Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Thanks in advance Required: Based on FRS 133. Earnings Per Share, compute Earnings Per Share for Casey Berhed for financial year ended 31 December 2018

Thanks in advance

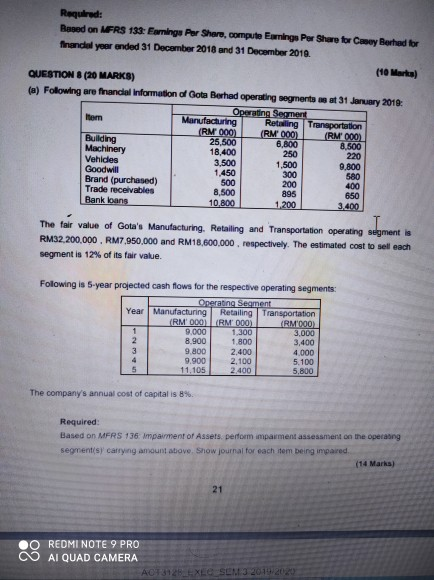

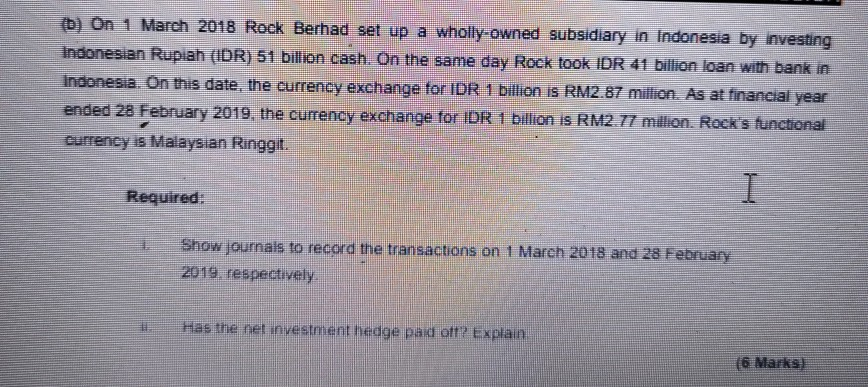

Required: Based on FRS 133. Earnings Per Share, compute Earnings Per Share for Casey Berhed for financial year ended 31 December 2018 and 31 December 2018 (16 Marts) QUESTIONS (20 MARKS) (a) Following are financial Information of Gota Berhad operating segmertas at 31 January 2018 Operating Segment Item Manufacturing Retailing Transportation (RM 000) (RM 000 (RM 000) Building 25.500 6,800 8,500 Machinery 18.400 250 220 Vehides 3,500 1,500 9,800 Goodwill 1.450 300 580 Brand (purchased) 500 200 400 Trade receivables 8,500 895 650 Bank loans 10.800 1.200 3.400 The fair value of Gota's Manufacturing, Retailing and Transportation operating segment is RM32,200,000 RM7.950,000 and RM18,600,000, respectively. The estimated cost to sell each segment is 12% of its fair value. Following is 5-year projected cash flows for the respective operating segments: Operating Segment Year Manufacturing Retailing Transportation (RM 001 (RM 000) (RM1000 1 9.000 1,300 3,000 2. 8.900 1.800 3,400 3 9.800 2.400 4.000 4 9.900 2.100 5.100 5 11.105 2.400 5,800 The company's annual cost of capital is 8%. Required Based on MERS 136 mpament of Assets, perform impairment assessment on the operang segments carrying amount above. Show journal for each item being impaired (14 Marks) 21 OO REDMI NOTE 9 PRO CO AI QUAD CAMERA AC73125 EXL b) On 1 March 2018 Rock Berhad set up a wholly-owned subsidiary in Indonesia by nvesting Indonesian Rupiah (IDR) 51 billion cash. On the same day Rock took IDR 41 billion loan with bank in Indonesia. On this date, the currency exchange for IDR 1 billion is RM2.87 milion. As at financial year ended 28 February 2019, the currency exchange for IDR 1 billion is RM2.77 milion. Rock's functional currency is Malaysian Ringgit. I Required: Show journals to record the transactions on 1 March 2018 and 28 February 2019. respectively Has the net investment hedge pad off? Explain 16 Marks) Required: Based on FRS 133. Earnings Per Share, compute Earnings Per Share for Casey Berhed for financial year ended 31 December 2018 and 31 December 2018 (16 Marts) QUESTIONS (20 MARKS) (a) Following are financial Information of Gota Berhad operating segmertas at 31 January 2018 Operating Segment Item Manufacturing Retailing Transportation (RM 000) (RM 000 (RM 000) Building 25.500 6,800 8,500 Machinery 18.400 250 220 Vehides 3,500 1,500 9,800 Goodwill 1.450 300 580 Brand (purchased) 500 200 400 Trade receivables 8,500 895 650 Bank loans 10.800 1.200 3.400 The fair value of Gota's Manufacturing, Retailing and Transportation operating segment is RM32,200,000 RM7.950,000 and RM18,600,000, respectively. The estimated cost to sell each segment is 12% of its fair value. Following is 5-year projected cash flows for the respective operating segments: Operating Segment Year Manufacturing Retailing Transportation (RM 001 (RM 000) (RM1000 1 9.000 1,300 3,000 2. 8.900 1.800 3,400 3 9.800 2.400 4.000 4 9.900 2.100 5.100 5 11.105 2.400 5,800 The company's annual cost of capital is 8%. Required Based on MERS 136 mpament of Assets, perform impairment assessment on the operang segments carrying amount above. Show journal for each item being impaired (14 Marks) 21 OO REDMI NOTE 9 PRO CO AI QUAD CAMERA AC73125 EXL b) On 1 March 2018 Rock Berhad set up a wholly-owned subsidiary in Indonesia by nvesting Indonesian Rupiah (IDR) 51 billion cash. On the same day Rock took IDR 41 billion loan with bank in Indonesia. On this date, the currency exchange for IDR 1 billion is RM2.87 milion. As at financial year ended 28 February 2019, the currency exchange for IDR 1 billion is RM2.77 milion. Rock's functional currency is Malaysian Ringgit. I Required: Show journals to record the transactions on 1 March 2018 and 28 February 2019. respectively Has the net investment hedge pad off? Explain 16 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started