Answered step by step

Verified Expert Solution

Question

1 Approved Answer

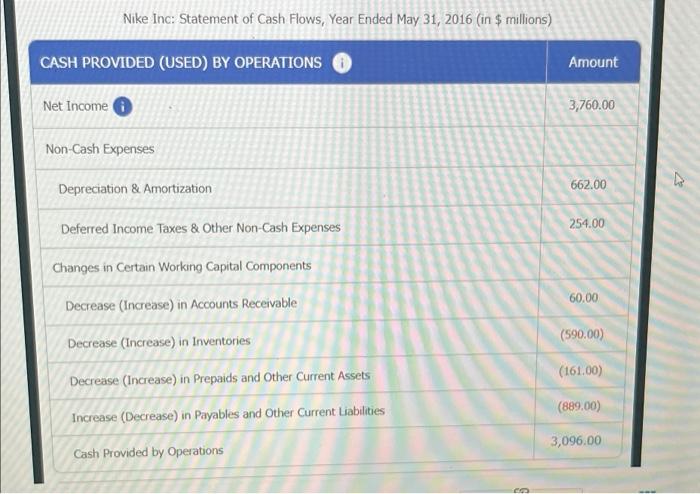

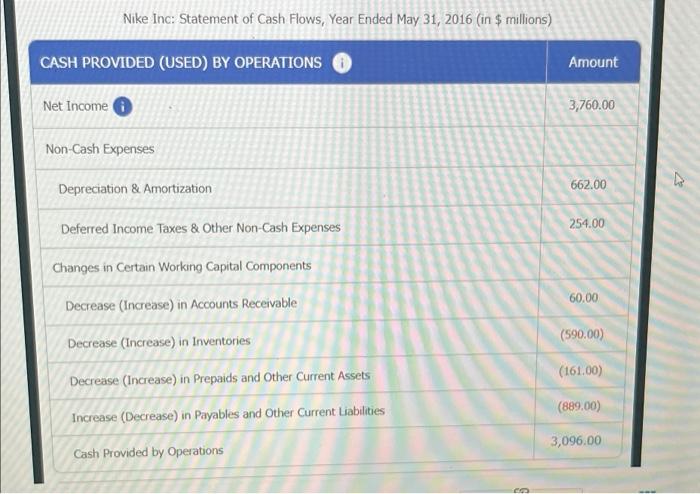

thank you Nike Inc: Statement of Cash Flows, Year Ended May 31, 2016 (in $ millions) CASH PROVIDED (USED) BY OPERATIONS Amount Net Income a

thank you

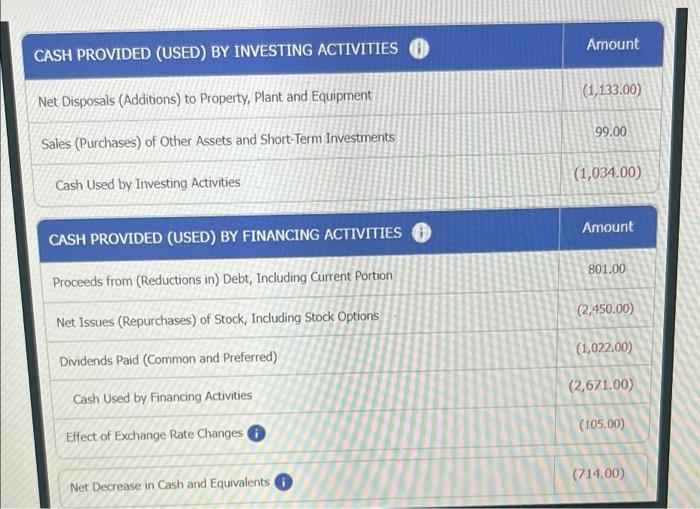

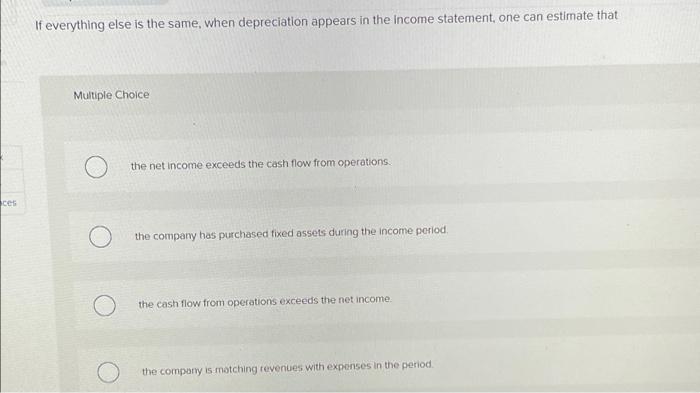

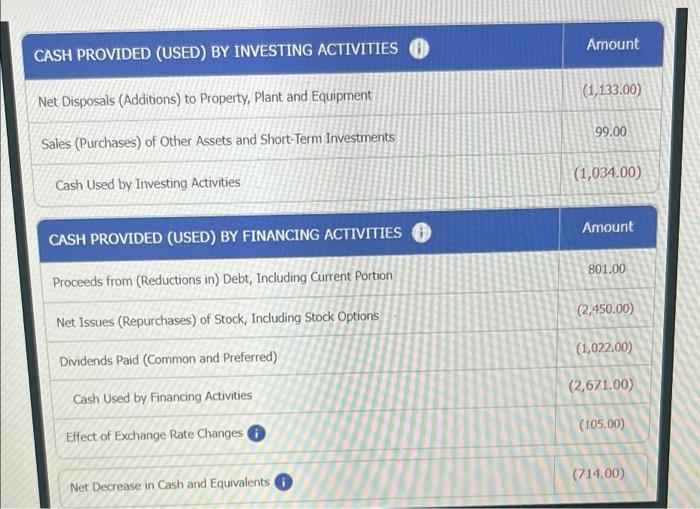

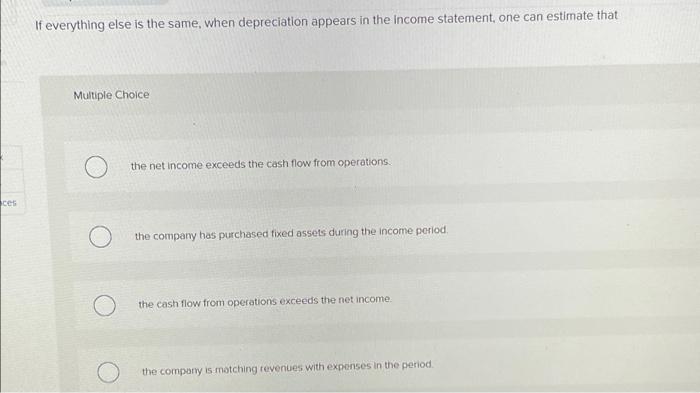

Nike Inc: Statement of Cash Flows, Year Ended May 31, 2016 (in $ millions) CASH PROVIDED (USED) BY OPERATIONS Amount Net Income a 3,760.00 Non-Cash Expenses Depreciation & Amortization 662.00 Deferred Income Taxes & Other Non-Cash Expenses 254.00 Changes in Certain Working Capital Components Decrease (Increase) in Accounts Receivable 60.00 Decrease (Increase) in Inventories (590.00) (161.00) Decrease (Increase) in Prepaids and Other Current Assets (889.00) Increase (Decrease) in Payables and Other Current Liabilities 3,096.00 Cash Provided by Operations Amount CASH PROVIDED (USED) BY INVESTING ACTIVITIES O (1,133.00) Net Disposals (Additions) to Property, Plant and Equipment 99.00 Sales (Purchases) of Other Assets and Short-Term Investments (1,034.00 Cash Used by Investing Activities Amount CASH PROVIDED (USED) BY FINANCING ACTIVITIES 801.00 Proceeds from (Reductions in) Debt, Including Current Portion (2,450.00) Net Issues (Repurchases) of Stock, Including Stock Options (1,022.00) Dividends Paid (Common and Preferred) (2,671.00) Cash Used by Financing Activities (105,00) Effect of Exchange Rate Changes (714.00) Net Decrease in Cash and Equivalents If everything else is the same, when depreciation appears in the income statement, one can estimate that Multiple Choice the net income exceeds the cash flow from operations ces the company has purchased fixed assets during the income period the cash flow from operations exceeds the net income the company is matching revenues with expenses in the period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started