Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thank you ! The questions for the correlation matrix are in the second picture. A brief deseviption as to why would be great for the

Thank you ! The questions for the correlation matrix are in the second picture. A brief deseviption as to "why" would be great for the answers.

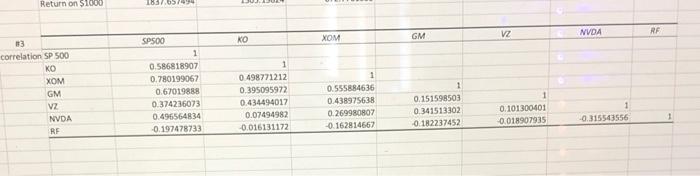

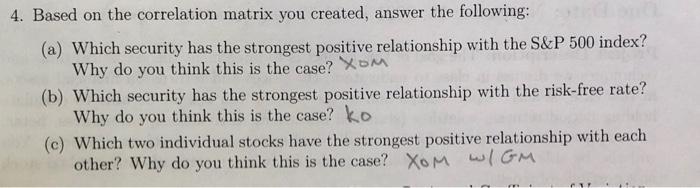

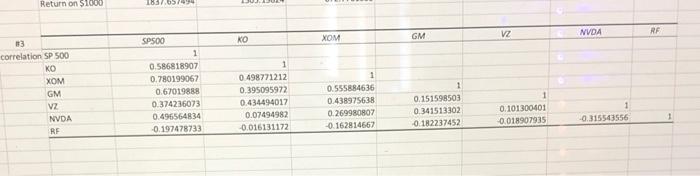

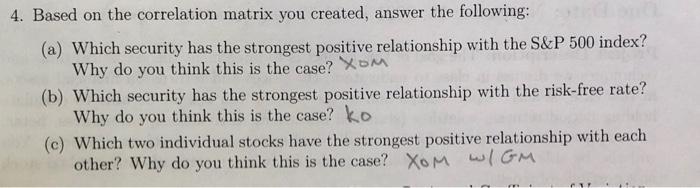

Return on $1000 1837. 05/ VZ RF XOM GM NVDA KO correlation SP 500 KO XOM GM VZ NVDA RF SP500 1 0.586818907 0.780199067 0.67019888 0.374236073 0.496564834 -0.197478733 1 0.498771212 0.395095972 0.434494017 0.07494982 0.016131172 1 0.555884636 0.438975638 0.269980807 -0.162814667 1 0.151598503 0.341513302 0.182237452 0.101300401 0.018907935 1 -0.315543556 4. Based on the correlation matrix you created, answer the following: (a) Which security has the strongest positive relationship with the S&P 500 index? Why do you think this is the case? Xom (b) Which security has the strongest positive relationship with the risk-free rate? Why do you think this is the case? ko (c) Which two individual stocks have the strongest positive relationship with each other? Why do you think this is the case? XOM WIGM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started