thank you for the help!

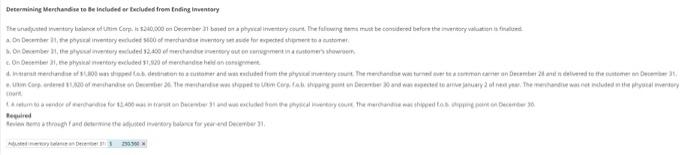

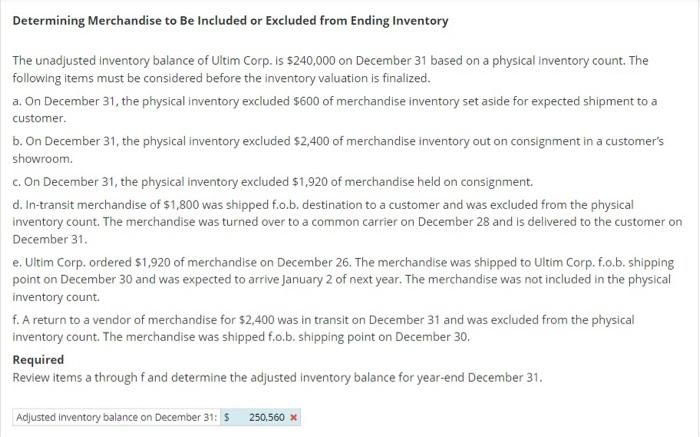

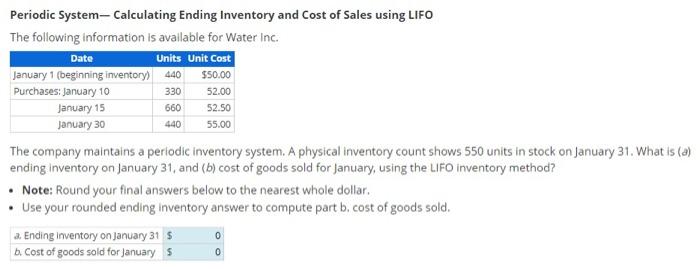

Peniodic System- Cakculating Lnding Inventory and Cost of Sales wsing LFO The follownig inforinaten is availabie boe Waser ine. A cerr of gacds neit for ianayy Decenmining Menhandie te Be insluded er tedluded frem tnding inventsry 10 Bewained Determining Merchandise to Be Included or Excluded from Ending Inventory The unadjusted inventory balance of Uitim Corp. Is $240,000 on December 31 based on a physical inventory count. The following items must be considered before the inventory valuation is finalized. a. On December 31 , the physical inventory excluded $600 of merchandise inventory set aside for expected shipment to a customer. b. On December 31 , the physical inventory excluded $2,400 of merchandise inventory out on consignment in a customer's showroom. c. On December 31 , the physical inventory excluded $1,920 of merchandise held on consignment. d. In-transit merchandise of $1,800 was shipped f.o.b. destination to a customer and was excluded from the physical inventory count. The merchandise was turned over to a common carrier on December 28 and is delivered to the customer on December 31. e. Ultim Corp. ordered $1,920 of merchandise on December 26. The merchandise was shipped to Ultim Corp. f.o.b. shipping point on December 30 and was expected to arrive January 2 of next year. The merchandise was not included in the physical inventory count. f. A return to a vendor of merchandise for $2,400 was in transit on December 31 and was excluded from the physical inventory count. The merchandise was shipped f.o.b. shipping point on December 30 . Required Review items a through f and determine the adjusted inventory balance for year-end December 31. Periodic System-Calculating Ending Inventory and Cost of Sales using LIFO The following information is avallable for Water Inc. The company maintains a periodic inventory system. A physical inventory count shows 550 units in stock on January 31 . What is (a) ending inventory on January 31 , and (b) cost of goods sold for January, using the L.FO inventory method? - Note: Round your final answers below to the nearest whole dollar. - Use your rounded ending inventory answer to compute part b. cost of goods sold