Question

TGA is a pharmaceutical company. The company has been having challenges in the management of its working capital and has decided to examine its performance.

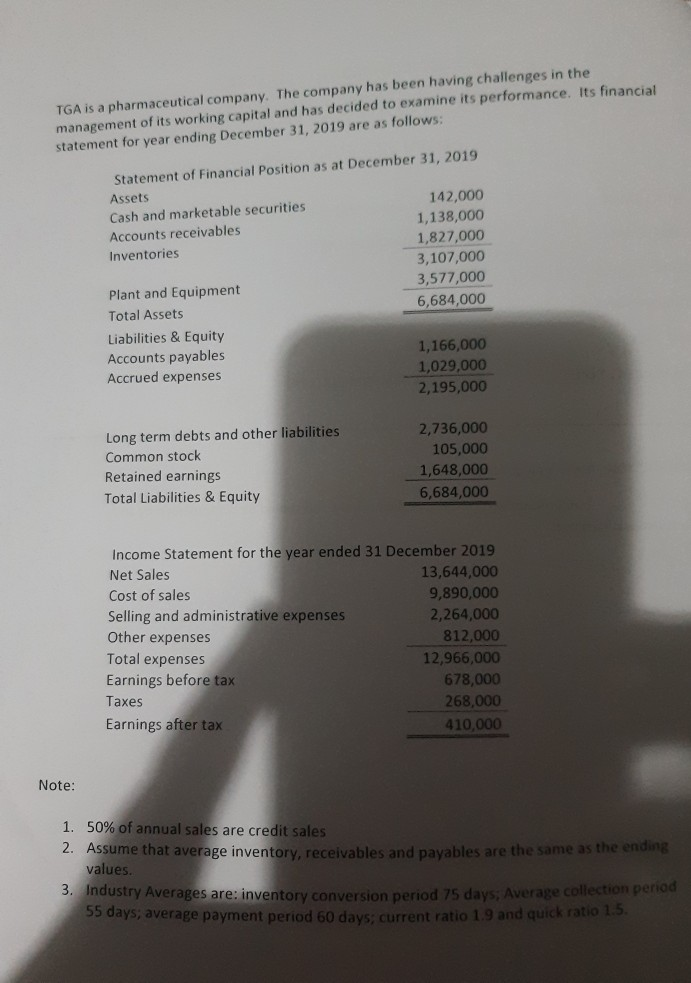

TGA is a pharmaceutical company. The company has been having challenges in the management of its working capital and has decided to examine its performance. Its financial statement for year ending December 31, 2019 are as follows:

Statement of Financial Position as at December 31, 2019 Assets Cash and marketable securities 142,000 Accounts receivables 1,138,000 Inventories 1,827,000 3,107,000 Plant and Equipment 3,577,000 Total Assets 6,684,000 Liabilities & Equity Accounts payables 1,166,000 Accrued expenses 1,029,000 2,195,000 Long term debts and other liabilities 2,736,000 Common stock 105,000 Retained earnings 1,648,000 Total Liabilities & Equity 6,684,000 Income Statement for the year ended 31 December 2019 Net Sales 13,644,000 Cost of sales 9,890,000 Selling and administrative expenses 2,264,000 Other expenses 812,000 Total expenses 12,966,000 Earnings before tax 678,000 Taxes 268,000 Earnings after tax 410,000

Note:

50% of annual sales are credit sales

Assume that average inventory, receivables and payables are the same as the ending values.

Industry Averages are: inventory conversion period 75 days; Average collection period 55 days; average payment period 60 days; current ratio 1.9 and quick ratio 1.5.

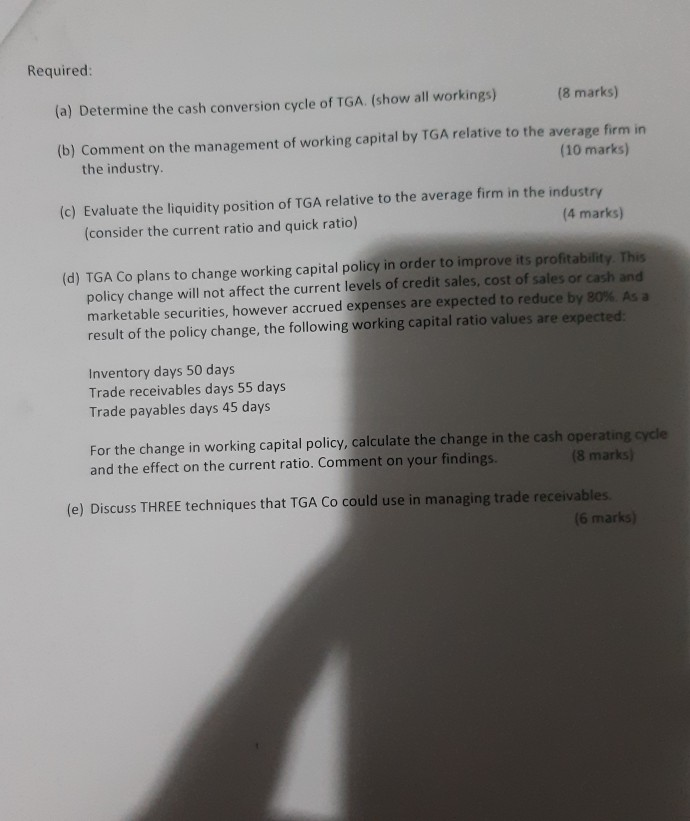

Required:

Determine the cash conversion cycle of TGA. (show all workings)

Comment on the management of working capital by TGA relative to the average firm in the industry.

Evaluate the liquidity position of TGA relative to the average firm in the industry (consider the current ratio and quick ratio)

TGA Co plans to change working capital policy in order to improve its profitability. This policy change will not affect the current levels of credit sales, cost of sales or cash and marketable securities, however accrued expenses are expected to reduce by 80%. As a result of the policy change, the following working capital ratio values are expected:

Inventory days 50 days

Trade receivables days 55 days

Trade payables days 45 days

For the change in working capital policy, calculate the change in the cash operating cycle and the effect on the current ratio. Comment on your findings.

Discuss THREE techniques that TGA Co could use in managing trade receivables.

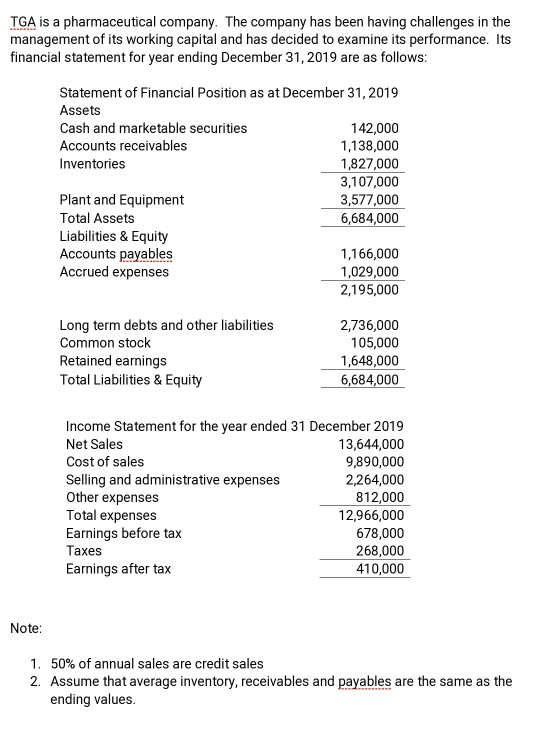

TGA is a pharmaceutical company. The company has been having challenges in the management of its working capital and has decided to examine its performance. Its financial statement for year ending December 31, 2019 are as follows: Statement of Financial Position as at December 31, 2019 Assets Cash and marketable securities 142,000 Accounts receivables 1,138,000 Inventories 1,827,000 3,107,000 Plant and Equipment 3,577,000 Total Assets 6,684,000 Liabilities & Equity Accounts payables 1,166,000 Accrued expenses 1,029,000 2,195,000 Long term debts and other liabilities Common stock Retained earnings Total Liabilities & Equity 2,736,000 105,000 1,648,000 6,684,000 Income Statement for the year ended 31 December 2019 Net Sales 13,644,000 Cost of sales 9,890,000 Selling and administrative expenses 2,264,000 Other expenses 812,000 Total expenses 12,966,000 Earnings before tax 678,000 Taxes 268,000 Earnings after tax 410,000 Note: 1. 50% of annual sales are credit sales 2. Assume that average inventory, receivables and payables are the same as the ending values. 3. Industry Averages are: inventory conversion period 75 days; Average collection period 55 days; average payment period 60 days; current ratio 1.9 and quick ratio 1.5. Required: (a) Determine the cash conversion cycle of TGA (show all workings) (8 marks) (b) Comment on the management of working capital by TGA relative to the average firm in the industry (10 marks) (c) Evaluate the liquidity position of TGA relative to the average firm in the industry (consider the current ratio and quick ratio) (4 marks) (d) TGA Co plans to change working capital policy in order to improve its profitability. This policy change will not affect the current levels of credit sales, cost of sales or cash and marketable securities, however accrued expenses are expected to reduce by 80%. As a result of the policy change, the following working capital ratio values are expected: Inventory days 50 days Trade receivables days 55 days Trade payables days 45 days For the change in working capital policy, calculate the change in the cash operating cycle and the effect on the current ratio. Comment on your findings. (8 marks) (e) Discuss THREE techniques that TGA Co could use in managing trade receivables. (6 marks) TGA is a pharmaceutical company. The company has been having challenges in the management of its working capital and has decided to examine its performance. Its financial statement for year ending December 31, 2019 are as follows: Statement of Financial Position as at December 31, 2019 Assets Cash and marketable securities 142,000 Accounts receivables 1,138,000 Inventories 1,827,000 3,107,000 Plant and Equipment 3,577,000 Total Assets 6,684,000 Liabilities & Equity Accounts payables 1,166,000 Accrued expenses 1,029,000 2,195,000 Long term debts and other liabilities Common stock Retained earnings Total Liabilities & Equity 2,736,000 105,000 1,648,000 6,684,000 Income Statement for the year ended 31 December 2019 Net Sales 13,644,000 Cost of sales 9,890,000 Selling and administrative expenses 2,264,000 Other expenses 812,000 Total expenses 12,966,000 Earnings before tax 678,000 Taxes 268,000 Earnings after tax 410,000 Note: 1. 50% of annual sales are credit sales 2. Assume that average inventory, receivables and payables are the same as the ending values

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started