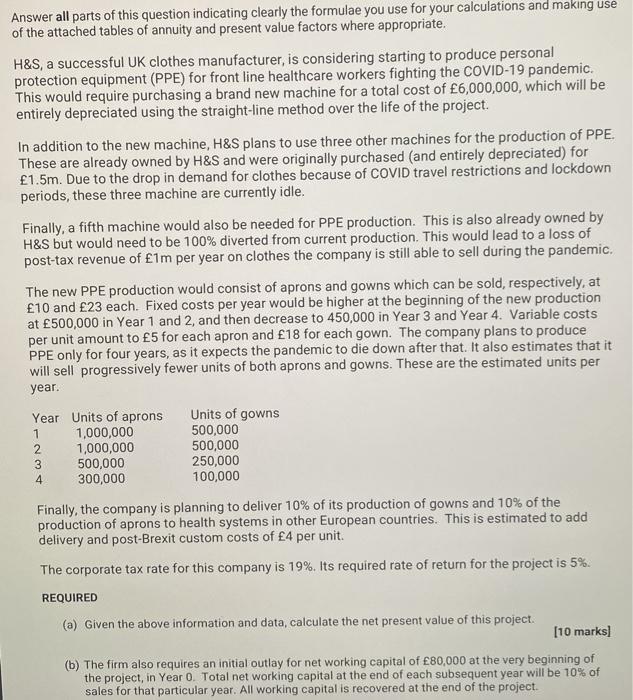

Answer all parts of this question indicating clearly the formulae you use for your calculations and making use of the attached tables of annuity and present value factors where appropriate. H&S, a successful UK clothes manufacturer, is considering starting to produce personal protection equipment (PPE) for front line healthcare workers fighting the COVID-19 pandemic. This would require purchasing a brand new machine for a total cost of 6,000,000, which will be entirely depreciated using the straight-line method over the life of the project. In addition to the new machine, H&S plans to use three other machines for the production of PPE. These are already owned by H&S and were originally purchased (and entirely depreciated) for 1.5m. Due to the drop in demand for clothes because of COVID travel restrictions and lockdown periods, these three machine are currently idle. Finally, a fifth machine would also be needed for PPE production. This is also already owned by H&S but would need to be 100% diverted from current production. This would lead to a loss of post-tax revenue of 1m per year on clothes the company is still able to sell during the pandemic. The new PPE production would consist of aprons and gowns which can be sold, respectively, at 10 and 23 each. Fixed costs per year would be higher at the beginning of the new production at 500,000 in Year 1 and 2, and then decrease to 450,000 in Year 3 and Year 4. Variable costs per unit amount to 5 for each apron and 18 for each gown. The company plans to produce PPE only for four years, as it expects the pandemic to die down after that. It also estimates that it will sell progressively fewer units of both aprons and gowns. These are the estimated units per year. Year Units of aprons Units of gowns 1,000,000 500,000 1,000,000 500,000 500,000 250,000 300,000 100,000 Finally, the company is planning to deliver 10% of its production of gowns and 10% of the production of aprons to health systems in other European countries. This is estimated to add delivery and post-Brexit custom costs of 4 per unit. The corporate tax rate for this company is 19%. Its required rate of return for the project is 5%. REQUIRED 1 2 3 4 (a) Given the above information and data, calculate the net present value of this project. [10 marks) (b) The firm also requires an initial outlay for net working capital of 80,000 at the very beginning of the project, in Year O. Total net working capital at the end of each subsequent year will be 10% of sales for that particular year. All working capital is recovered at the end of the project. Clearly showing the formulae you use and your calculations, compute the Net Present Value of this project including the net working capital. [7 marks]