Answered step by step

Verified Expert Solution

Question

1 Approved Answer

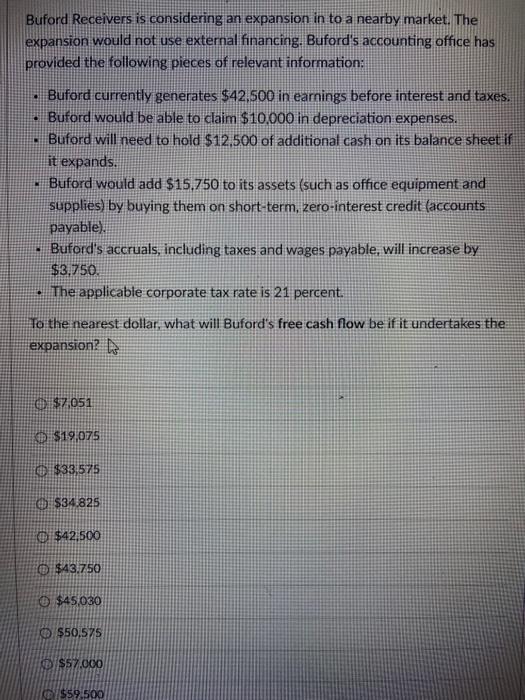

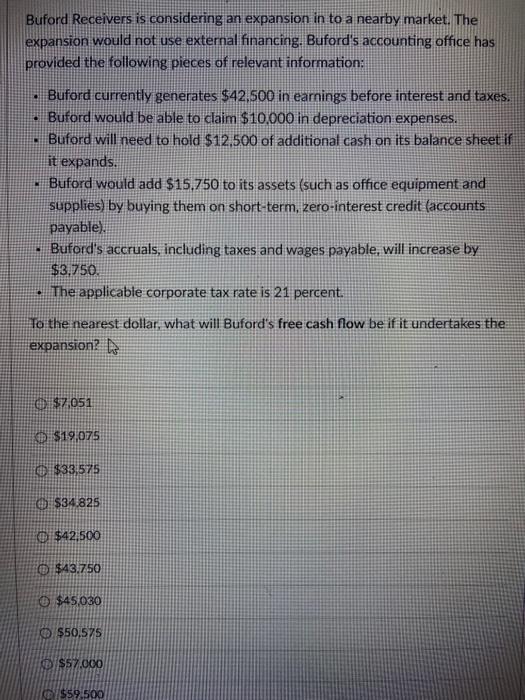

thank you im advance Buford Receivers is considering an expansion in to a nearby market. The expansion would not use external financing. Buford's accounting office

thank you im advance

Buford Receivers is considering an expansion in to a nearby market. The expansion would not use external financing. Buford's accounting office has provided the following pieces of relevant information: - Buford currently generates $42,500 in eamings before interest and taxes. - Buford would be able to claim $10.000 in depreciation expenses. - Buford will need to hold $12,500 of additional cash on its balance sheet if it expands. - Buford would add $15.750 to its assets (such as office equipment and supplies) by buying them on short-term, zero-interest credit faccounts payable), - Buford's accruals, including taxes and wages payable, will increase by $3.750 - The applicable corporate tax rate is 21 percent. To the nearest dollar, what will Buford's free cash flow be if it undertakes the expansion

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started