Thank you for the help! I appreciate it!

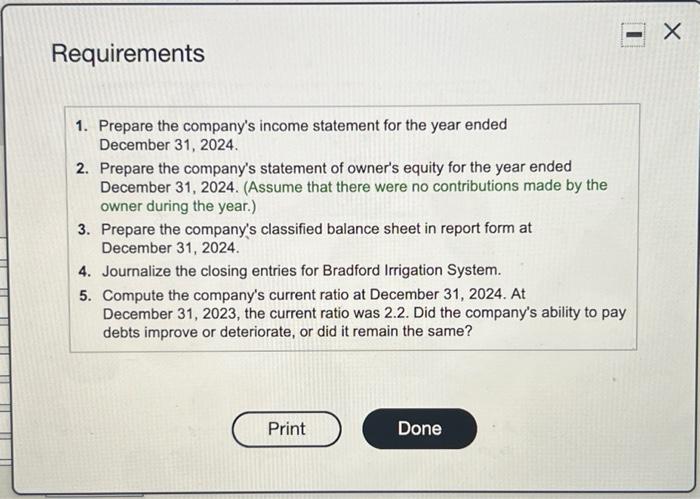

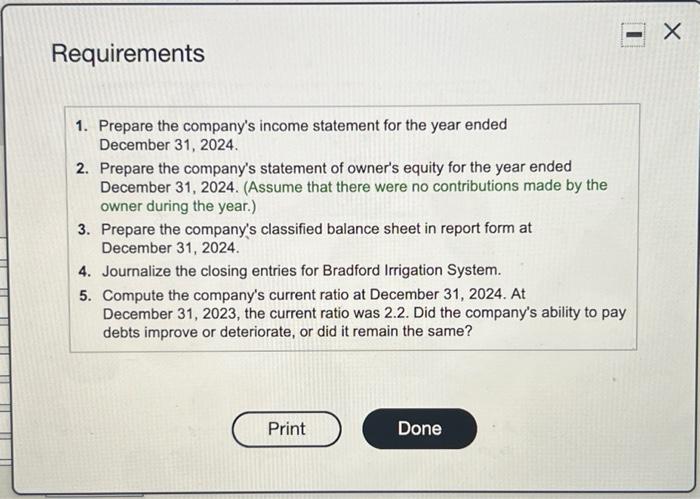

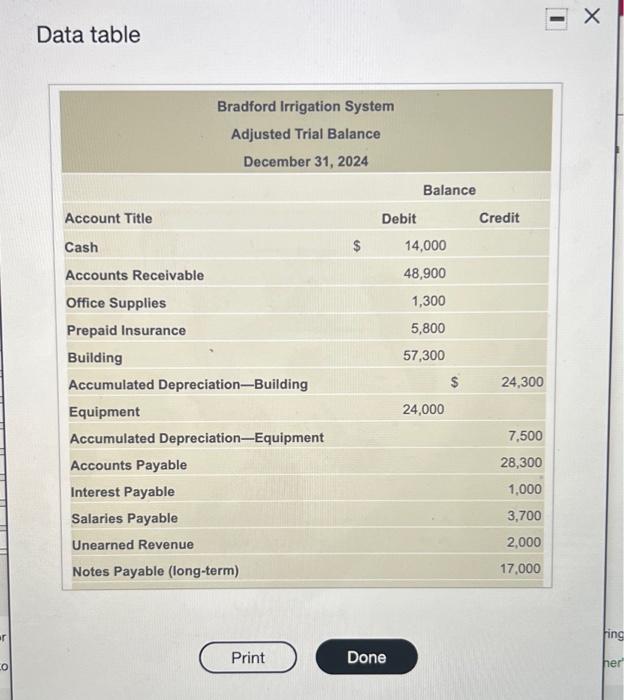

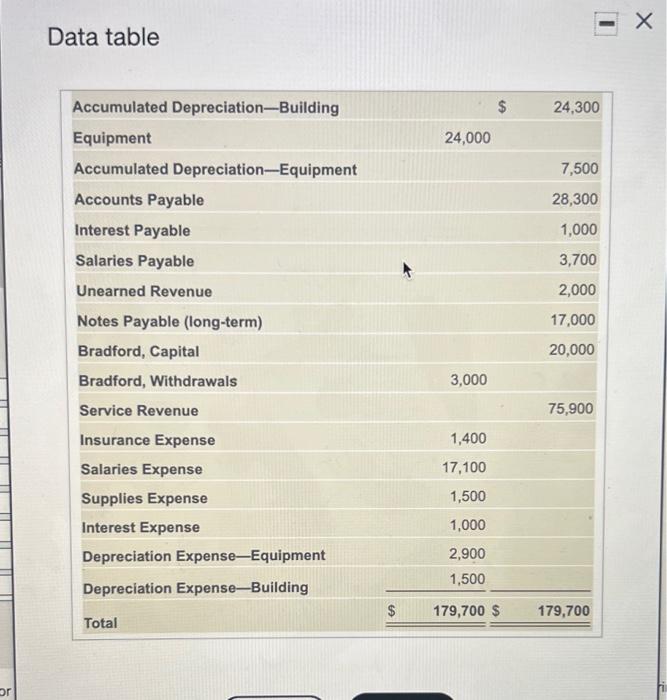

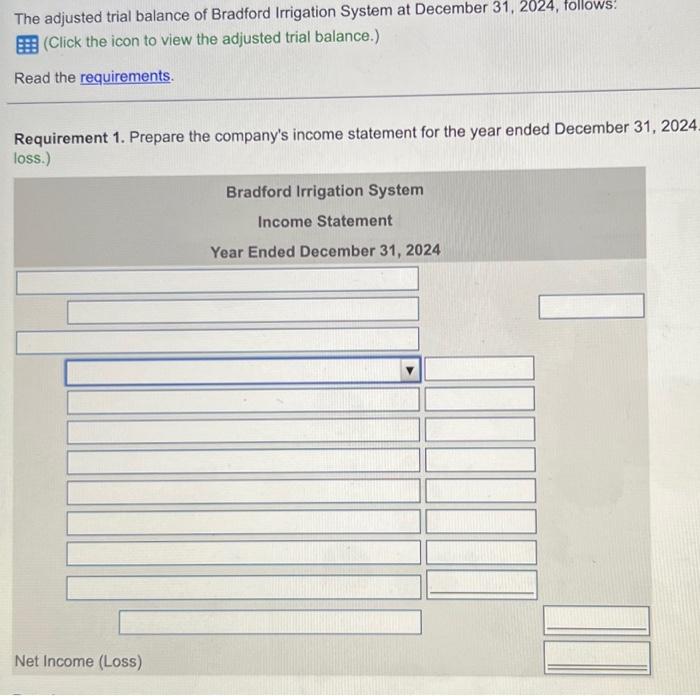

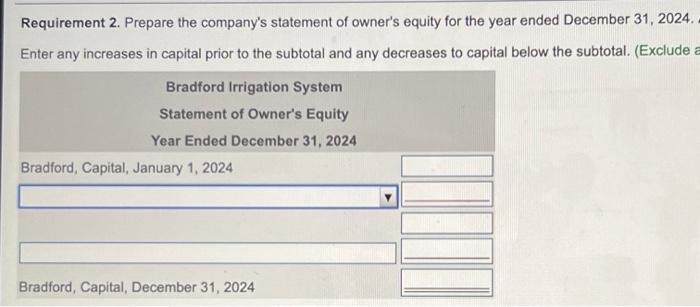

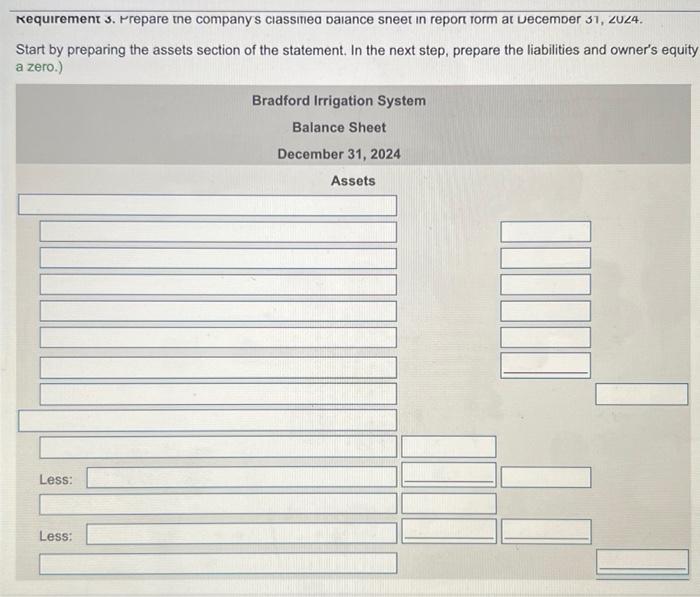

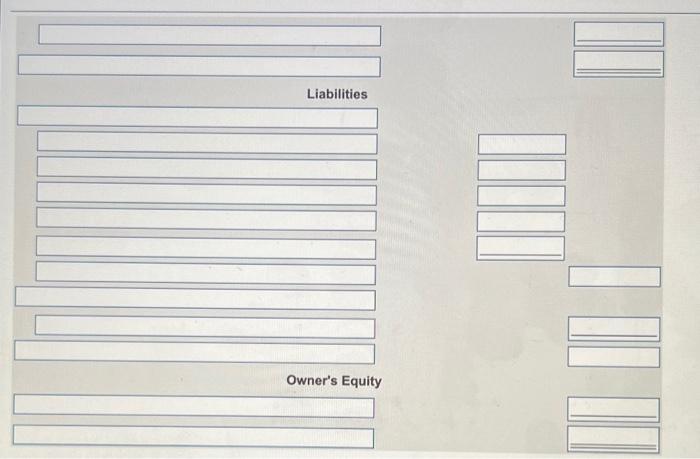

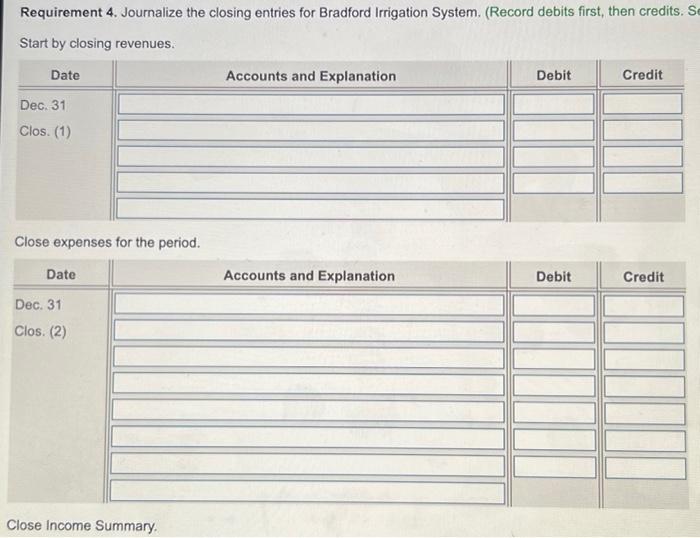

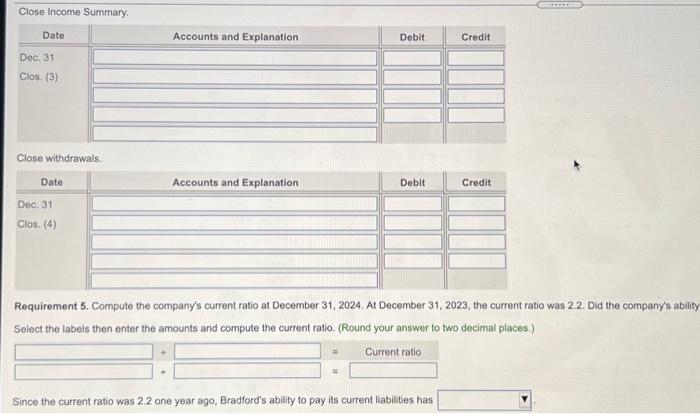

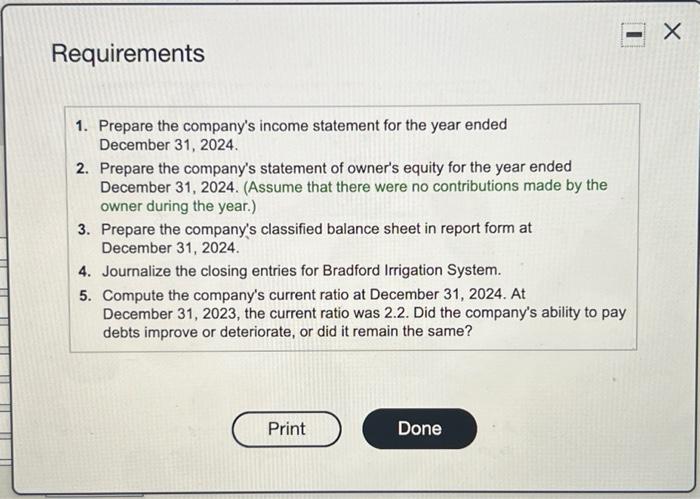

Requirements 1. Prepare the company's income statement for the year ended December 31, 2024. 2. Prepare the company's statement of owner's equity for the year ended December 31, 2024. (Assume that there were no contributions made by the owner during the year.) 3. Prepare the company's classified balance sheet in report form at December 31, 2024. 4. Journalize the closing entries for Bradford Irrigation System. 5. Compute the company's current ratio at December 31, 2024. At December 31, 2023, the current ratio was 2.2. Did the company's ability to pay debts improve or deteriorate, or did it remain the same? Print Done Data table Bradford Irrigation System Adjusted Trial Balance December 31, 2024 Balance Account Title Debit Credit Cash 14,000 48,900 1,300 5,800 57,300 $ 24,300 24,000 Accounts Receivable Office Supplies Prepaid Insurance Building Accumulated Depreciation-Building Equipment Accumulated Depreciation-Equipment Accounts Payable Interest Payable Salaries Payable Unearned Revenue Notes Payable (long-term) 7.500 28,300 1.000 3,700 2,000 17,000 fing Print Done CO her Data table Accumulated Depreciation-Building 24.300 24,000 7,500 28,300 1,000 3,700 Equipment Accumulated Depreciation-Equipment Accounts Payable Interest Payable Salaries Payable Unearned Revenue Notes Payable (long-term) Bradford, Capital Bradford, Withdrawals Service Revenue Insurance Expense 2,000 17,000 20,000 3,000 75,900 1,400 Salaries Expense 17,100 1,500 Supplies Expense Interest Expense Depreciation Expense-Equipment 1,000 2,900 1,500 Depreciation Expense-Building $ 179,700 $ 179,700 Total or The adjusted trial balance of Bradford Irrigation System at December 31, 2024, follows: E (Click the icon to view the adjusted trial balance.) Read the requirements. Requirement 1. Prepare the company's income statement for the year ended December 31, 2024 loss.) Bradford Irrigation System Income Statement Year Ended December 31, 2024 Net Income (Loss) Requirement 2. Prepare the company's statement of owner's equity for the year ended December 31, 2024. Enter any increases in capital prior to the subtotal and any decreases to capital below the subtotal. (Exclude a Bradford Irrigation System Statement of Owner's Equity Year Ended December 31, 2024 Bradford, Capital, January 1, 2024 Bradford, Capital, December 31, 2024 Requirements. Prepare the company's classmea balance sneer in report form at December 31, 2024. Start by preparing the assets section of the statement. In the next step, prepare the liabilities and owner's equity a zero.) Bradford Irrigation System Balance Sheet December 31, 2024 Assets Less: Less: Liabilities ULT Owner's Equity Requirement 4. Journalize the closing entries for Bradford Irrigation System. (Record debits first, then credits. Se Start by closing revenues. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (1) Close expenses for the period. Date Accounts and Explanation Debit Credit Dec. 31 Clos. (2) Close Income Summary. Close Income Summary Date Accounts and Explanation Dobit Credit Dec 31 Clos (3) Close withdrawals Date Accounts and Explanation Debit Credit Dec. 31 Clos (4) Requirement 5. Compute the company's current ratio at December 31, 2024. At December 31, 2023, the current ratio was 2.2. Did the company's ability Select the labels then enter the amounts and compute the current ratio. (Round your answer to two decimal places) Current ratio Since the current ratio was 2.2 one year ago, Bradford's ability to pay its current liabilities has