Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you! Making Norwich Tool's Lathe Investment Decision. Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two

Thank you!

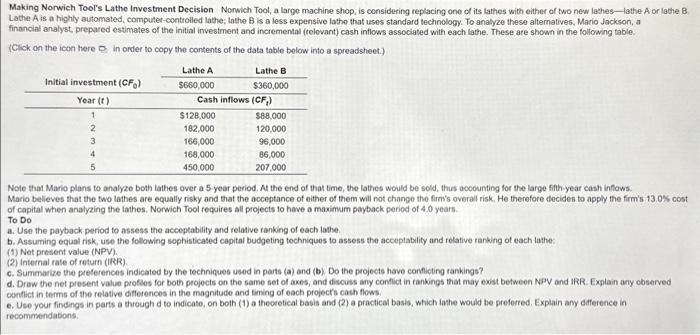

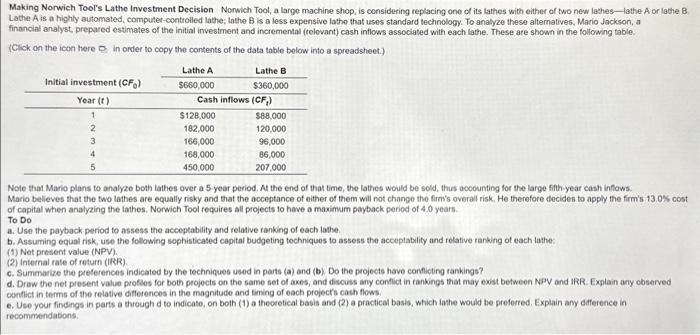

Making Norwich Tool's Lathe Investment Decision. Norwich Tool, a large machine shop, is considering replacing one of its lathes with either of two new lathes-lathe A or lathe B Lathe A is a highly automated, computer-controlled lathe; lathe B is a less expensive lathe that uses standard technology. To analyze these alternatives, Mario Jackson, a financial analyst, prepared estmates of the initial investment and incremental (televant) cash inflows associated with each lathe. These are shown in the following table. (Cick an the icon here Q in order to copy the contents of the data table below into a spreadsheet.) Note that Mario plans to analyze both lathes over a 5 -year period. A the end of that time, the lathes would be sold, thus aocounting for the large fith-year cash inflows. Mario believes that the two lathes are equally risky and that the aoceptance of either of them will not chango the firm's overall risk. He therefore decides to apply the firm's 13.0% cost of capital when analyzing the lathes. Norwich Tool fequires all projects to have a maximum payback penod of 4.0 yoars. To Do a. Use the paybock period to assess the acceptability and relative tanking of each lathe. b. Assuming equal risk, use the following sophisticated capital budgeting tochniques to assess the acceptability and relative ranking of each lathe: (1) Net present value (NPV). (2) Internal rate of retum (IRR). c. Summarize the preferences indicated by the techniques used in paits (a) and (b) Do the projects have conficting rankings? d. Draw the net present value profles for both projects on the same set of axes, and discuss any confict in rankings that may exist between NPV and IRR. Explain any observed canflict in terms of the relative diflerences in the magnitude and timing of each projects cash flows. e. Use your findings in parts a through d to indicate, on both (1) a theoretical basis and (2) a practical basis, which iathe would be preferred. Explain any difference in recommendations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started