THANK YOU FOR YOUR HELP

Shake Shack sells burgers in restaurants. In 2020, it applied for and received $10 million loan from the U.S. government as a part of the effort to help small businesses survive during the Coronavirus crisis. Shake Shack returned the money after receiving bad publicity. Use its financial statements to answer the remaining questions.

a. If Shake Shack had kept the $10 million loan, what would have appeared in the its cash flow statement related to the loan? In which section of the cash flow statement would the entry appear?

b. Did Shake Shack report a gain or loss on the disposal of PPE? How large was the gain or loss?

c. It is a good sign about a companys prospects when it generates enough cash flow from operations to fund its purchases of property, plant and equipment. Is Brinker generating enough cash flow to accomplish this? Explain how you reach this conclusion. What do we call cash flow from operations capital expenditures?

d. Check to see if the change in inventories and accounts payable in the balance sheet match the information in the cash flow statement. For many firms, these numbers do not match as a result of acquisitions, foreign currency translation gains or losses or other reasons.

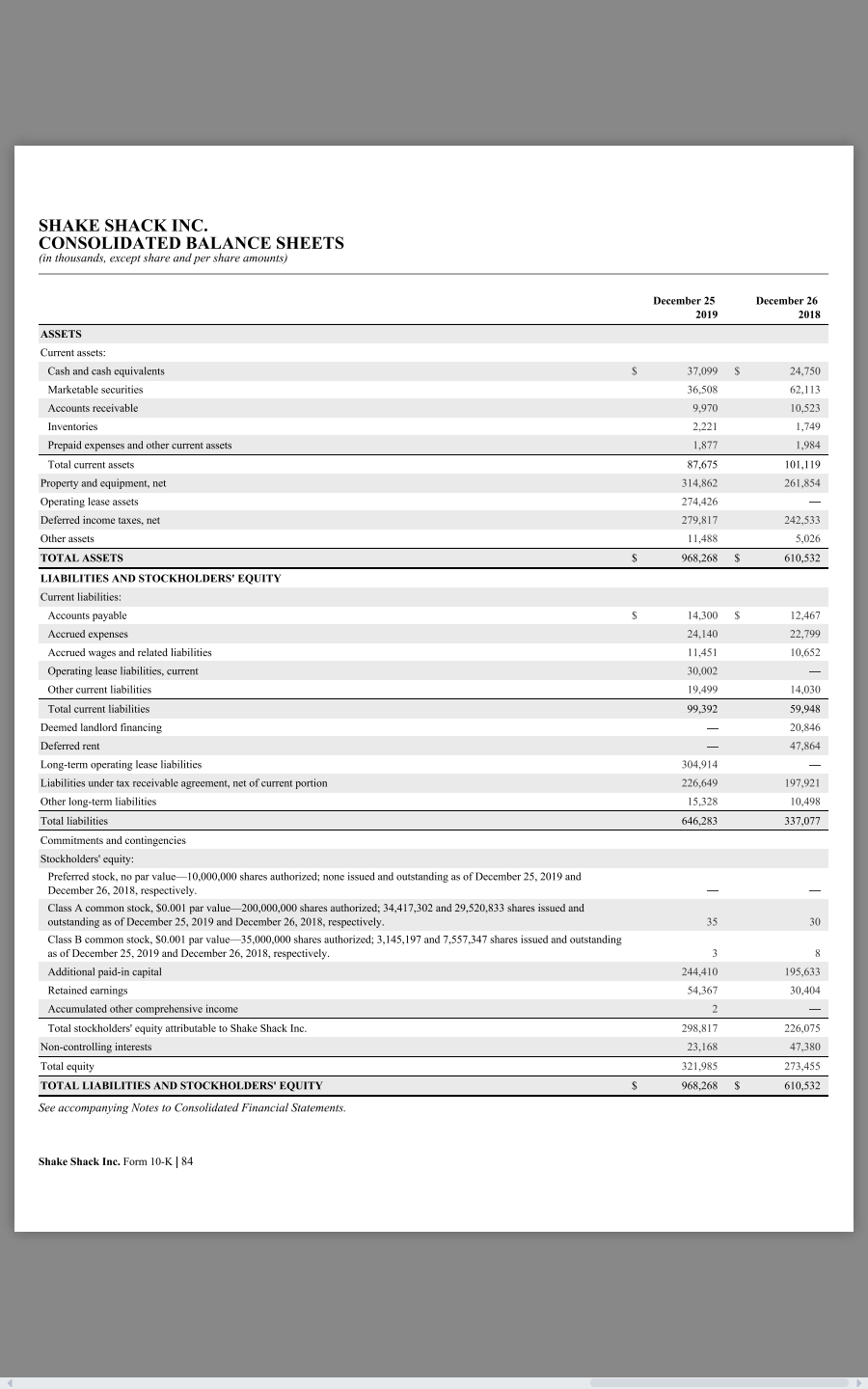

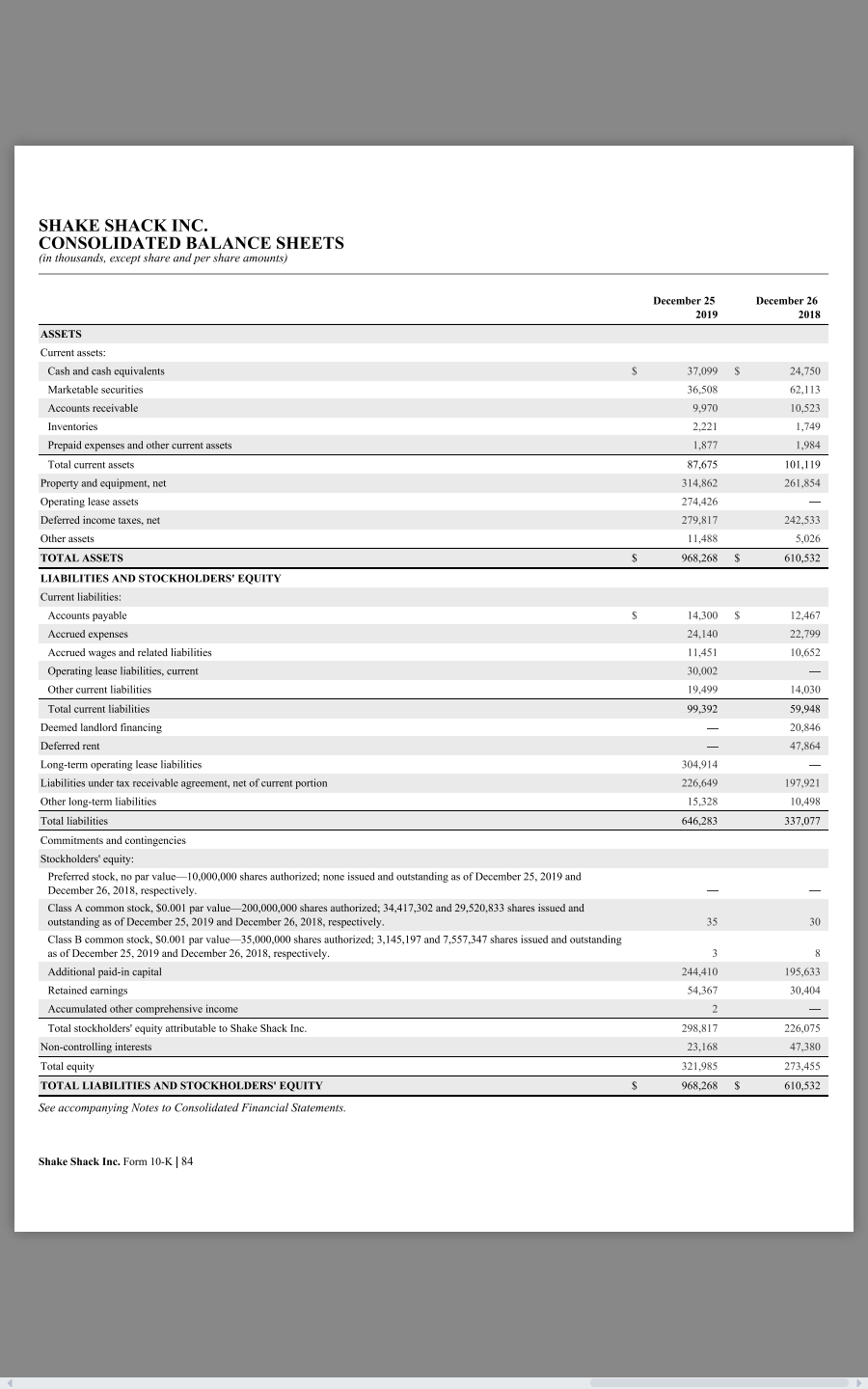

SHAKE SHACK INC. CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share amounts) December 25 2019 December 26 2018 ASSETS 37,099 24,750 62,113 10,523 1,749 1,984 36,508 9,970 2.221 1,877 87,675 314,862 274,426 279,817 11,488 968,268 101,119 261,854 242,533 5,026 $ $ 610,532 $ $ 12,467 22,799 10,652 14,300 24.140 11,451 30,002 19,499 99.392 Current assets: Cash and cash equivalents Marketable securities Accounts receivable Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net Operating lease assets Deferred income taxes, net Other assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses Accrued wages and related liabilities Operating lease liabilities, current Other current liabilities Total current liabilities Deemed landlord financing Deferred rent Long-term operating lease liabilities Liabilities under tax receivable agreement, net of current portion Other long-term liabilities Total liabilities Commitments and contingencies Stockholders' equity: Preferred stock, no par value10,000,000 shares authorized; none issued and outstanding as of December 25, 2019 and December 26, 2018, respectively. Class A common stock, $0.001 par value200,000,000 shares authorized; 34,417,302 and 29,520,833 shares issued and outstanding as of December 25, 2019 and December 26, 2018, respectively, Class B common stock, 50.001 par value35,000,000 shares authorized; 3,145,197 and 7,557,347 shares issued and outstanding as of December 25, 2019 and December 26, 2018, respectively. Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity attributable to Shake Shack Inc. Non-controlling interests Total equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 14.030 59,948 20.846 47,864 197,921 10,498 337,077 304,914 226,649 15,328 646.283 244,410 54,367 195,633 30,404 298,817 23,168 321,985 968,268 226,075 47,380 273,455 610,532 $ $ See accompanying Notes to Consolidated Financial Statements. Shake Shack Inc. Form 10-K | 84 SHAKE SHACK INC. CONSOLIDATED BALANCE SHEETS (in thousands, except share and per share amounts) December 25 2019 December 26 2018 ASSETS 37,099 24,750 62,113 10,523 1,749 1,984 36,508 9,970 2.221 1,877 87,675 314,862 274,426 279,817 11,488 968,268 101,119 261,854 242,533 5,026 $ $ 610,532 $ $ 12,467 22,799 10,652 14,300 24.140 11,451 30,002 19,499 99.392 Current assets: Cash and cash equivalents Marketable securities Accounts receivable Inventories Prepaid expenses and other current assets Total current assets Property and equipment, net Operating lease assets Deferred income taxes, net Other assets TOTAL ASSETS LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued expenses Accrued wages and related liabilities Operating lease liabilities, current Other current liabilities Total current liabilities Deemed landlord financing Deferred rent Long-term operating lease liabilities Liabilities under tax receivable agreement, net of current portion Other long-term liabilities Total liabilities Commitments and contingencies Stockholders' equity: Preferred stock, no par value10,000,000 shares authorized; none issued and outstanding as of December 25, 2019 and December 26, 2018, respectively. Class A common stock, $0.001 par value200,000,000 shares authorized; 34,417,302 and 29,520,833 shares issued and outstanding as of December 25, 2019 and December 26, 2018, respectively, Class B common stock, 50.001 par value35,000,000 shares authorized; 3,145,197 and 7,557,347 shares issued and outstanding as of December 25, 2019 and December 26, 2018, respectively. Additional paid-in capital Retained earnings Accumulated other comprehensive income Total stockholders' equity attributable to Shake Shack Inc. Non-controlling interests Total equity TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 14.030 59,948 20.846 47,864 197,921 10,498 337,077 304,914 226,649 15,328 646.283 244,410 54,367 195,633 30,404 298,817 23,168 321,985 968,268 226,075 47,380 273,455 610,532 $ $ See accompanying Notes to Consolidated Financial Statements. Shake Shack Inc. Form 10-K | 84