Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you so much! Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost

Thank you so much!

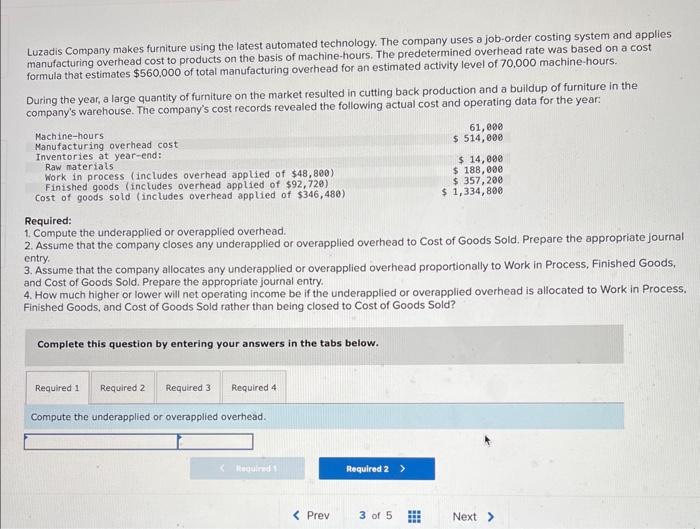

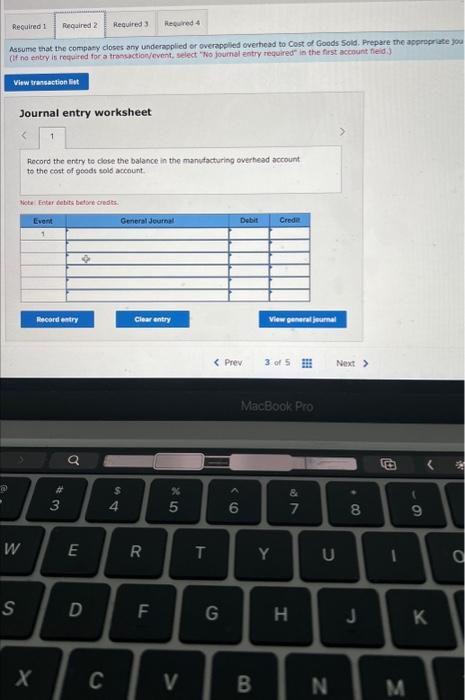

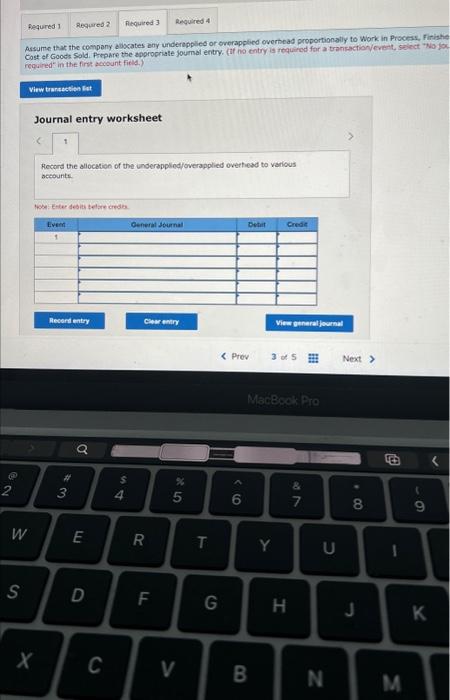

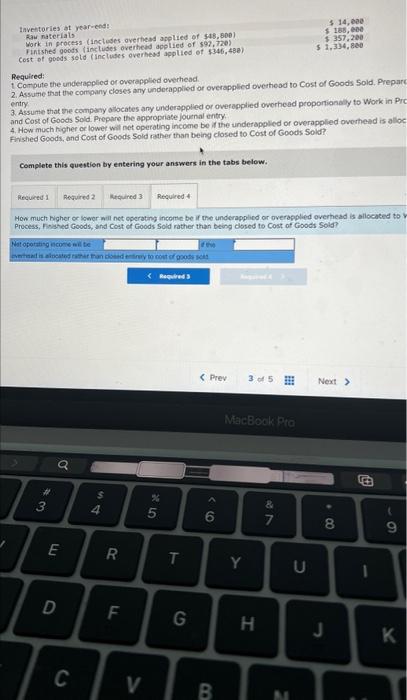

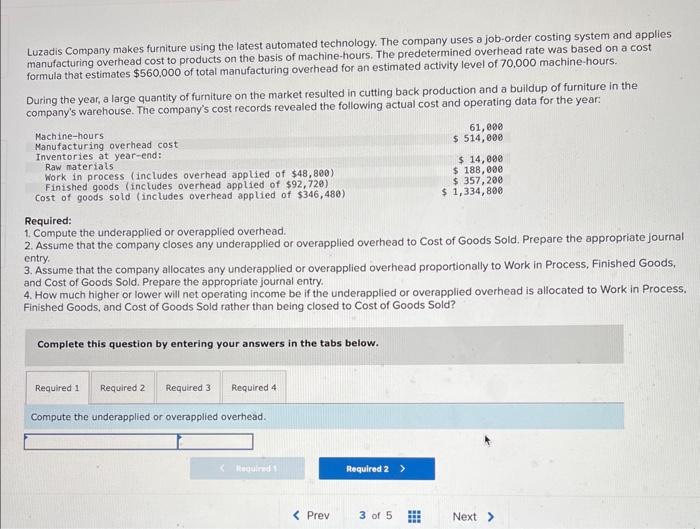

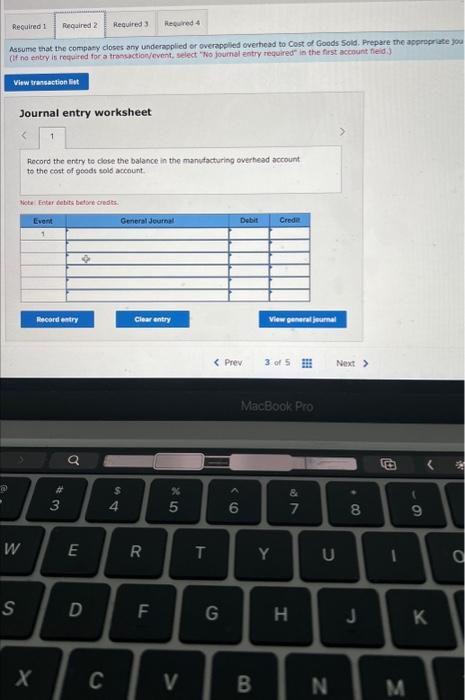

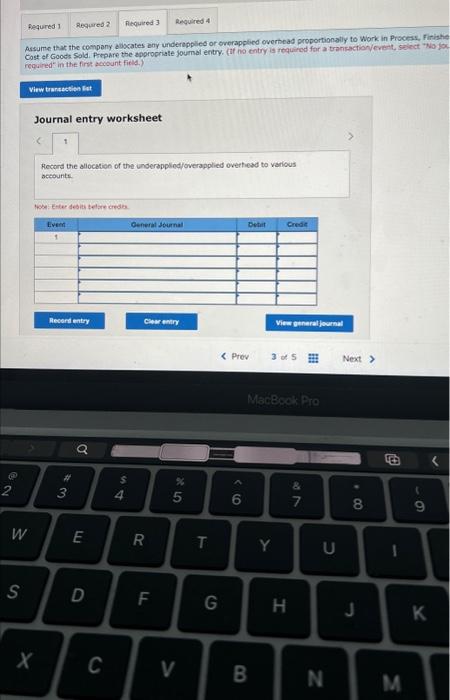

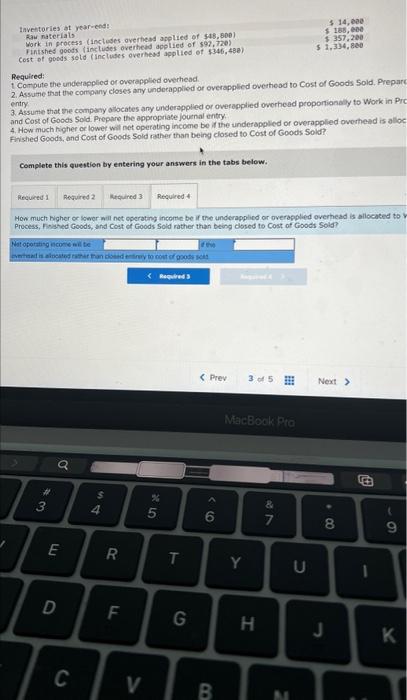

Luzadis Company makes furniture using the latest automated technology. The company uses a job-order costing system and applies manufacturing overhead cost to products on the basis of machine-hours. The predetermined overhead rate was based on a cost formula that estimates $560,000 of total manufacturing overhead for an estimated activity level of 70,000 machine-hours. During the year, a large quantity of furniture on the market resulted in cutting back production and a buildup of furniture in the company's warehouse. The company's cost records revealed the following actual cost and operating data for the year: Required: 1. Compute the underapplied or overapplied overhead. 2. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. Prepare the appropriate Journa entry. 3. Assume that the company allocates any underapplied or overapplied overhead proportionally to Work in Process, Finished Goods, and Cost of Goods Sold. Prepare the appropriate journal entry. 4. How much higher or lower will net operating income be if the underapplied or overapplied overhead is allocated to Work in Process Finished Goods, and Cost of Goods Sold rather than being closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below. Compute the underapplied or overapplied overhead. Assume that the compasy closes any undernpplied or overappilisd overhead to Cost of Goods 5old, Prepare the appropriate jou If no tentry is roquired for a troschction/cvent, select " Wo journal entry required" in the frst account feeid 3) Journal entry worksheet Focord the entry te close the balance in the manufacturing overhead account to the cost of geods told account. Mote Eoter detits betore tredts. assume that the company alasates eny undereppiled or overapplied overhead proportionally to work in Process, Firish cegured" in the firnt serount ficld.? Journal entry worksheet Rocard the allockion of the inserapplind/overapplied overtiead to vatious aceounts. Required: 1 Combute the suderapplicd or ovorapptied ow thead 2. Assume that the cormpany closes any undecapplied or overappicd owertheod to Cost of Goods 5old, Prepur 3. Assume that the compsiy allocates any underapplied or overapplied overhead proportionaly to Wiork in entry and Cost of Goods Sold. Prepare the appropriate joutnal entry. 4. How moch higher or lower wil net operating income be if the underapplied or overapplied overtheled is alle Finished Ggods, and Cost of Goods Sold rather than beind closed to Cost of Goods Sold? Complete this question by entering your answers in the tabs below: How much Figher or lower will net operating income be if the underapplicd or overapplied overhead is aliocited bo Process, Fished Goods, sind Cout of Goods Sold rather than being closed to Cost af Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started