Answered step by step

Verified Expert Solution

Question

1 Approved Answer

that is P/e...how will I find p/e if earnings is not given? kindly provide me the working solution as soon as possible! You are researching

that is P/e...how will I find p/e if earnings is not given?

kindly provide me the working solution as soon as possible!

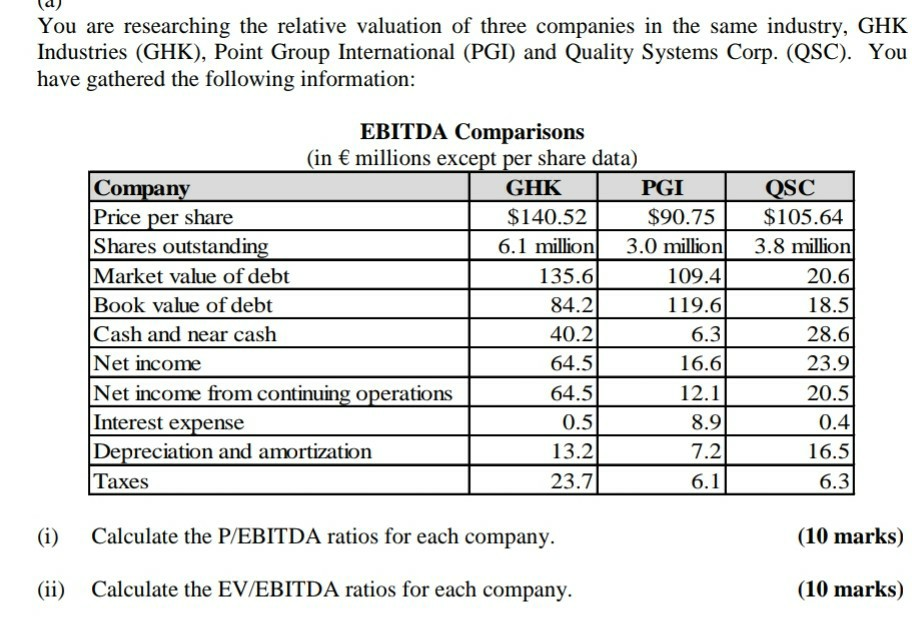

You are researching the relative valuation of three companies in the same industry, GHK Industries (GHK), Point Group International (PGI) and Quality Systems Corp. (QSC). You have gathered the following information: EBITDA Comparisons (in millions except per share data) Company GHK PGI Price per share $140.52 $90.75 Shares outstanding 6.1 million 3.0 million Market value of debt 135.6 109.4 Book value of debt 84.2 119.6 Cash and near cash 40.2 6.3 Net income 64.5 16.6 Net income from continuing operations 64.5 12.1 Interest expense 0.5 8.9 Depreciation and amortization 13.2 7.2 Taxes 23.7 6.1 QSC $105.64 3.8 million 20.6 18.5 28.6 23.9 20.5 0.4 16.5 6.3 (i) Calculate the P/EBITDA ratios for each company. (10 marks) (ii) Calculate the EV/EBITDA ratios for each company. (10 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started