thanks a lot

there are 15 questions

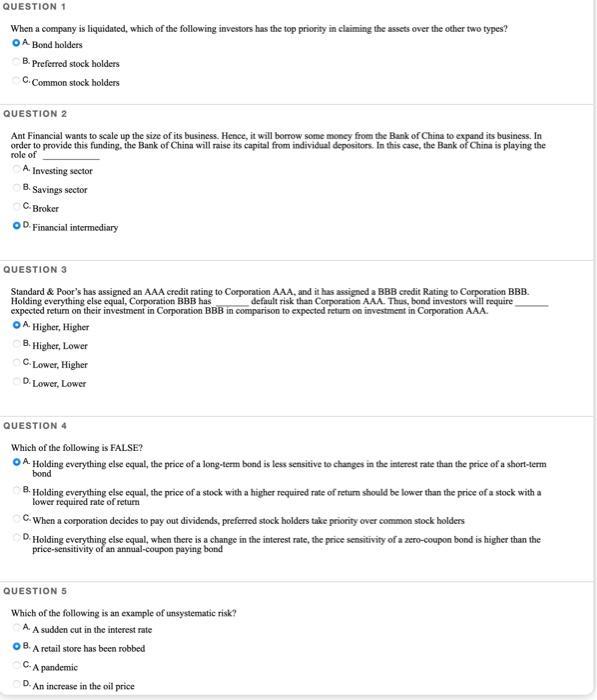

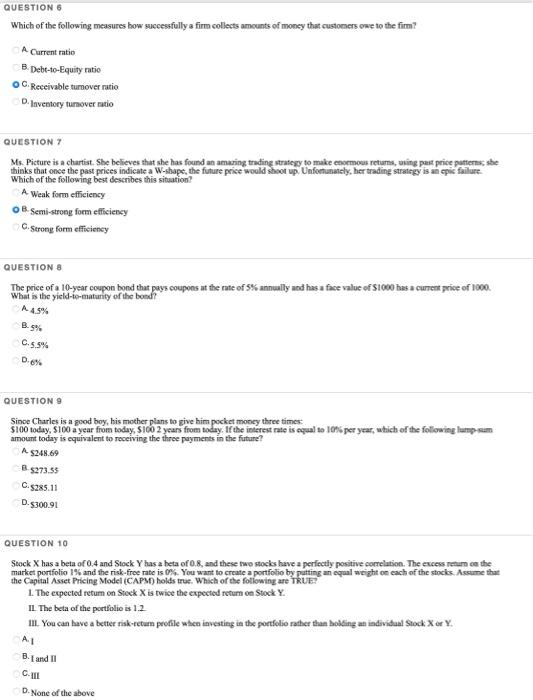

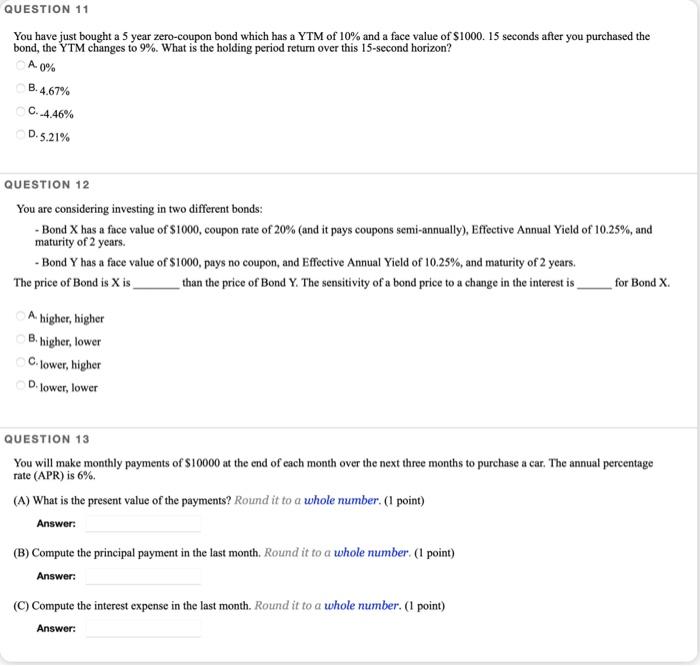

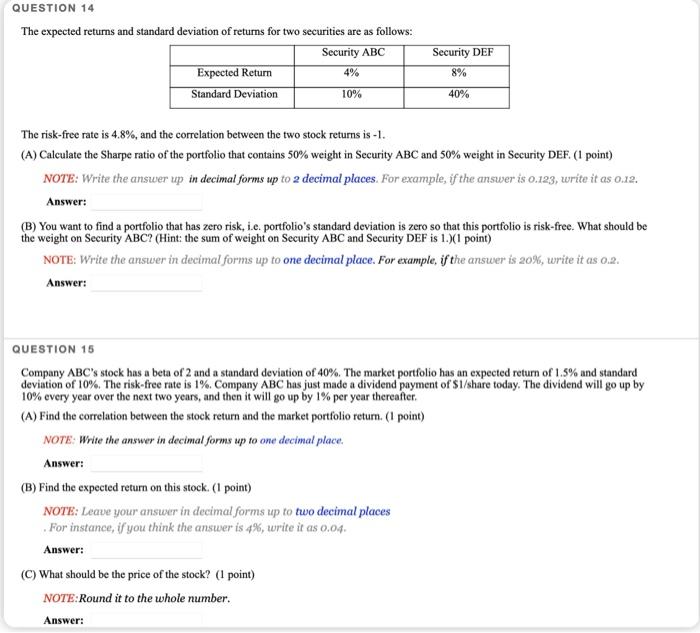

QUESTION 1 When a company is liquidated, which of the following investors has the top priority in claiming the assets over the other two types? O A Bond holders B. Preferred stock holders C. Common stock holders QUESTION 2 Ant Financial wants to scale up the size of its business. Hence, it will borrow some money from the Bank of China to expand its business. In order to provide this funding, the Bank of China will raise its capital from individual depositors. In this case, the Bank of China is playing the role of A. Investing sector B Savings sector C.Broker OD Financial intermediary QUESTION 3 Standard & Poor's has assigned an AAA credit rating to Corporation AAA, and it has assigned a BBB credit Rating to Corporation BBB. Holding everything else equal, Corporation BBB has default risk than Corporation AAA. Thus, bond investors will require expected return on their investment in Corporation BBB in comparison to expected return on investment in Corporation AAA. OA. Higher, Higher B. Higher, Lower C. Lower, Higher D. Lower, Lower QUESTION 4 bond Which of the following is FALSE? A Holding everything else equal, the price of a long-term bond is less sensitive to changes in the interest rate than the price of a short-term B. Holding everything else equal, the price of a stock with a higher required rate of retum should be lower than the price of a stock with a C. When a corporation decides to pay out dividends, preferred stock holders take priority over common stock holders D Holding everything else equal, when there is a change in the interest rate, the price sensitivity of a zero-coupon bond is higher than the price-sensitivity of an annual-coupon paying bond lower required rate of return QUESTIONS Which of the following is an example of unsystematic risk? A. A sudden cut in the interest rate B. A retail store has been robbed A pandemic D. An increase in the oil price C. QUESTION Which of the following measures how successfully a firm collects amounts of money that customers one to the fim? A Current ratio B. Debe-to-Equity ratio OC Receivable tumover ratio 0. Inventory tumover natio QUESTION 7 Ms. Picture is a chartist. She believes that she has found an amazing trading strategy to make enormous returns, using past price putem she thinks that once the past prices indicate a W-shaps, the future price would shoot up Unfortunately, her trading strategy is an epic failure. Which of the following best describes this situation? A Weak form efficiency B Semi-strong form efficiency C. Strong form efficiency QUESTIONS The price of a 10-year coupon bond that pays coupons at the rate of 5% annually and has a face value of 1000 has a curent price of 1000 What is the yield-to-maturity of the bond? A 45% B.9% 6.5.3% 0.6% QUESTION 9 Since Charles is a good plans to money $100 today, $100 a year from today, 51002 years from today. If the interest rate is equal to 10 per year, which of the following lump som amount is the three future? A $249.69 $273.55 C.$28.11 D.$300.91 QUESTION 10 Stock X has a beta of 0.4 and Stock Y has a beta of 0.8, and these two stocks have a perfectly positive correlation. The excess retum can the market portfolio 1% and the risk-free rate is 0%. You want to create a portfolio by putting an equal weight on each of the stocks. Assume that the Capital Asset Pricing Model (CAPM) holds true. Which of the following are TRUE 1. The expected retum on Stock X is twice the expected retum on Stock Y. IL The beta of the portfolio is 1.2 III. You can have a better tisk-return profile when investing in the portfolio rather than holding an individual Stock X or Y. AL Band C. D. None of the above QUESTION 11 You have just bought a 5 year zero-coupon bond which has a YTM of 10% and a face value of S1000. 15 seconds after you purchased the bond, the YTM changes to 9%. What is the holding period return over this 15-second horizon? A. 0% B.4.67% C.-4.46% D.5.21% QUESTION 12 You are considering investing in two different bonds: - Bond X has a face value of $1000, coupon rate of 20% (and it pays coupons semi-annually), Effective Annual Yield of 10.25%, and maturity of 2 years. - Bond Y has a face value of $1000, pays no coupon, and Effective Annual Yield of 10.25%, and maturity of 2 years. The price of Bond is X is than the price of Bond Y. The sensitivity of a bond price to a change in the interest is for Bond X A higher, higher B. higher, lower Clower, higher D. lower, lower QUESTION 13 You will make monthly payments of $10000 at the end of each month over the next three months to purchase a car. The annual percentage rate (APR) is 6% (A) What is the present value of the payments? Round it to a whole number. (1 point) Answer: (B) Compute the principal payment in the last month. Round it to a whole number. (1 point) Answer: () Compute the interest expense in the last month. Round it to a whole number. (I point) Answer: QUESTION 14 The expected returns and standard deviation of returns for two securities are as follows: Security ABC Expected Return 4% Standard Deviation Security DEF 8% 10% 40% The risk-free rate is 4.8%, and the correlation between the two stock returns is -1. (A) Calculate the Sharpe ratio of the portfolio that contains 50% weight in Security ABC and 50% weight in Security DEF. (1 point) NOTE: Write the answer up in decimal forms up to 2 decimal places. For example, if the answer is 0.123, write it as 0.12. Answer: (B) You want to find a portfolio that has zero risk, i.e. portfolio's standard deviation is zero so that this portfolio is risk-free. What should be the weight on Security ABC? (Hint: the sum of weight on Security ABC and Security DEF is 1.1 point) NOTE: Write the answer in decimal forms up to one decimal place. For example, if the answer is 20%, write it as 0.2. Answer: QUESTION 15 Company ABC's stock has a beta of 2 and a standard deviation of 40%. The market portfolio has an expected return of 1.5% and standard deviation of 10%. The risk-free rate is 1%. Company ABC has just made a dividend payment of S1/share today. The dividend will go up by 10% every year over the next two years, and then it will go up by 1% per year thereafter. (A) Find the correlation between the stock return and the market portfolio return. (I point) NOTE: Write the answer in decimal forms up to one decimal place. Answer: (B) Find the expected return on this stock. (I point) NOTE: Leave your answer in decimal forms up to two decimal places For instance, if you think the answer is 4%, write it as 0.04. Answer: (C) What should be the price of the stock? (1 point) NOTE:Round it to the whole number. Answer: QUESTION 1 When a company is liquidated, which of the following investors has the top priority in claiming the assets over the other two types? O A Bond holders B. Preferred stock holders C. Common stock holders QUESTION 2 Ant Financial wants to scale up the size of its business. Hence, it will borrow some money from the Bank of China to expand its business. In order to provide this funding, the Bank of China will raise its capital from individual depositors. In this case, the Bank of China is playing the role of A. Investing sector B Savings sector C.Broker OD Financial intermediary QUESTION 3 Standard & Poor's has assigned an AAA credit rating to Corporation AAA, and it has assigned a BBB credit Rating to Corporation BBB. Holding everything else equal, Corporation BBB has default risk than Corporation AAA. Thus, bond investors will require expected return on their investment in Corporation BBB in comparison to expected return on investment in Corporation AAA. OA. Higher, Higher B. Higher, Lower C. Lower, Higher D. Lower, Lower QUESTION 4 bond Which of the following is FALSE? A Holding everything else equal, the price of a long-term bond is less sensitive to changes in the interest rate than the price of a short-term B. Holding everything else equal, the price of a stock with a higher required rate of retum should be lower than the price of a stock with a C. When a corporation decides to pay out dividends, preferred stock holders take priority over common stock holders D Holding everything else equal, when there is a change in the interest rate, the price sensitivity of a zero-coupon bond is higher than the price-sensitivity of an annual-coupon paying bond lower required rate of return QUESTIONS Which of the following is an example of unsystematic risk? A. A sudden cut in the interest rate B. A retail store has been robbed A pandemic D. An increase in the oil price C. QUESTION Which of the following measures how successfully a firm collects amounts of money that customers one to the fim? A Current ratio B. Debe-to-Equity ratio OC Receivable tumover ratio 0. Inventory tumover natio QUESTION 7 Ms. Picture is a chartist. She believes that she has found an amazing trading strategy to make enormous returns, using past price putem she thinks that once the past prices indicate a W-shaps, the future price would shoot up Unfortunately, her trading strategy is an epic failure. Which of the following best describes this situation? A Weak form efficiency B Semi-strong form efficiency C. Strong form efficiency QUESTIONS The price of a 10-year coupon bond that pays coupons at the rate of 5% annually and has a face value of 1000 has a curent price of 1000 What is the yield-to-maturity of the bond? A 45% B.9% 6.5.3% 0.6% QUESTION 9 Since Charles is a good plans to money $100 today, $100 a year from today, 51002 years from today. If the interest rate is equal to 10 per year, which of the following lump som amount is the three future? A $249.69 $273.55 C.$28.11 D.$300.91 QUESTION 10 Stock X has a beta of 0.4 and Stock Y has a beta of 0.8, and these two stocks have a perfectly positive correlation. The excess retum can the market portfolio 1% and the risk-free rate is 0%. You want to create a portfolio by putting an equal weight on each of the stocks. Assume that the Capital Asset Pricing Model (CAPM) holds true. Which of the following are TRUE 1. The expected retum on Stock X is twice the expected retum on Stock Y. IL The beta of the portfolio is 1.2 III. You can have a better tisk-return profile when investing in the portfolio rather than holding an individual Stock X or Y. AL Band C. D. None of the above QUESTION 11 You have just bought a 5 year zero-coupon bond which has a YTM of 10% and a face value of S1000. 15 seconds after you purchased the bond, the YTM changes to 9%. What is the holding period return over this 15-second horizon? A. 0% B.4.67% C.-4.46% D.5.21% QUESTION 12 You are considering investing in two different bonds: - Bond X has a face value of $1000, coupon rate of 20% (and it pays coupons semi-annually), Effective Annual Yield of 10.25%, and maturity of 2 years. - Bond Y has a face value of $1000, pays no coupon, and Effective Annual Yield of 10.25%, and maturity of 2 years. The price of Bond is X is than the price of Bond Y. The sensitivity of a bond price to a change in the interest is for Bond X A higher, higher B. higher, lower Clower, higher D. lower, lower QUESTION 13 You will make monthly payments of $10000 at the end of each month over the next three months to purchase a car. The annual percentage rate (APR) is 6% (A) What is the present value of the payments? Round it to a whole number. (1 point) Answer: (B) Compute the principal payment in the last month. Round it to a whole number. (1 point) Answer: () Compute the interest expense in the last month. Round it to a whole number. (I point) Answer: QUESTION 14 The expected returns and standard deviation of returns for two securities are as follows: Security ABC Expected Return 4% Standard Deviation Security DEF 8% 10% 40% The risk-free rate is 4.8%, and the correlation between the two stock returns is -1. (A) Calculate the Sharpe ratio of the portfolio that contains 50% weight in Security ABC and 50% weight in Security DEF. (1 point) NOTE: Write the answer up in decimal forms up to 2 decimal places. For example, if the answer is 0.123, write it as 0.12. Answer: (B) You want to find a portfolio that has zero risk, i.e. portfolio's standard deviation is zero so that this portfolio is risk-free. What should be the weight on Security ABC? (Hint: the sum of weight on Security ABC and Security DEF is 1.1 point) NOTE: Write the answer in decimal forms up to one decimal place. For example, if the answer is 20%, write it as 0.2. Answer: QUESTION 15 Company ABC's stock has a beta of 2 and a standard deviation of 40%. The market portfolio has an expected return of 1.5% and standard deviation of 10%. The risk-free rate is 1%. Company ABC has just made a dividend payment of S1/share today. The dividend will go up by 10% every year over the next two years, and then it will go up by 1% per year thereafter. (A) Find the correlation between the stock return and the market portfolio return. (I point) NOTE: Write the answer in decimal forms up to one decimal place. Answer: (B) Find the expected return on this stock. (I point) NOTE: Leave your answer in decimal forms up to two decimal places For instance, if you think the answer is 4%, write it as 0.04. Answer: (C) What should be the price of the stock? (1 point) NOTE:Round it to the whole number