Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you . . 19. Given the following information for Langs, Inc., calculate per share dividend dollar amount (that is, the dividends per share), rounded

Thank you

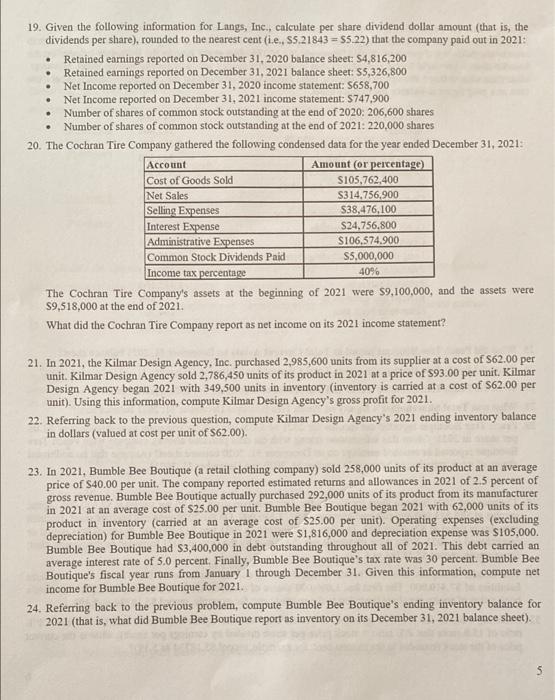

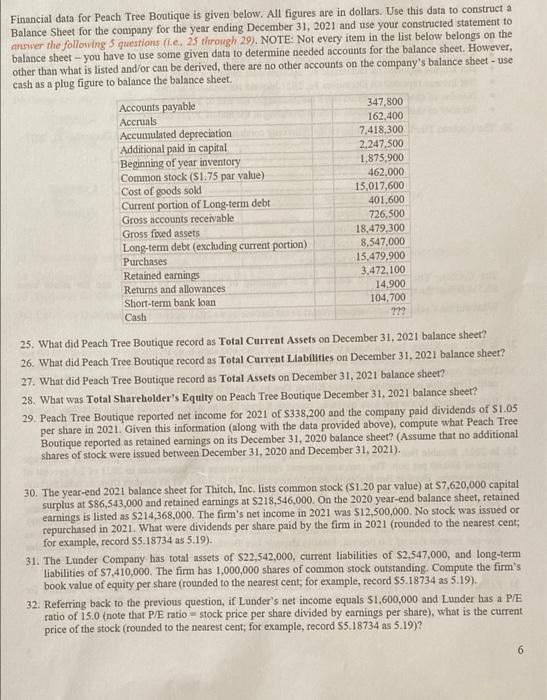

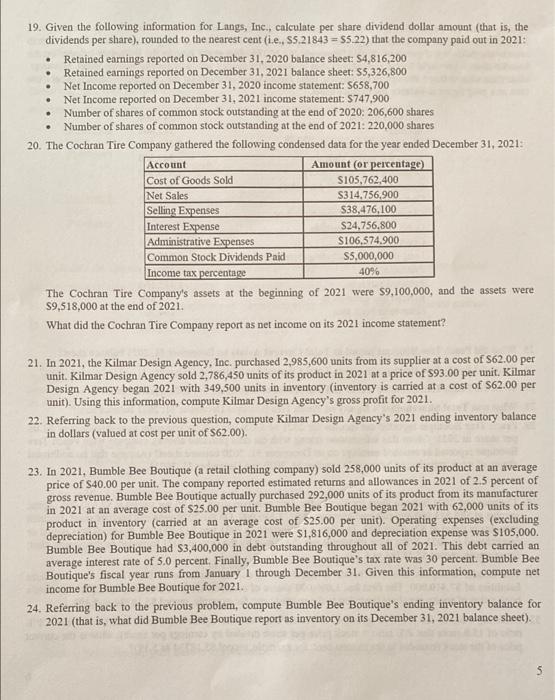

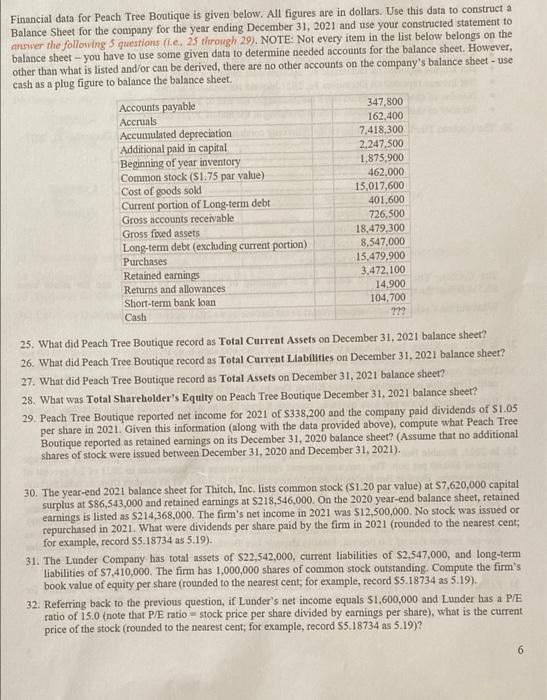

. . 19. Given the following information for Langs, Inc., calculate per share dividend dollar amount (that is, the dividends per share), rounded to the nearest cent (.e., 55.21843 = $5.22) that the company paid out in 2021: Retained earnings reported on December 31, 2020 balance sheet: 54,816,200 Retained earnings reported on December 31, 2021 balance sheet: 55,326,800 Net Income reported on December 31, 2020 income statement: $658,700 Net Income reported on December 31, 2021 income statement: $747,900 Number of shares of common stock outstanding at the end of 2020: 206,600 shares Number of shares of common stock outstanding at the end of 2021: 220,000 shares 20. The Cochran Tire Company gathered the following condensed data for the year ended December 31, 20213 Account Amount (or percentage) Cost of Goods Sold S105,762,400 Net Sales S314.756.900 Selling Expenses S38,476,100 Interest Expense $24.756.800 Administrative Expenses S106.574.900 Common Stock Dividends Paid S5,000,000 Income tax percentage 4096 The Cochran Tire Company's assets at the beginning of 2021 were $9,100,000, and the assets were $9,518,000 at the end of 2021. What did the Cochran Tire Company report as net income on its 2021 income statement? 21. In 2021, the Kilmar Design Agency, Inc. purchased 2,985,600 units from its supplier at a cost of $62.00 per unit. Kilmar Design Agency sold 2,786,450 units of its product in 2021 at a price of $93.00 per unit. Kilmar Design Agency began 2021 with 349.500 units in inventory (inventory is carried at a cost of $62.00 per unit). Using this information, compute Kilmar Design Agency's gross profit for 2021. 22. Referring back to the previous question, compute Kilmar Design Agency's 2021 ending inventory balance in dollars (valued at cost per unit of S62.00). 23. In 2021, Bumble Bee Boutique (a retail clothing company) sold 258,000 units of its product at an average price of $40.00 per unit. The company reported estimated returns and allowances in 2021 of 2.5 percent of gross revenue. Bumble Bee Boutique actually purchased 292,000 units of its product from its manufacturer in 2021 at an average cost of $25.00 per unit. Bumble Bee Boutique began 2021 with 62,000 units of its product in inventory (carried at an average cost of $25.00 per unit). Operating expenses (excluding depreciation) for Bumble Bee Boutique in 2021 were $1,816,000 and depreciation expense was $105,000 Bumble Bee Boutique had $3,400,000 in debt outstanding throughout all of 2021. This debt carried an average interest rate of 5.0 percent. Finally, Bumble Bee Boutique's tax rate was 30 percent. Bumble Bee Boutique's fiscal year runs from January 1 through December 31. Given this information, compute net income for Bumble Bee Boutique for 2021. 24. Referring back to the previous problem, compute Bumble Bee Boutique's ending inventory balance for 2021 (that is, what did Bumble Bee Boutique report as inventory on its December 31, 2021 balance sheet). $ Financial data for Peach Tree Boutique is given below. All figures are in dollars. Use this data to construct a Balance Sheet for the company for the year ending December 31, 2021 and use your constructed statement to answer the following questions (ie, 25 through 29). NOTE: Not every item in the list below belongs on the balance sheet - you have to use some given data to determine needed accounts for the balance sheet. However, other than what is listed and/or can be derived, there are no other accounts on the company's balance sheet - use cash as a plug figure to balance the balance sheet. Accounts payable 347,800 Accruals 162.400 Accumulated depreciation 7,418,300 Additional paid in capital 2.247,500 Beginning of year inventory 1.875,900 Common stock (S1.75 par value) 462,000 Cost of goods sold 15,017,600 Current portion of Long-term debt 401,600 Gross accounts receivable 726,500 Gross fixed assets 18,479,300 Long-term debt (excluding current portion) 8,547.000 Purchases 15,479.900 Retained earnings 3,472,100 Returns and allowances 14,900 Short-term bank loan 104,700 Cash 272 25. What did Peach Tree Boutique record as Total Current Assets on December 31, 2021 balance sheet? 26. What did Peach Tree Boutique record as Total Current Liabilities on December 31, 2021 balance sheet? 27. What did Peach Tree Boutique record as Total Assets on December 31, 2021 balance sheet? 28. What was Total Shareholder's Equlty on Peach Tree Boutique December 31, 2021 balance sheet? 29. Peach Tree Boutique reported net income for 2021 of 338,200 and the company paid dividends of S1.05 per share in 2021. Given this information (along with the data provided above), compute what Peach Tree Boutique reported as retained earnings on its December 31, 2020 balance sheet? (Assume that no additional shares of stock were issued between December 31, 2020 and December 31, 2021). 30. The year-end 2021 balance sheet for Thitch, Inc. lists common stock (S1.20 par value) at S7,620,000 capital surplus at $86,543,000 and retained earnings at S218,546,000. On the 2020 year-end balance sheet, retained earnings is listed as S214,368,000. The firm's net income in 2021 was $12.500,000. No stock was issued or repurchased in 2021. What were dividends per share paid by the firm in 2021 (rounded to the nearest cent; for example, record 55.18734 as 5.19). 31. The Lunder Company has total assets of $22,542,000, current liabilities of $2,547,000, and long-term liabilities of S7,410,000. The firm has 1,000,000 shares of common stock outstanding. Compute the firm's book value of equity per share (rounded to the nearest cent, for example, record 55.18734 as 5.19). 32. Referring back to the previous question, if Lunder's net income equals $1,600,000 and Lunder has a PE ratio of 15.0 (note that P/E ratio stock price per share divided by earnings per share), what is the current price of the stock (rounded to the nearest cent; for example, record 55.18734 as 5.19)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started