Answered step by step

Verified Expert Solution

Question

1 Approved Answer

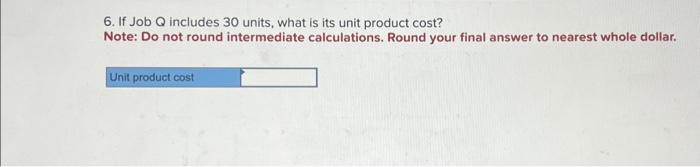

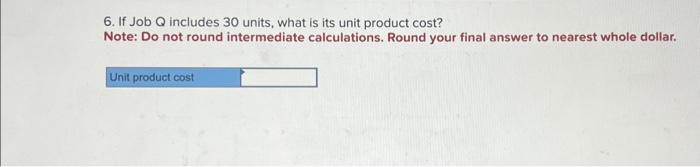

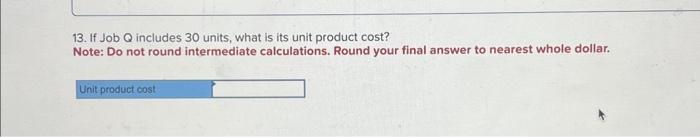

thank you so much in advance! 6. If Job Q includes 30 units, what is its unit product cost? Note: Do not round intermediate calculations.

thank you so much in advance!

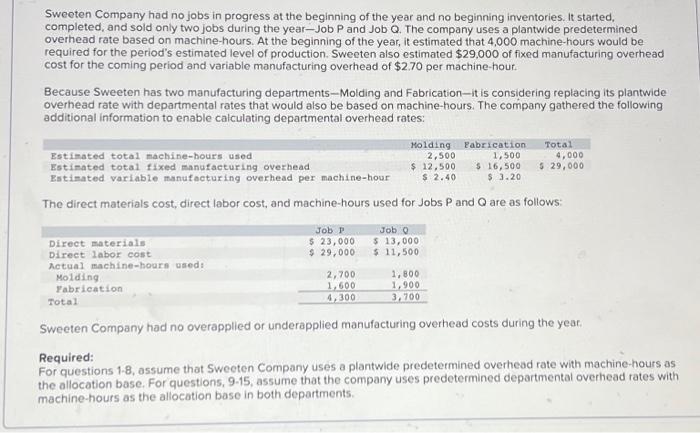

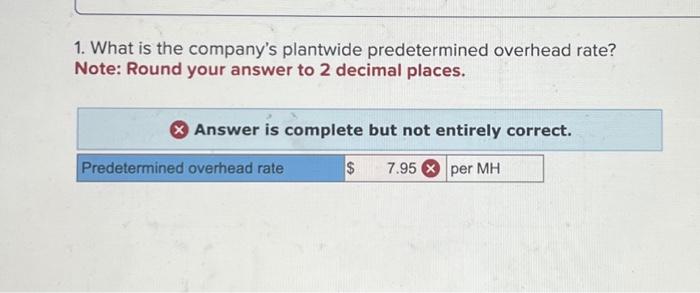

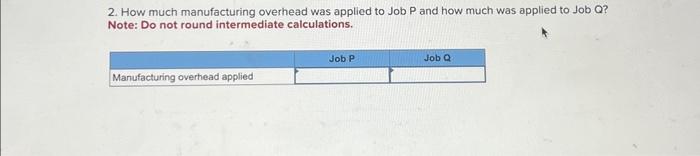

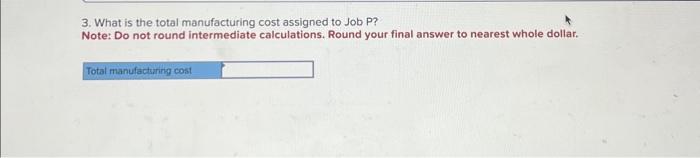

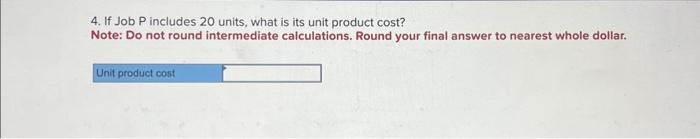

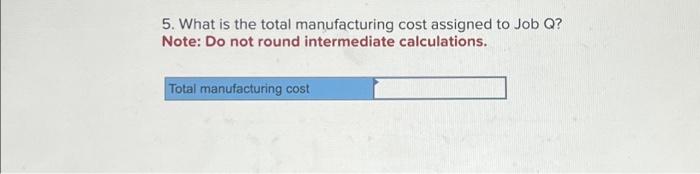

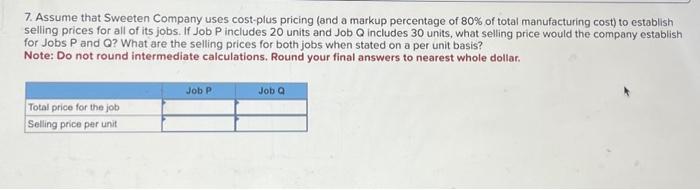

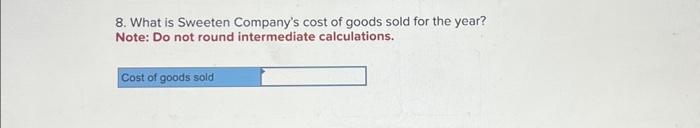

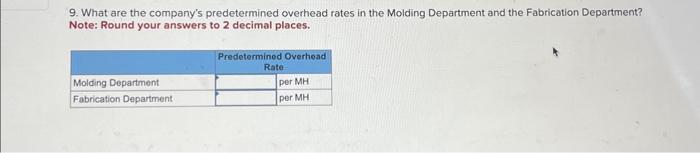

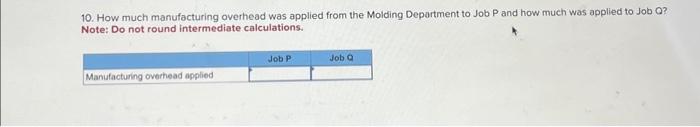

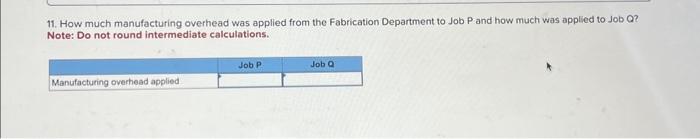

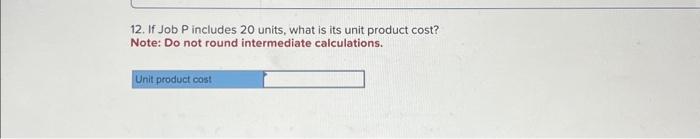

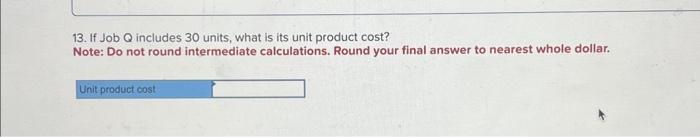

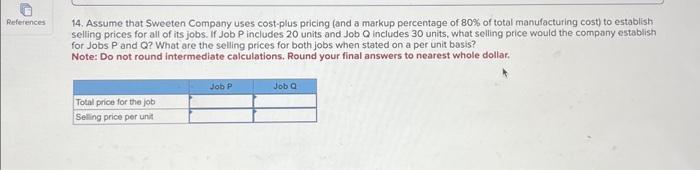

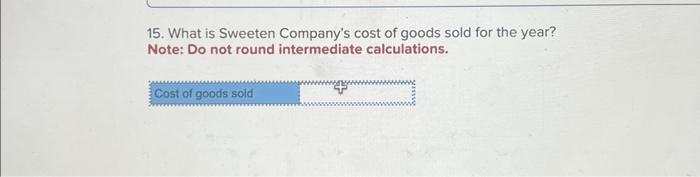

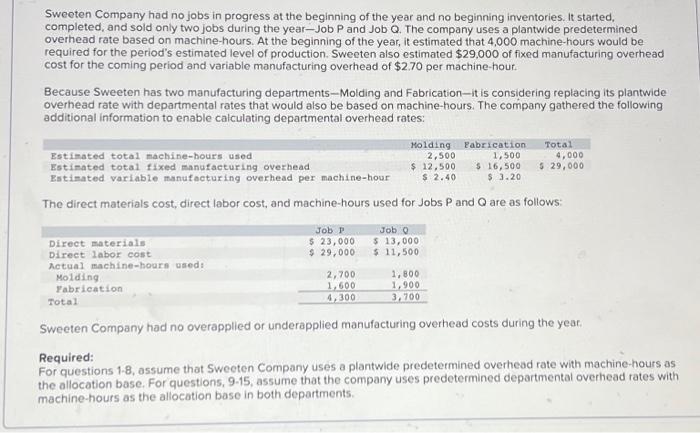

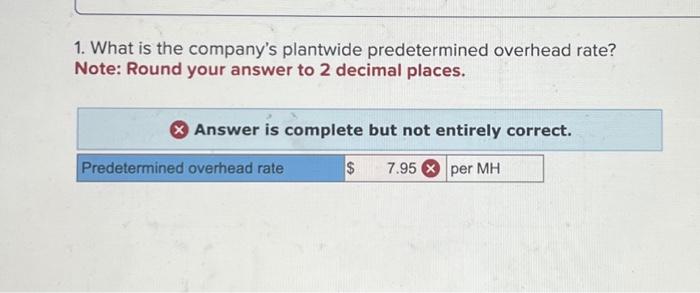

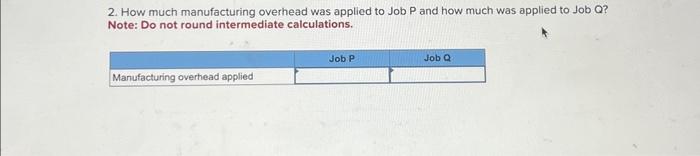

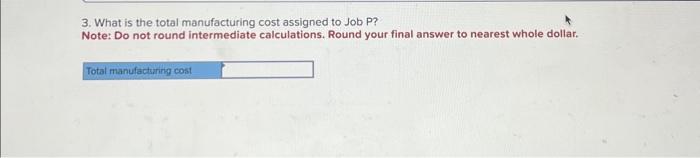

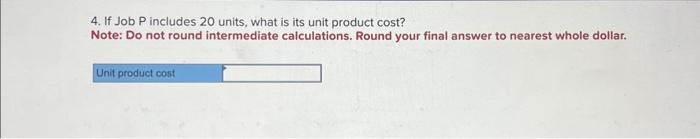

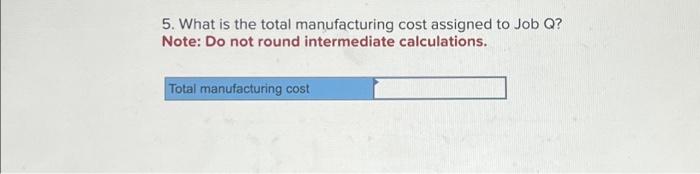

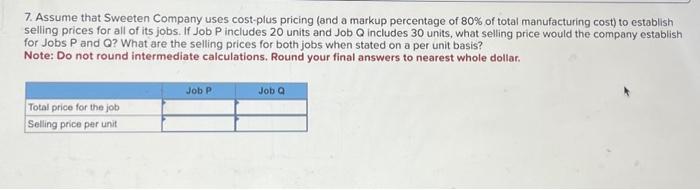

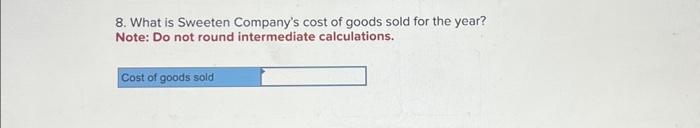

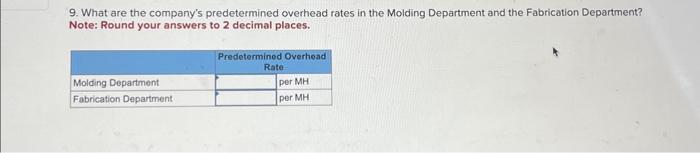

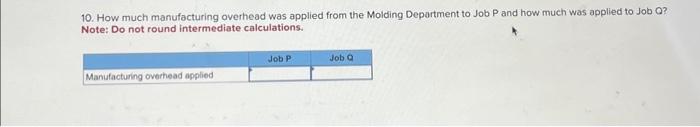

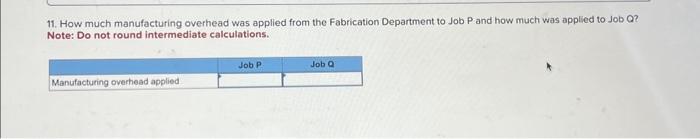

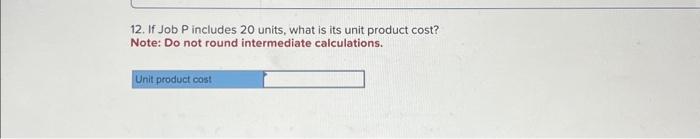

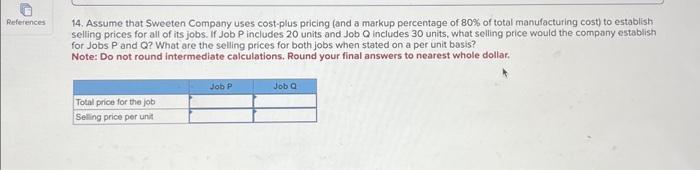

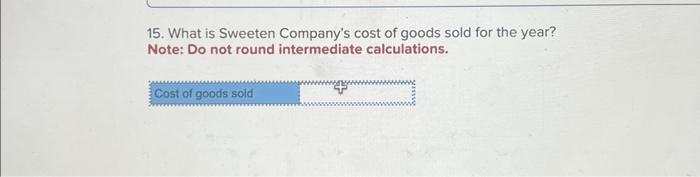

6. If Job Q includes 30 units, what is its unit product cost? Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. 1. What is the company's plantwide predetermined overhead rate? Note: Round your answer to 2 decimal places. Answer is complete but not entirely correct. 11. How much manufacturing overhead was applied from the Fabrication Department to Job P and how much was applied to Job Q? Note: Do not round intermediate calculations. 3. What is the total manufacturing cost assigned to Job P? Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. 5. What is the total manufacturing cost assigned to Job Q? Note: Do not round intermediate calculations. 12. If Job P includes 20 units, what is its unit product cost? Note: Do not round intermediate calculations. 2. How much manufacturing overhead was applied to Job P and how much was applied to Job Q ? Note: Do not round intermediate calculations. 8. What is Sweeten Company's cost of goods sold for the year? Note: Do not round intermediate calculations. 13. If Job Q includes 30 units, what is its unit product cost? Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. 4. If Job P includes 20 units, what is its unit product cost? Note: Do not round intermediate calculations. Round your final answer to nearest whole dollar. 10. How much manufacturing overhead was applied from the Molding Department to Job P and how much was applied to Job Q ? Note: Do not round intermediate calculations. 14. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q ? What are the selling prices for both jobs when stated on a per unit basis? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. 9. What are the company's predetermined overhead rates in the Molding Department and the Fabrication Department? Note: Round your answers to 2 decimal places. 7. Assume that Sweeten Company uses cost-plus pricing (and a markup percentage of 80% of total manufacturing cost) to establish selling prices for all of its jobs. If Job P includes 20 units and Job Q includes 30 units, what selling price would the company establish for Jobs P and Q ? What are the selling prices for both jobs when stated on a per unit basis? Note: Do not round intermediate calculations. Round your final answers to nearest whole dollar. 15. What is Sweeten Company's cost of goods sold for the year? Note: Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started