Question

(TEXT BOX)It is 2024 and Carpet Baggers Inc. is proposing to construct a new bagging plant in a country in Europe. The two prime candidates

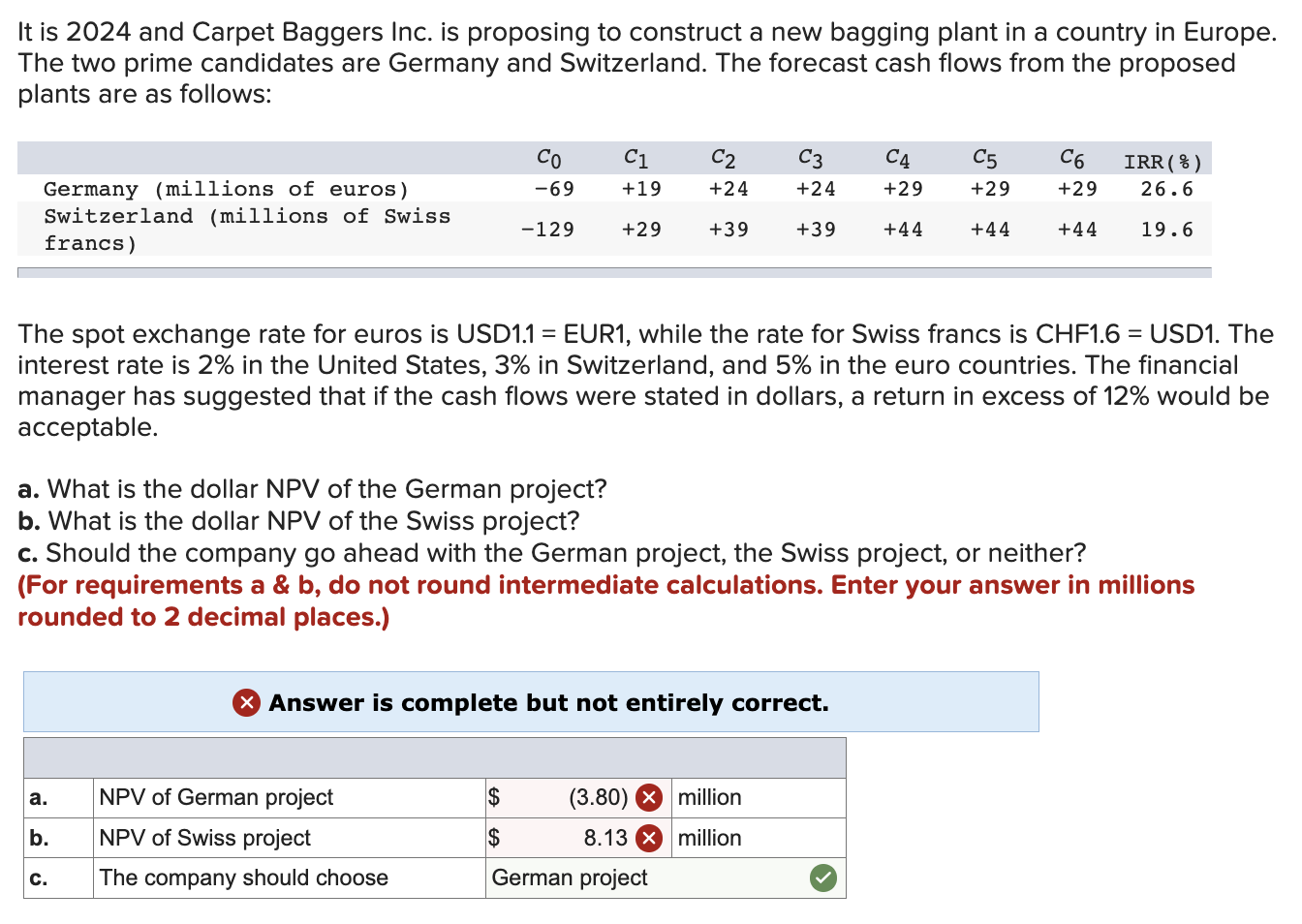

(TEXT BOX)It is 2024 and Carpet Baggers Inc. is proposing to construct a new bagging plant in a country in Europe. The two prime candidates are Germany and Switzerland. The forecast cash flows from the proposed plants are as follows:

(TEXT BOX)It is 2024 and Carpet Baggers Inc. is proposing to construct a new bagging plant in a country in Europe. The two prime candidates are Germany and Switzerland. The forecast cash flows from the proposed plants are as follows:

| C0 | C1 | C2 | C3 | C4 | C5 | C6 | IRR(%) | |

| Germany (millions of euros) | 69 | +19 | +24 | +24 | +29 | +29 | +29 | 26.6 |

| Switzerland (millions of Swiss francs) | 129 | +29 | +39 | +39 | +44 | +44 | +44 | 19.6 |

The spot exchange rate for euros is USD1.1 = EUR1, while the rate for Swiss francs is CHF1.6 = USD1. The interest rate is 2% in the United States, 3% in Switzerland, and 5% in the euro countries. The financial manager has suggested that if the cash flows were stated in dollars, a return in excess of 12% would be acceptable.

a. What is the dollar NPV of the German project?

b. What is the dollar NPV of the Swiss project?

c. Should the company go ahead with the German project, the Swiss project, or neither?

(For requirements a & b, do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)

It is 2024 and Carpet Baggers Inc. is proposing to construct a new bagging plant in a country in Europe. The two prime candidates are Germany and Switzerland. The forecast cash flows from the proposed plants are as follows: The spot exchange rate for euros is USD1.1 = EUR1, while the rate for Swiss francs is CHF1.6 = USD1. The interest rate is 2% in the United States, 3% in Switzerland, and 5% in the euro countries. The financial manager has suggested that if the cash flows were stated in dollars, a return in excess of 12% would be acceptable. a. What is the dollar NPV of the German project? b. What is the dollar NPV of the Swiss project? c. Should the company go ahead with the German project, the Swiss project, or neither? (For requirements a \& b, do not round intermediate calculations. Enter your answer in millions rounded to 2 decimal places.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started