Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you so much! An Individual Retirement Account (IRA) is an account in which the saver does not pay income tax on the amount deposited

Thank you so much!

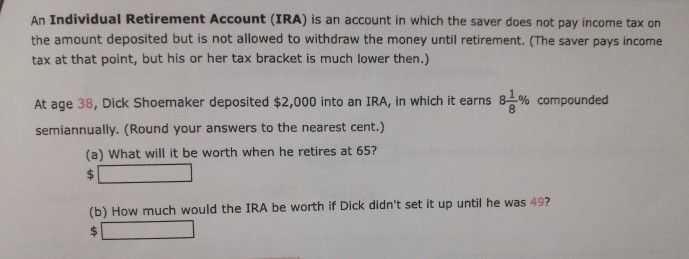

An Individual Retirement Account (IRA) is an account in which the saver does not pay income tax on the amount deposited but is not allowed to withdraw the money until retirement. (The saver pays income tax at that point, but his or her tax bracket is much lower then.) At age 38, Dick Shoemaker deposited $2,000 into an IRA, in which it earns 8 % compounded semiannually. (Round your answers to the nearest cent.) (a) What will it be worth when he retires at 65? (b) How much would the IRA be worth if Dick didn't set it up until he was 49Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started