Answered step by step

Verified Expert Solution

Question

1 Approved Answer

thank you in advance 4. (Ch. 11) VaR and Transaction Exposure Today is November 25, 2021. Easton, a U.S. company, exports baseball equipment to Taiwan.

thank you in advance

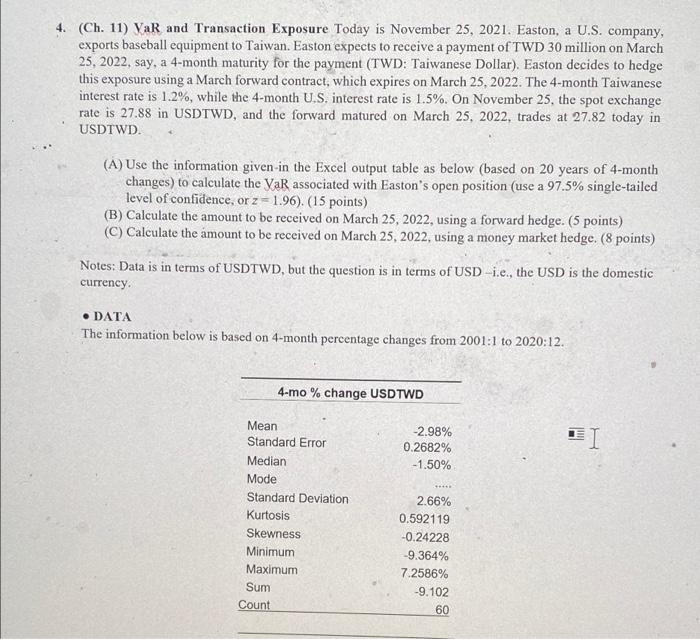

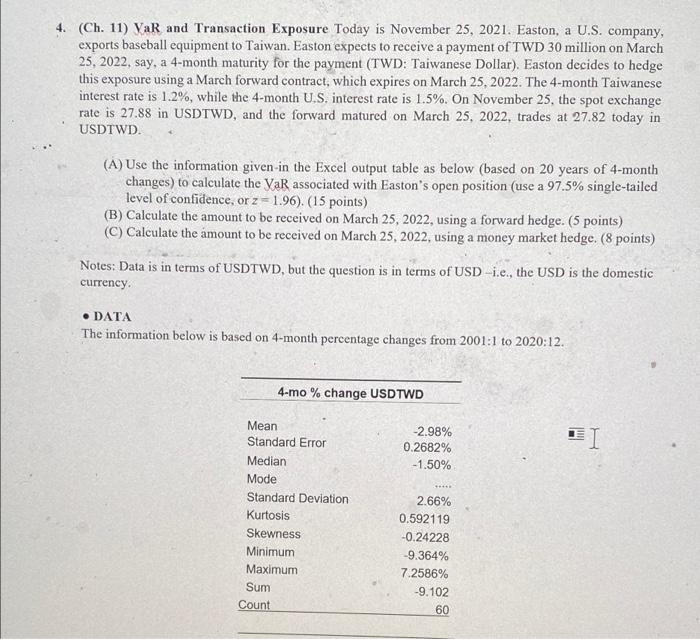

4. (Ch. 11) VaR and Transaction Exposure Today is November 25, 2021. Easton, a U.S. company, exports baseball equipment to Taiwan. Easton expects to receive a payment of TWD 30 million on March 25, 2022, say, a 4-month maturity for the payment (TWD: Taiwanese Dollar). Easton decides to hedge this exposure using a March forward contract, which expires on March 25, 2022. The 4-month Taiwanese interest rate is 1.2%, while the 4-month U.S. interest rate is 1.5%. On November 25, the spot exchange rate is 27.88 in USDTWD, and the forward matured on March 25, 2022, trades at 27.82 today in USDTWD (A) Use the information given-in the Excel output table as below (based on 20 years of 4-month changes) to calculate the VaR associated with Easton's open position (use a 97.5% single-tailed level of confidence, or z=1.96). (15 points) (B) Calculate the amount to be received on March 25, 2022, using a forward hedge. (5 points) (C) Calculate the amount to be received on March 25, 2022, using a money market hedge. (8 points) a Notes: Data is in terms of USDTWD, but the question is in terms of USD -i.e., the USD is the domestic currency DATA The information below is based on 4-month percentage changes from 2001:1 to 2020:12. 4-mo% change USDTWD 1 -2.98% 0.2682% -1.50% I Mean Standard Error Median Mode Standard Deviation Kurtosis Skewness Minimum Maximum Sum Count 2.66% 0.592119 -0.24228 -9.364% 7.2586% -9.102 60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started