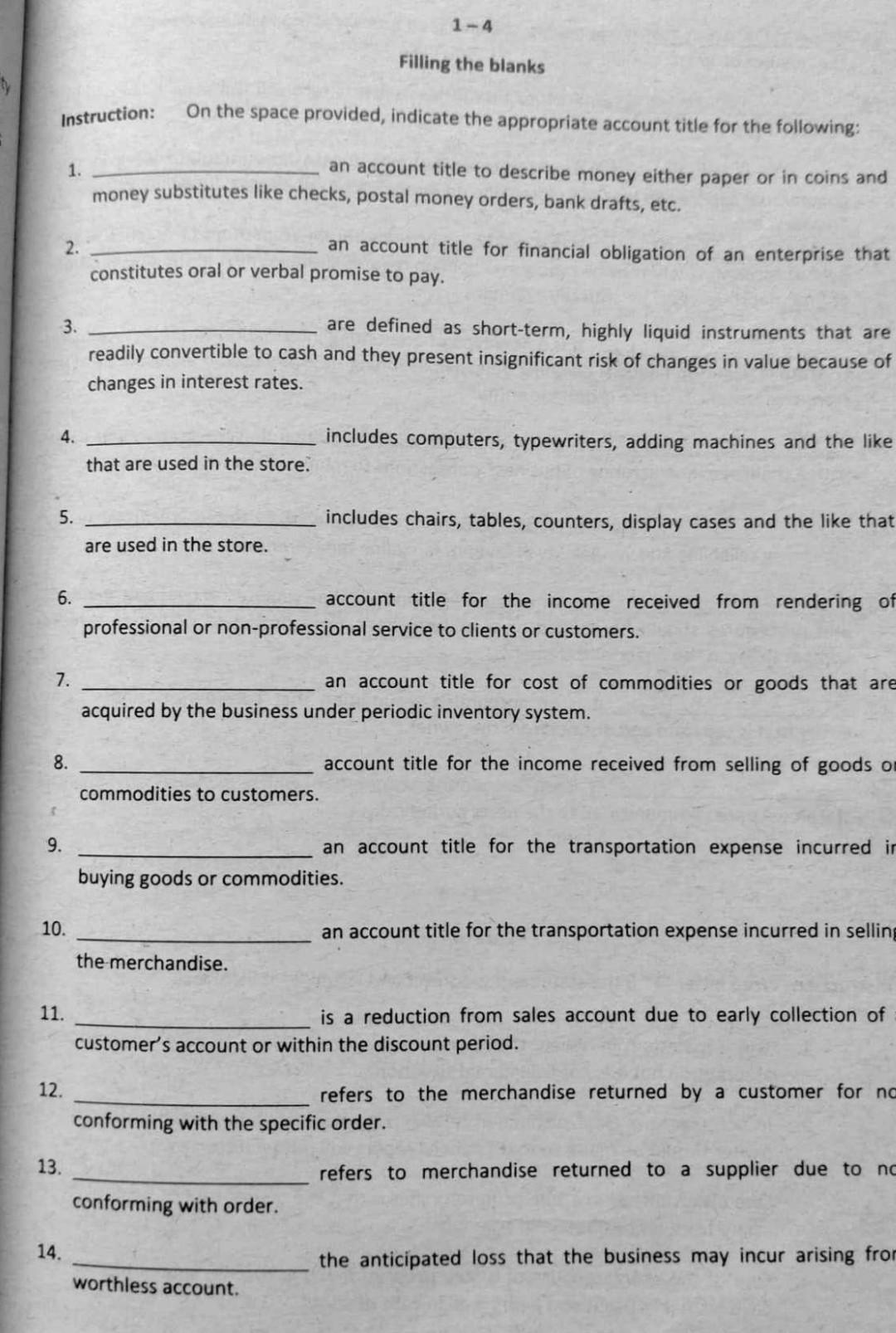

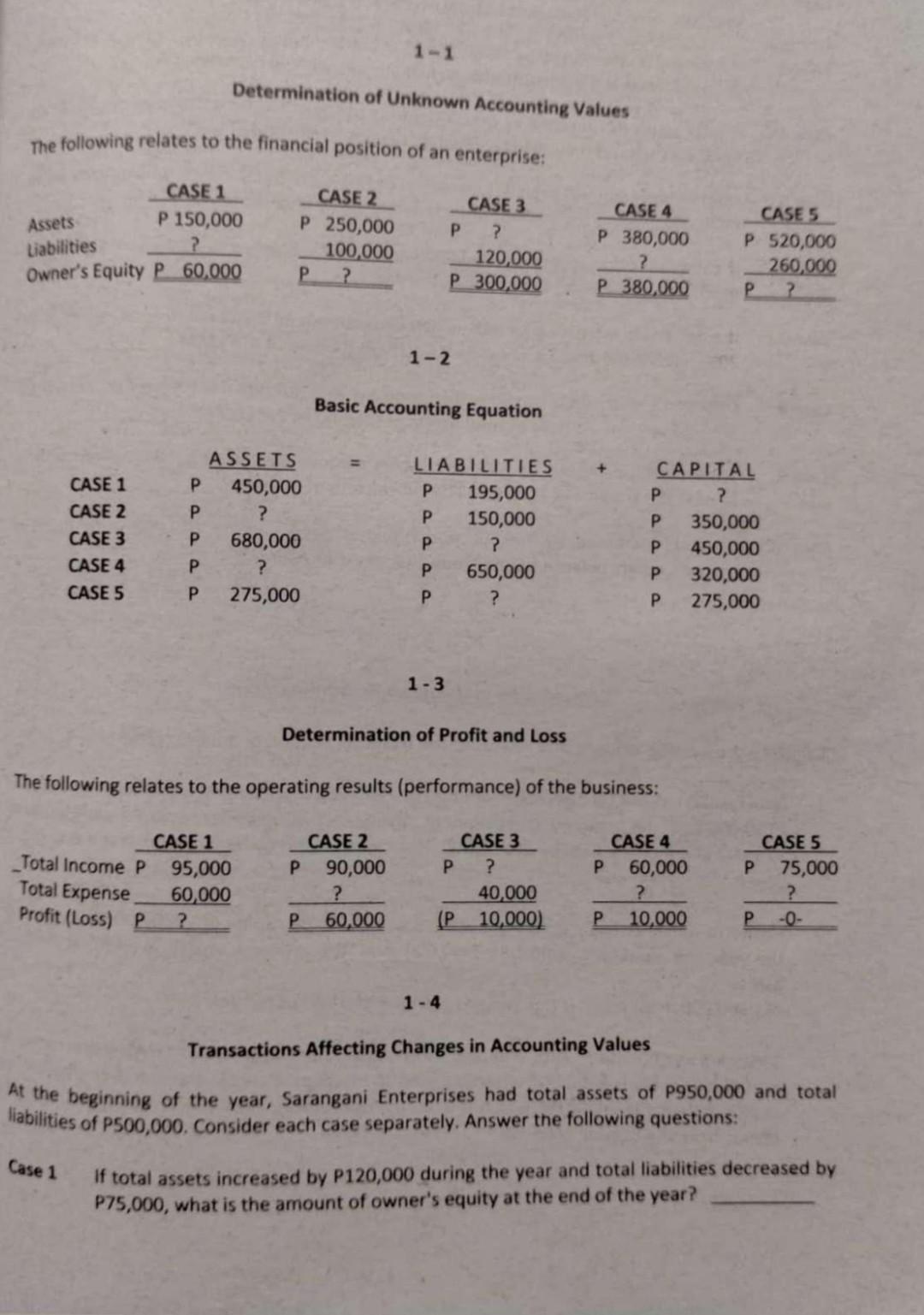

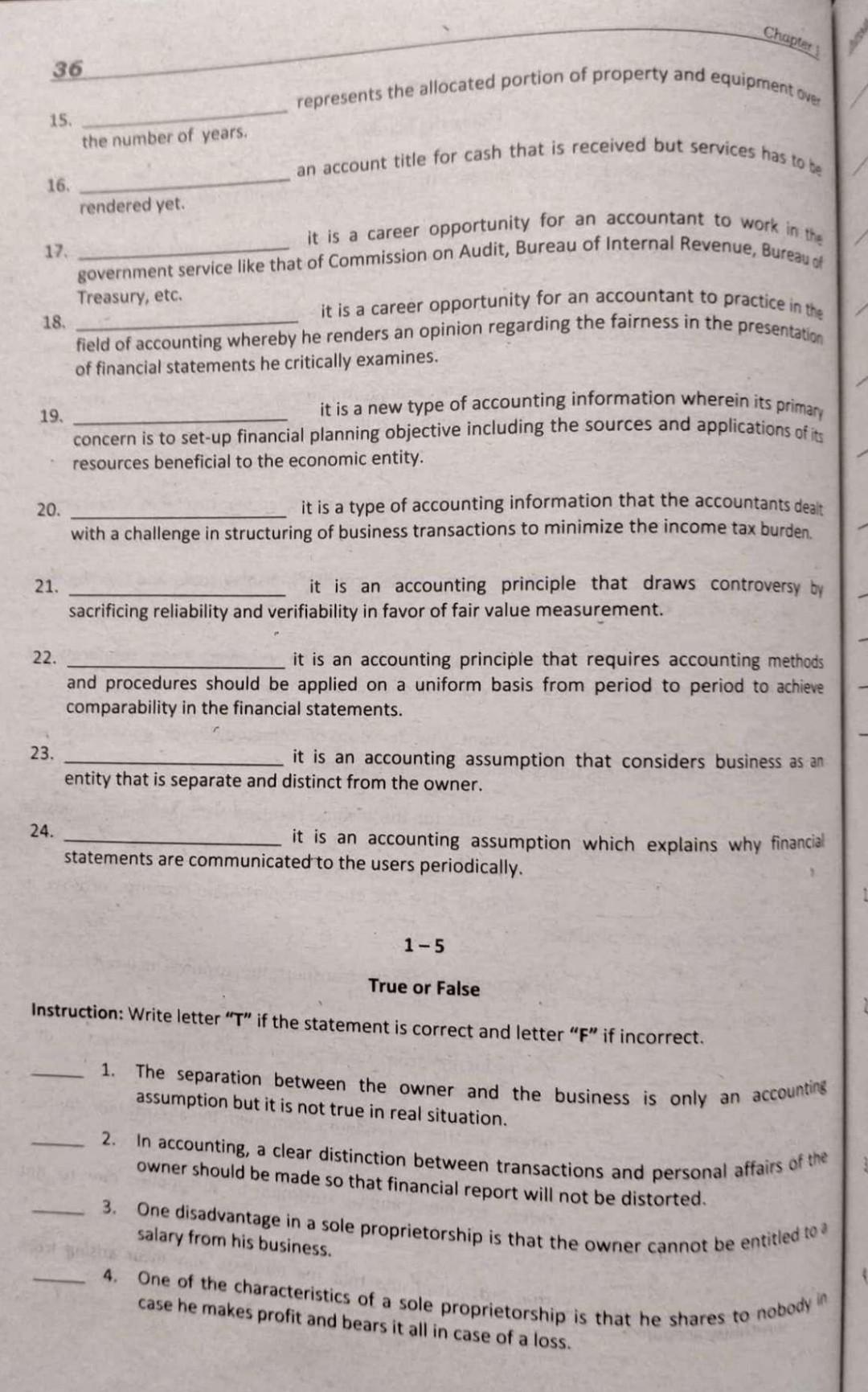

Instruction: 1-1 Identifying Business Transactions Under the "business entity concept" which of the following are considered as business transactions and events. Place a check mark" on the space provided: 1. salaries paid to employees 2. the store was robbed by bad elements 3. tuition fees for children 4. bought rice and fish for family consumption 5. repair of a car owned by business 6. a store building was razed by fire 7. salaries paid to house helpers 8. incurred inventory loss due to theft and robbery 9. cash withdrawn from the business 10. salaries paid to a company driver 1-2 Identifying the Nature of Business Organization Instruction: Enumerated below are the list of business organizations. Identify and classify each based on the nature of business whether it is a Service Concern, Trading or Merchandising, Manufacturing, Agri-Business and Hybrid Business. 1. Hotel Industry 11. Auto Repair Shop 2. Shopping Malls 12. Sari-sari Store 3. Banana Plantation 13. Key Duplicator 4. Restaurants 14. Shipping Lines 5. Schools 15. Bus Company 6. Bag Factory 16. Beauty Parlor 7. Bookstore 17. Airline Business 18. Gasoline Station 8. Cigarette Factory 9. Vegetable Stalls 10. Pineapple Plantation 19. Barber Shop 20. Internet Caf 1-3 Instruction: Classify the following account titles as to Assets, Liabilities and Owner's Equity (Income, Cost and Expense). Use "check mark". Classifying Accounting Elements OWNER'S EQUITY ASSET LIABILITY Sample (a) Rent Expense 1. Cash In Bank 2. Felinita Barroga, Capital 3. Prepaid Expenses 4. Accounts Receivable 5. Accounts Payable 6. Unused Office Supplies 7. Taxes and Licenses 8. Uncollectible Accounts 9. Felinita Barroga, Drawing 10. Notes Payable 11. Repairs and Maintenance 12. Accrued Income 13. Petty Cash Fund 14. Insurance Expense 15. Purchases 16. Cash on Hand 17. Unearned Income 18. Accumulated Depreciation 19. Estimated Uncollectible Accounts 20. Sales 21. Merchandise inventory, beginning 22. Freight Out 23. Sales Returns & Allowances 24. Merchandise Inventory, end 25. Freight In Chapter 1 During the year, total liabilities increased by P20,000 and owner's equity decreased by if total assets decreased by P60,000 and owner's equity increased by P80,000 during If total assets increased to P1,000,000 during the year and total liabilities decreased to Case 2 P50,000, what is the amount of total assets at the end of the year? Case 3 the year, what is the amount of total liabilities at the end of the year? Case 4 P400,000, what is the amount of owner's equity at the end of the year? Case 5 During the year, total liabilities increased to P650,000 and owner's equity increased to P475,000, what is the amount of total assets at the end of the year? Case 6 If total assets decreased by P50,000 and owner's equity remained the same, how much is total liabilities at the end of the year? Case 7 If total assets increased by 30% which corresponds to decrease in total liabilities by 20%, what is the amount of owner's equity at the end of the year? Case 8 During the year, total liabilities increased by 40%, and owner's equity decreased by 30%, what is the amount of total assets at the end of the year? Case 9 Total assets increased by 30% and owner's equity increased by the same percent, what is the amount of Total Liabilities at the end of the year? Case 10 If assets increased by P60,000 and liabilities decreased by P40,000, how much is owner's equity balance before these changes took place? 1-5 Computation of Unknown Accounting Values Calculate the missing amount that relates to the financial position of an enterprise: 1. June Lambo has put up cash in the amount of P150,000 representing his initial capital. Out of P150,000 cash, he acquired an equipment costing P100,000 which requires a cash outlay of P75,000 and incurs a liability of P25,000. How much is the owner's equity at the end of the year? 2. Norberto Barsal opens a servicing business and started a capital of P200,000. At the end of the year, the creditor's claims is P100,000 and the owner's equity is 80% of the total assets of P500,000. How much is the owner's equity at the end of the year? 3. Jonas Mascarias starts with a Repair Shop business in Davao City. At the beginning of the period his capital is P350,000 which equaled to his investment. At the end of the period, his capital balance is P450,000 which is 60% of total assets. How much represents the total claims from the outside creditors? 1-4 Filling the blanks Instruction: On the space provided, indicate the appropriate account title for the following: 1. an account title to describe money either paper or in coins and money substitutes like checks, postal money orders, bank drafts, etc. 2. an account title for financial obligation of an enterprise that constitutes oral or verbal promise to pay. 3. are defined as short-term, highly liquid instruments that are readily convertible to cash and they present insignificant risk of changes in value because of changes in interest rates. 4. includes computers, typewriters, adding machines and the like that are used in the store. 5. includes chairs, tables, counters, display cases and the like that are used in the store. 6. account title for the income received from rendering of professional or non-professional service to clients or customers. 7. an account title for cost of commodities or goods that are acquired by the business under periodic inventory system. 8. account title for the income received from selling of goods o commodities to customers. 9. an account title for the transportation expense incurred in buying goods or commodities. 10. an account title for the transportation expense incurred in selling the merchandise. 11. is a reduction from sales account due to early collection of customer's account or within the discount period. 12. refers to the merchandise returned by a customer for na conforming with the specific order. 13 refers to merchandise returned to a supplier due to no conforming with order. 14. the anticipated loss that the business may incur arising fror worthless account. 1-1 Determination of Unknown Accounting Values The following relates to the financial position of an enterprise: Assets Liabilities CASE 1 P 150,000 ? Owner's Equity P 60,000 CASE 2 P250,000 100,000 P ? CASE 3 P ? 120,000 P300,000 CASE 4 P 380,000 ? P380,000 CASE 5 P520,000 260,000 P ? 1-2 Basic Accounting Equation + CASE 1 CASE 2 CASE 3 CASE 4 CASE 5 ASSETS P. 450,000 P. ? 680,000 P ? 275,000 LIABILITIES 195,000 P 150,000 P ? P. 650,000 P ? CAPITAL P ? P. 350,000 450,000 P. 320,000 275,000 1-3 Determination of Profit and Loss The following relates to the operating results (performance) of the business: CASE 1 Total Income P 95,000 60,000 ? Total Expense Profit (Loss) P CASE 2 P 90,000 ? P 60,000 CASE 3 P. ? 40,000 ( P10,000) CASE 4 P 60,000 ? 10,000 CASE 5 P. 75,000 ? P -0- 1-4 Transactions Affecting Changes in Accounting Values At the beginning of the year, Sarangani Enterprises had total assets of P950,000 and total liabilities of P500,000. Consider each case separately. Answer the following questions: Case 1 If total assets increased by P120,000 during the year and total liabilities decreased by P75,000, what is the amount of owner's equity at the end of the year? The separation between the owner and the business is only an accounting In accounting, a clear distinction between transactions and personal affairs of the 3. One disadvantage in a sole proprietorship is that the owner cannot be entitled to 4. One of the characteristics of a sole proprietorship is that he shares to nobody in Chapter represents the allocated portion of property and equipment over an account title for cash that is received but services has to be it is a career opportunity for an accountant to work in the government service like that of Commission on Audit, Bureau of Internal Revenue, Bureau of it is a career opportunity for an accountant to practice in the field of accounting whereby he renders an opinion regarding the fairness in the presentation it is a new type of accounting information wherein its primary 36 15. the number of years. 16. rendered yet. 17. Treasury, etc. 18. of financial statements he critically examines. 19. concern is to set-up financial planning objective including the sources and applications of it resources beneficial to the economic entity. 20. it is a type of accounting information that the accountants dealt with a challenge in structuring of business transactions to minimize the income tax burden. 21. it is an accounting principle that draws controversy by sacrificing reliability and verifiability in favor of fair value measurement. 22. it is an accounting principle that requires accounting methods and procedures should be applied on a uniform basis from period to period to achieve comparability in the financial statements. 23. it is an accounting assumption that considers business as an entity that is separate and distinct from the owner. 24. it is an accounting assumption which explains why financial statements are communicated to the users periodically. 1-5 True or False Instruction: Write letter "T" if the statement is correct and letter "F" if incorrect. 1. assumption but it is not true in real situation. 2. owner should be made so that financial report will not be distorted. salary from his business. LT case he makes profit and bears it all in case of a loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started