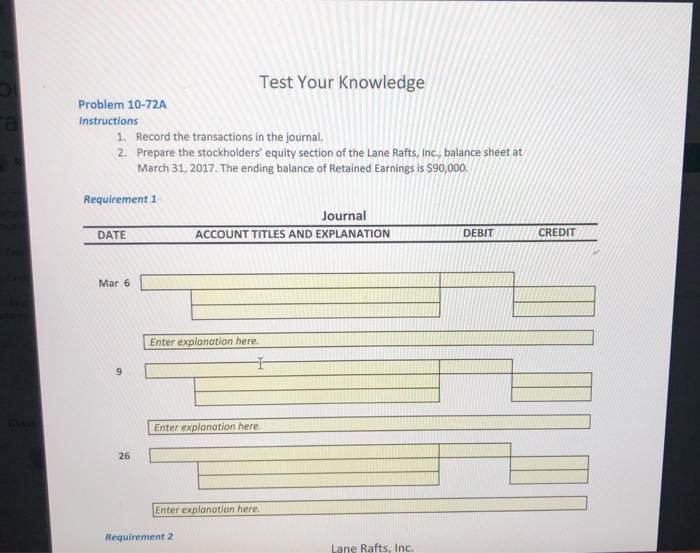

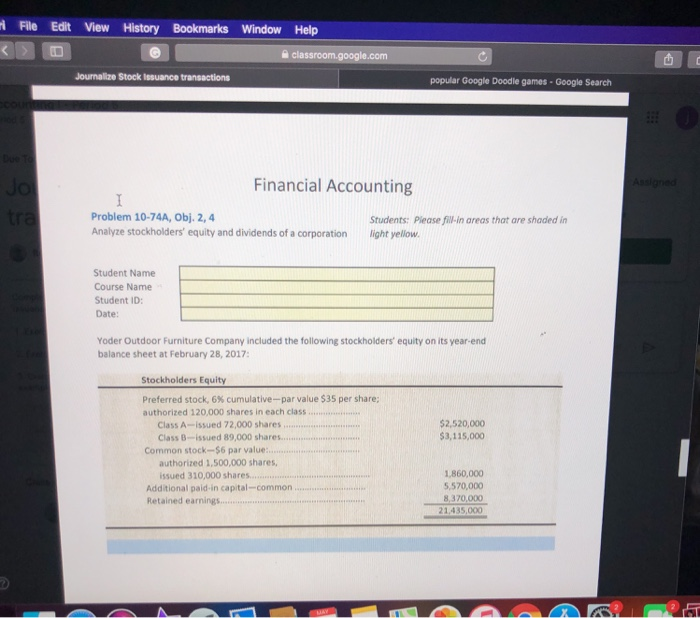

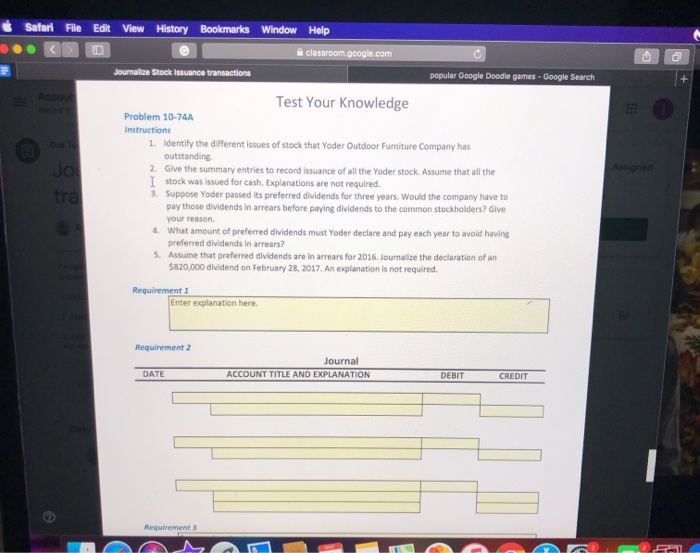

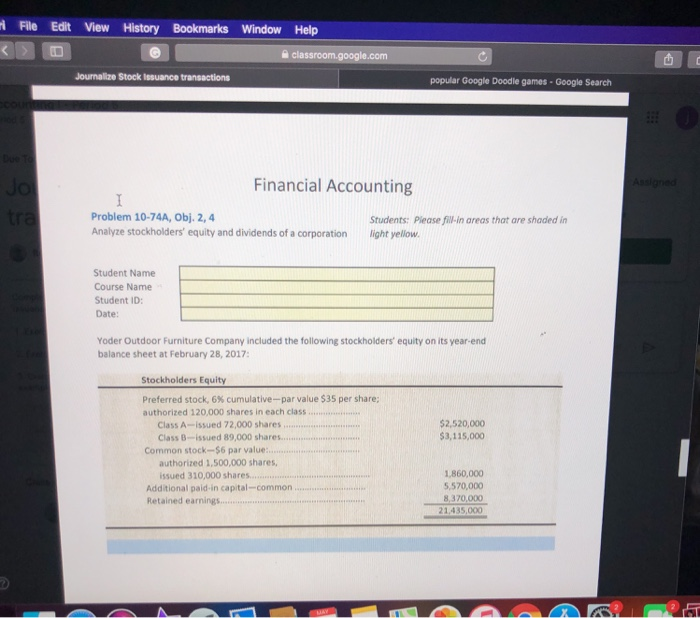

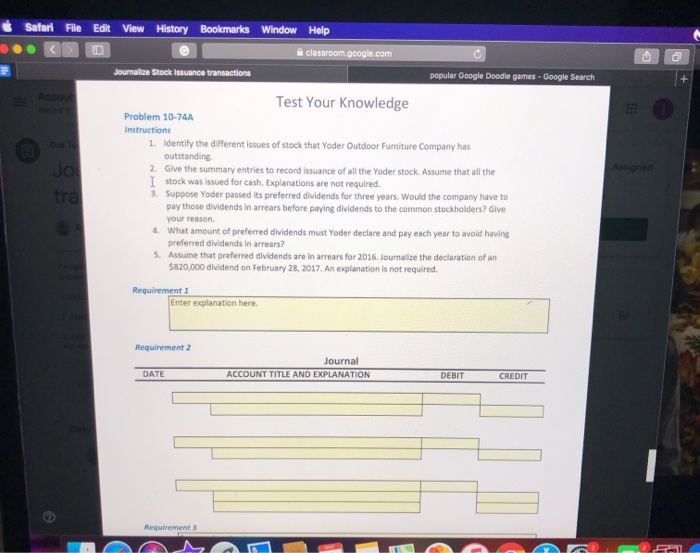

Test Your Knowledge Problem 10-72A Instructions 1. Record the transactions in the journal. 2. Prepare the stockholders' equity section of the Lane Rafts, Inc., balance sheet at March 31, 2017. The ending balance of Retained Earnings is $90,000. Requirement 1 DATE Journal ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT Mar 6 Enter explanation here. Enter explanation here. Enter explanation here. Requirement 2 Lane Rafts, Inc. File Edit View History Bookmarks Window Help classroom.google.com Journalize Stock Issuance transactions popular Google Doodle games - Google Search Financial Accounting Problem 10-74A, Obj. 2,4 Analyze stockholders' equity and dividends of a corporation Students: Please fill in areas that are shaded in light yellow Student Name Course Name Student ID: Date: Yoder Outdoor Furniture Company included the following stockholders' equity on its year-end balance sheet at February 28, 2017: $2,520,000 $3,115,000 Stockholders Equity Preferred stock, 6% cumulative-par value $35 per share; authorised 120,000 shares in each class Class A-issued 72,000 shares... Class 3-issued 89,000 shares... Common stock-$6 par value: authorized 1.500,000 shares. issued 310,000 shares...... Additional paid in capital-common... Retained earnings... 1.860,000 5.570,000 8,370,000 21435.000 Safari File Edit View History Bookmarks Window Help classroom.google.com Journalize Stock Issuance transactions popular Google Doodie games - Google Search Test Your Knowledge Problem 10-74A Instructions 1. Identify the different issues of stock that Yoder Outdoor Furniture Company has outstanding 2. Give the summary entries to record issuance of all the Yoder stock. Assume that all the I stock was issued for cash Explanations are not required 3. Suppose Yoder passed its preferred dividends for three years. Would the company have to pay those dividends in arrears before paying dividends to the common stockholders? Give your reason 4. What amount of preferred dividends must Yoder declare and pay each year to avoid having preferred dividends in arrears? 5. Assume that preferred dividends are in arrears for 2016. Journalize the declaration of an $820,000 dividend on February 28, 2017. An explanation is not required tra Requirement 1 Enter explanation here Requirement 2 Journal ACCOUNT TITLE AND EXPLANATION DATE Requirement 3