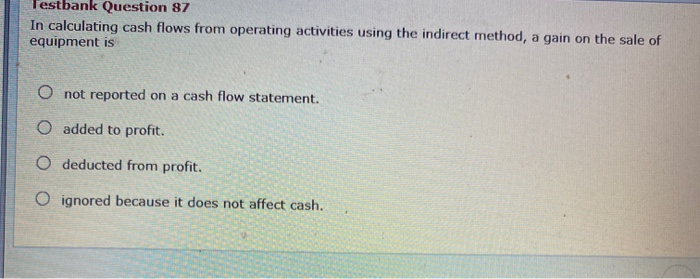

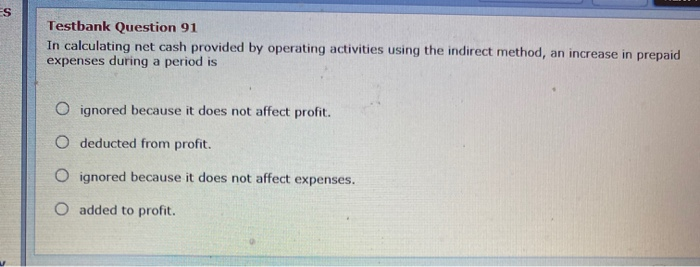

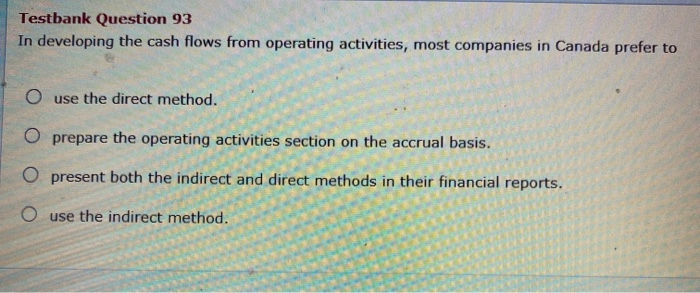

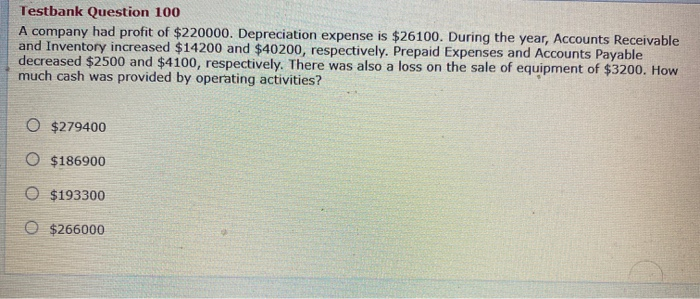

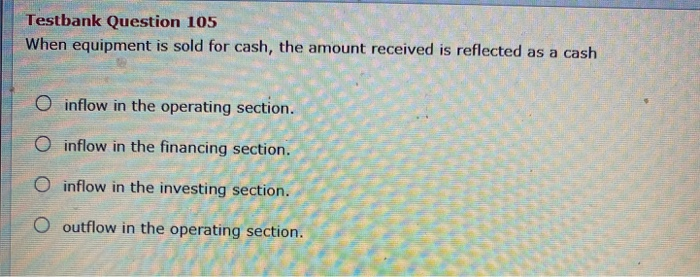

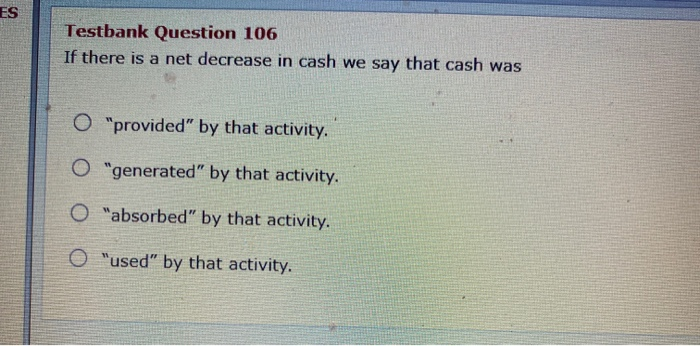

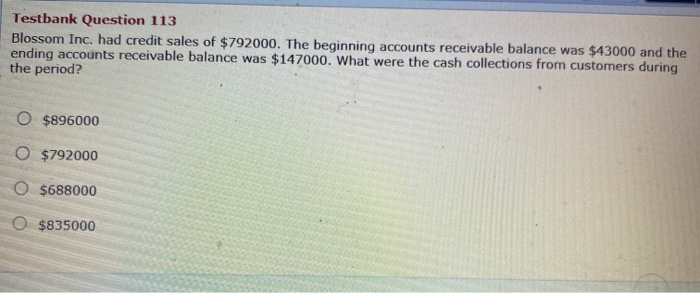

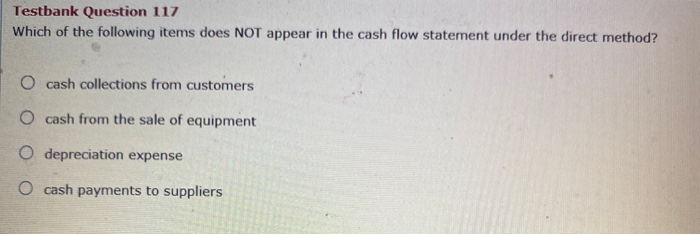

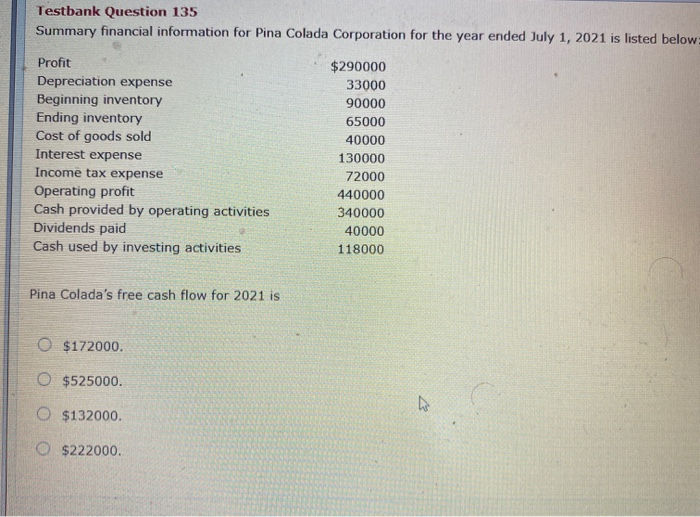

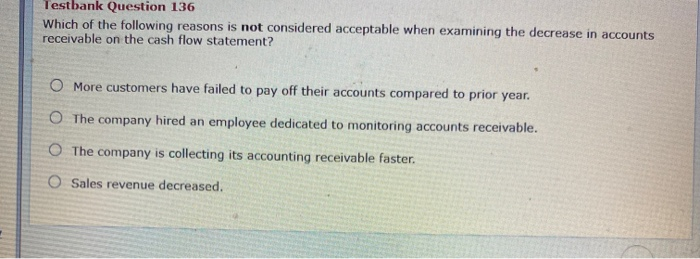

Testbank Question 87 In calculating cash flows from operating activities using the indirect method, a gain on the sale of equipment is O not reported on a cash flow statement. O added to profit. O deducted from profit. o ignored because it does not affect cash. ES Testbank Question 91 In calculating net cash provided by operating activities using the indirect method, an increase in prepaid expenses during a period is O ignored because it does not affect profit. O deducted from profit. O ignored because it does not affect expenses. added to profit. Testbank Question 93 In developing the cash flows from operating activities, most companies in Canada prefer to O use the direct method. O prepare the operating activities section on the accrual basis. O present both the indirect and direct methods in their financial reports. use the indirect method. Testbank Question 100 A company had profit of $220000. Depreciation expense is $26100. During the year, Accounts Receivable and Inventory increased $14200 and $40200, respectively. Prepaid Expenses and Accounts Payable decreased $2500 and $4100, respectively. There was also a loss on the sale of equipment of $3200. How much cash was provided by operating activities? O $279400 O $186900 $193300 $266000 Testbank Question 105 When equipment is sold for cash, the amount received is reflected as a cash O inflow in the operating section. o inflow in the financing section. O inflow in the investing section. O outflow in the operating section. ES Testbank Question 106 If there is a net decrease in cash we say that cash was o "provided" by that activity. O "generated" by that activity, o "absorbed" by that activity. O "used" by that activity. Testbank Question 113 Blossom Inc. had credit sales of $792000. The beginning accounts receivable balance was $43000 and the ending accounts receivable balance was $147000. What were the cash collections from customers during the period? O $896000 O $792000 O $688000 $835000 Testbank Question 135 Summary financial information for Pina Colada Corporation for the year ended July 1, 2021 is listed below: Profit Depreciation expense Beginning inventory Ending inventory Cost of goods sold Interest expense Income tax expense Operating profit Cash provided by operating activities Dividends paid Cash used by investing activities $290000 33000 90000 65000 40000 130000 72000 440000 340000 40000 118000 Pina Colada's free cash flow for 2021 is $172000. O $525000 O $132000. $222000 Testbank Question 136 Which of the following reasons is not considered acceptable when examining the decrease in accounts receivable on the cash flow statement? O More customers have failed to pay off their accounts compared to prior year. O The company hired an employee dedicated to monitoring accounts receivable. The company is collecting its accounting receivable faster. O Sales revenue decreased