Thank you will upvote!

Thank you will upvote!

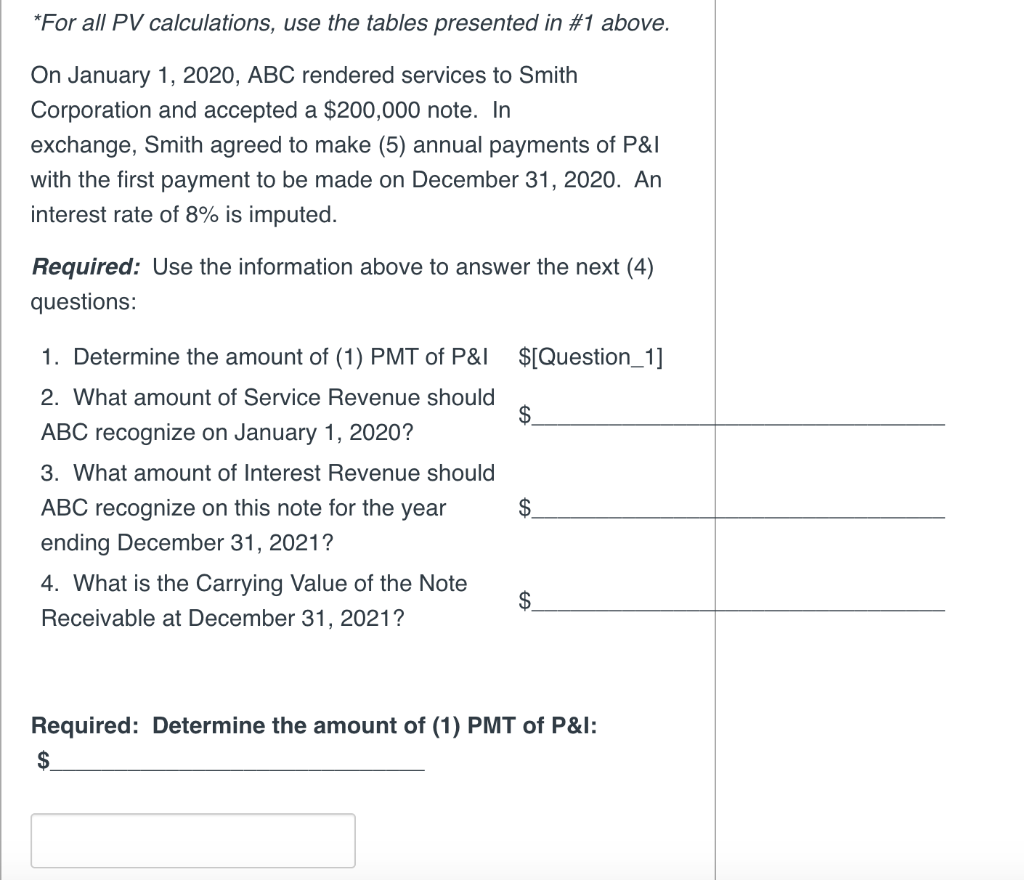

*For all PV calculations, use the tables presented in #1 above. On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 note. In exchange, Smith agreed to make (5) annual payments of P&T with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&L $[Question_1] 2. What amount of Service Revenue should $ ABC recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year $ ending December 31, 2021? 4. What is the Carrying Value of the Note $ Receivable at December 31, 2021? Required: Determine the amount of (1) PMT of P&I: $ Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $ Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $ Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. $ *For all PV calculations, use the tables presented in #1 above. On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 note. In exchange, Smith agreed to make (5) annual payments of P&T with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&L $[Question_1] 2. What amount of Service Revenue should $ ABC recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year $ ending December 31, 2021? 4. What is the Carrying Value of the Note $ Receivable at December 31, 2021? Required: Determine the amount of (1) PMT of P&I: $ Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $ Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $ Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. $

Thank you will upvote!

Thank you will upvote!