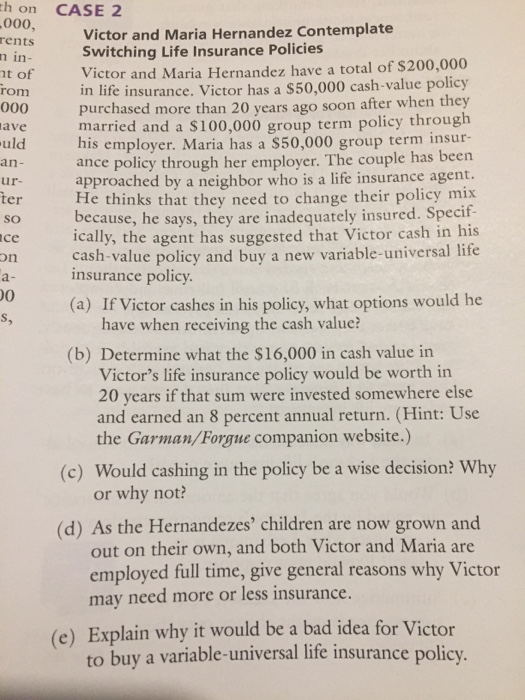

th on CASE 2 Victor and Maria Hernandez Contemplate Switching Life Insurance Policies rents n in- Victor and Maria Hernandez have a total of $200,000 in t of life insurance. Victor has a $50,000 cash-value policy rom purchased more than 20 years ago soon after when they married and a $100,000 group term policy through his employer. Maria has a $50,000 group term insur- ance policy through her employer. The couple has been approached by a neighbor who is a life insurance agent. ave uld an ur ter e thinks that they need to change their policy mix because, he says, they are inadequately insured. Specif- ically, the agent has suggested that Victor cash in his so ce on ash-value policy and buy a new variable-universal life 0 s, insurance policy. (a) If Victor cashes in his policy, what options would he have when receiving the cash value? (b) Determine what the $16,000 in cash value in Victor's life insurance policy would be worth in 20 years if that sum were invested somewhere else and earned an 8 percent annual return. (Hint: Use the Garman/Forgue companion website.) (c) Would cashing in the policy be a wise decision? Why or why not (d) As the Hernandezes' children are now grown and out on their own, and both Victor and Maria are employed full time, give general reasons why Victor may need more or less insurance. (e) Explain why it would be a bad idea for Victor to buy a variable-universal life insurance policy th on CASE 2 Victor and Maria Hernandez Contemplate Switching Life Insurance Policies rents n in- Victor and Maria Hernandez have a total of $200,000 in t of life insurance. Victor has a $50,000 cash-value policy rom purchased more than 20 years ago soon after when they married and a $100,000 group term policy through his employer. Maria has a $50,000 group term insur- ance policy through her employer. The couple has been approached by a neighbor who is a life insurance agent. ave uld an ur ter e thinks that they need to change their policy mix because, he says, they are inadequately insured. Specif- ically, the agent has suggested that Victor cash in his so ce on ash-value policy and buy a new variable-universal life 0 s, insurance policy. (a) If Victor cashes in his policy, what options would he have when receiving the cash value? (b) Determine what the $16,000 in cash value in Victor's life insurance policy would be worth in 20 years if that sum were invested somewhere else and earned an 8 percent annual return. (Hint: Use the Garman/Forgue companion website.) (c) Would cashing in the policy be a wise decision? Why or why not (d) As the Hernandezes' children are now grown and out on their own, and both Victor and Maria are employed full time, give general reasons why Victor may need more or less insurance. (e) Explain why it would be a bad idea for Victor to buy a variable-universal life insurance policy