Question

ABC Corporation issued a $100,000, 14-year, 10% bond on January 1, 2013, for $113467. ABC Corporation uses the straight-line method of amortization. On April

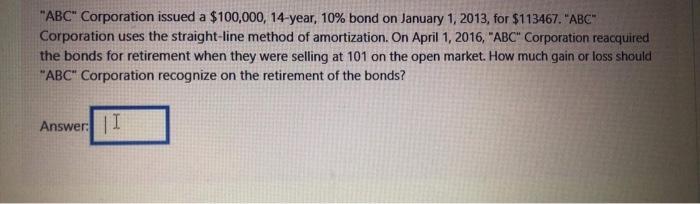

"ABC" Corporation issued a $100,000, 14-year, 10% bond on January 1, 2013, for $113467. "ABC" Corporation uses the straight-line method of amortization. On April 1, 2016, "ABC" Corporation reacquired the bonds for retirement when they were selling at 101 on the open market. How much gain or loss should "ABC" Corporation recognize on the retirement of the bonds? Answer: I

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer ABC Corporation should recognize Gain on the retirement of the bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistical Techniques in Business and Economics

Authors: Douglas A. Lind, William G Marchal

17th edition

1259666360, 978-1259666360

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App