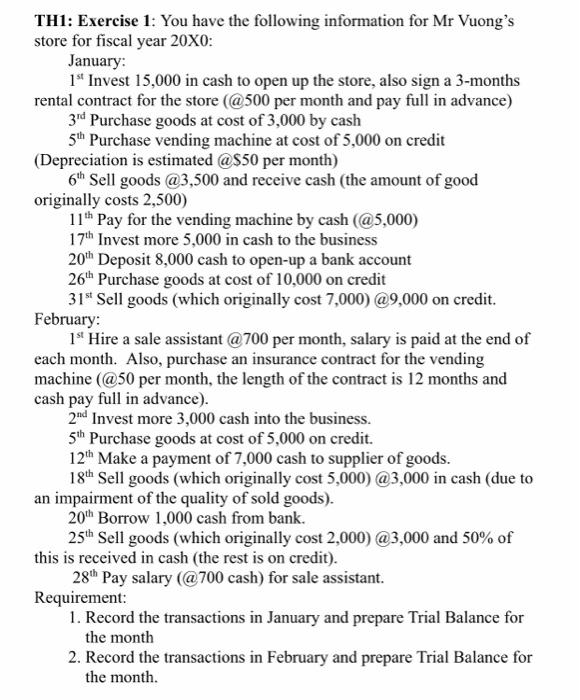

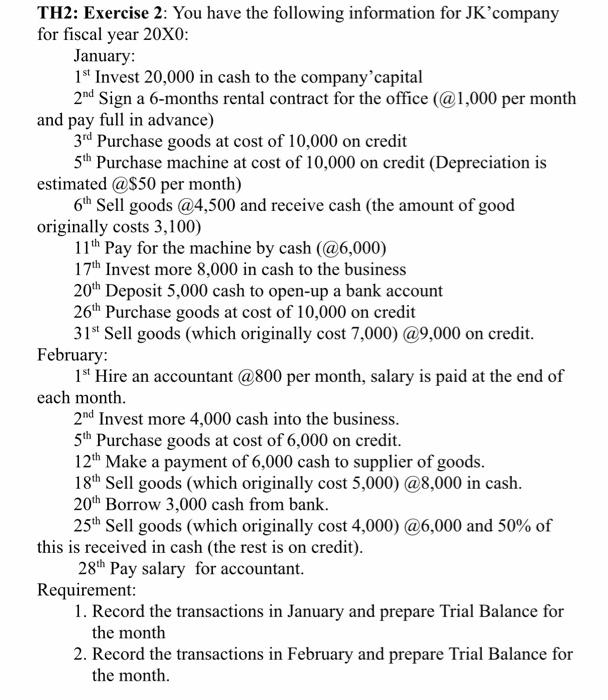

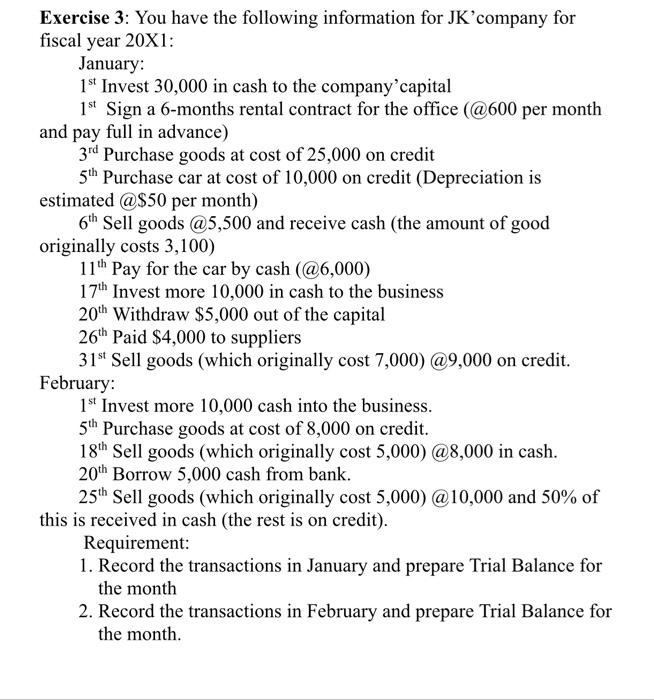

TH1: Exercise 1: You have the following information for Mr Vuong's store for fiscal year 20X0: January: 1" Invest 15,000 in cash to open up the store, also sign a 3-months rental contract for the store (@500 per month and pay full in advance) 3rd Purchase goods at cost of 3,000 by cash 51h Purchase vending machine at cost of 5,000 on credit (Depreciation is estimated @$50 per month) 6h Sell goods @3,500 and receive cash (the amount of good originally costs 2,500) 11h Pay for the vending machine by cash (@5,000) 17h Invest more 5,000 in cash to the business 20th Deposit 8,000 cash to open-up a bank account 26th Purchase goods at cost of 10,000 on credit 31" Sell goods (which originally cost 7,000) @9,000 on credit. February: 1" Hire a sale assistant @ 700 per month, salary is paid at the end of each month. Also, purchase an insurance contract for the vending machine (@50 per month, the length of the contract is 12 months and cash pay full in advance). 2nd Invest more 3,000 cash into the business. 5th Purchase goods at cost of 5,000 on credit. 12th Make a payment of 7,000 cash to supplier of goods. 18th Sell goods (which originally cost 5,000) @3,000 in cash (due to an impairment of the quality of sold goods). 20" Borrow 1,000 cash from bank. 25th Sell goods (which originally cost 2,000) @3,000 and 50% of this is received in cash (the rest is on credit). 28th Pay salary (@700 cash) for sale assistant. Requirement: 1. Record the transactions in January and prepare Trial Balance for the month 2. Record the transactions in February and prepare Trial Balance for the month. TH2: Exercise 2: You have the following information for JK'company for fiscal year 20X0: January: 1st Invest 20,000 in cash to the company capital 2nd Sign a 6-months rental contract for the office (@1,000 per month and pay full in advance) 3rd Purchase goods at cost of 10,000 on credit 5th Purchase machine at cost of 10,000 on credit (Depreciation is estimated @$50 per month) 6h Sell goods @4,500 and receive cash (the amount of good originally costs 3,100) 11th Pay for the machine by cash (@6,000) 17h Invest more 8,000 in cash to the business 20th Deposit 5,000 cash to open-up a bank account 26h Purchase goods at cost of 10,000 on credit 31st Sell goods (which originally cost 7,000) @9,000 on credit. February: 1* Hire an accountant @800 per month, salary is paid at the end of each month. 2nd Invest more 4,000 cash into the business. 5th Purchase goods at cost of 6,000 on credit. 12th Make a payment of 6,000 cash to supplier of goods. 18th Sell goods (which originally cost 5,000) @8,000 in cash. 20th Borrow 3,000 cash from bank. 25th Sell goods (which originally cost 4,000) @6,000 and 50% of this is received in cash (the rest is on credit). 28th Pay salary for accountant. Requirement: 1. Record the transactions in January and prepare Trial Balance for the month 2. Record the transactions in February and prepare Trial Balance for the month. Exercise 3: You have the following information for JK'company for fiscal year 20X1: January 1st Invest 30,000 in cash to the company'capital 1st Sign a 6-months rental contract for the office (@600 per month and pay full in advance) 3rd Purchase goods at cost of 25,000 on credit 5th Purchase car at cost of 10,000 on credit (Depreciation is estimated @$50 per month) 6th Sell goods @5,500 and receive cash (the amount of good originally costs 3,100) 11h Pay for the car by cash (@6,000) 17h Invest more 10,000 in cash to the business 20th Withdraw $5,000 out of the capital 26th Paid $4,000 to suppliers 31st Sell goods (which originally cost 7,000) @9,000 on credit. February: 1 st Invest more 10,000 cash into the business. 5th Purchase goods at cost of 8,000 on credit. 18th Sell goods (which originally cost 5,000) @8,000 in cash. 20th Borrow 5,000 cash from bank. 25th Sell goods (which originally cost 5,000) @10,000 and 50% of this is received in cash (the rest is on credit). Requirement: 1. Record the transactions in January and prepare Trial Balance for the month 2. Record the transactions in February and prepare Trial Balance for the month