Answered step by step

Verified Expert Solution

Question

1 Approved Answer

that is the only information that's all the information I have Data for adjusting the accounts are as follows: (a) Factory overhead to be applied

that is the only information

that's all the information I have

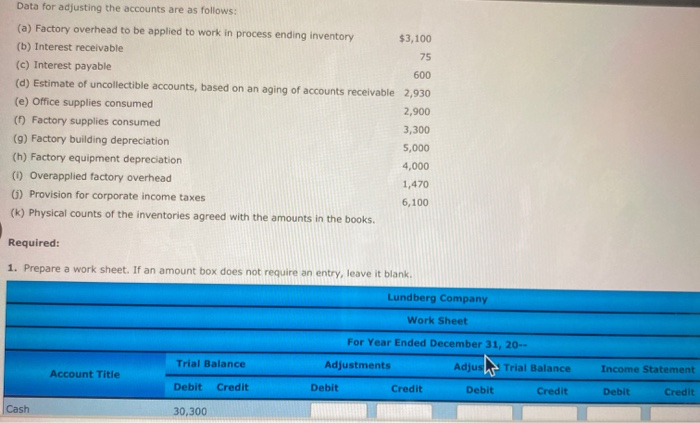

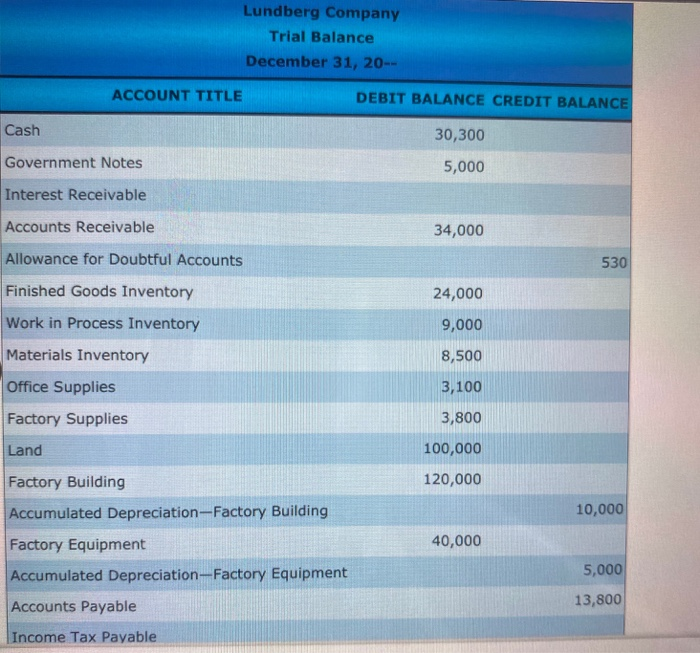

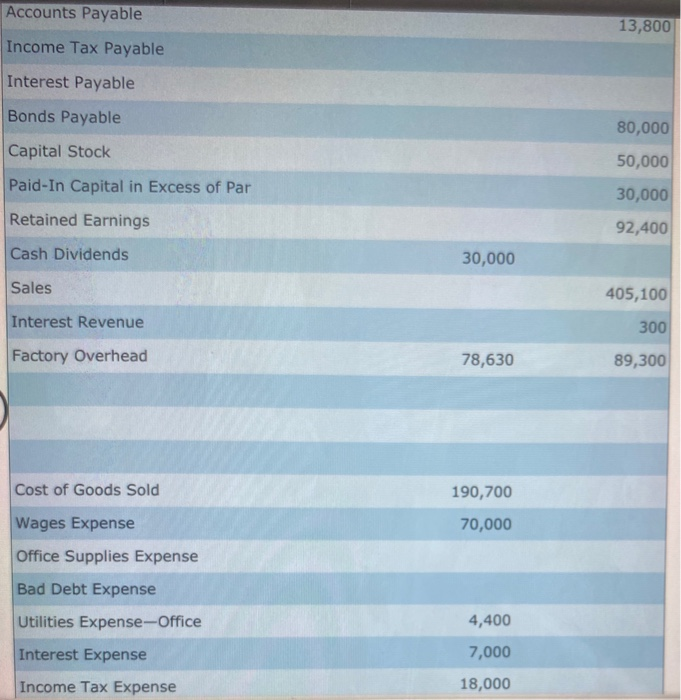

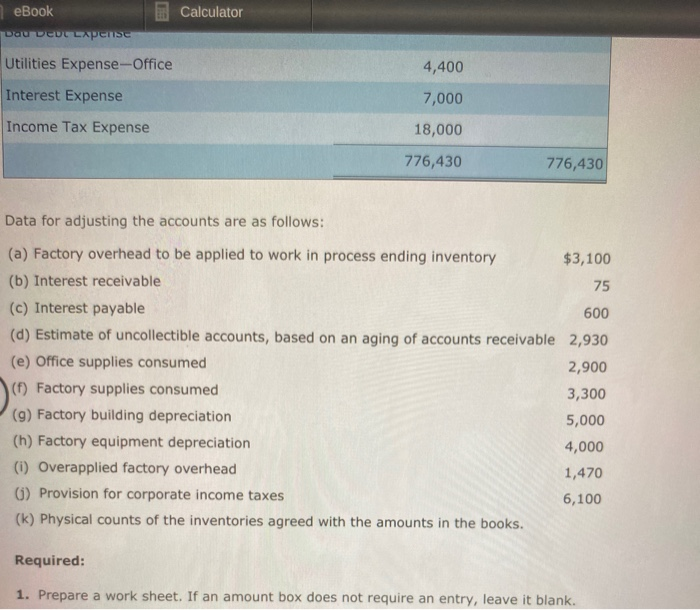

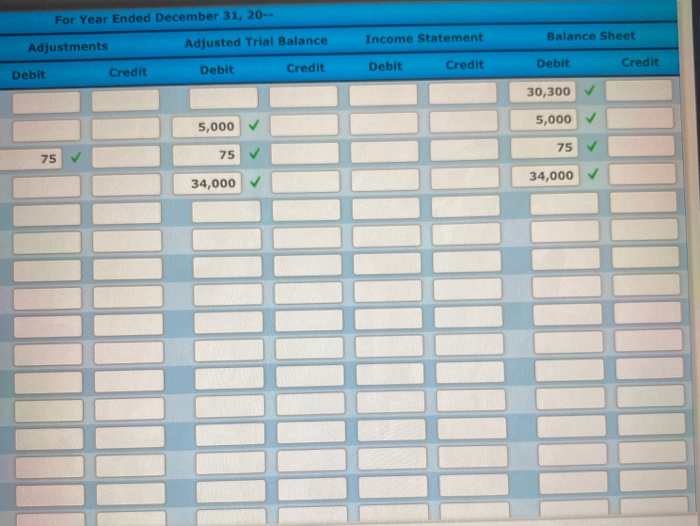

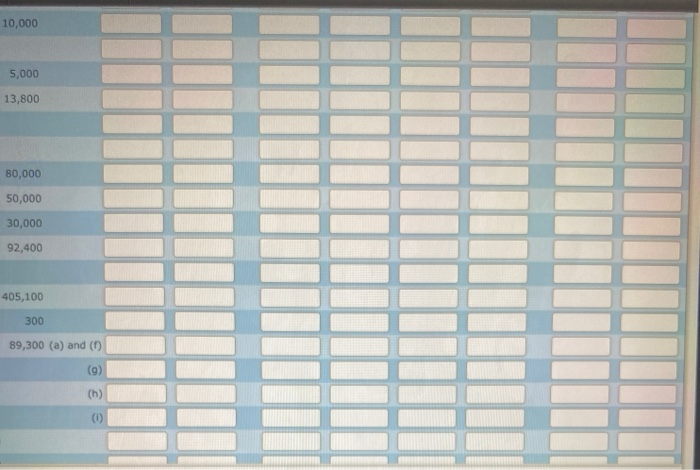

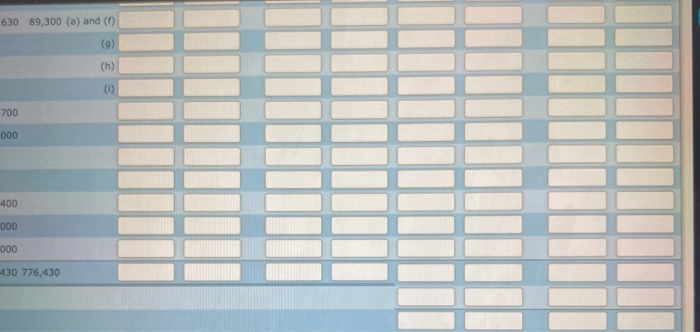

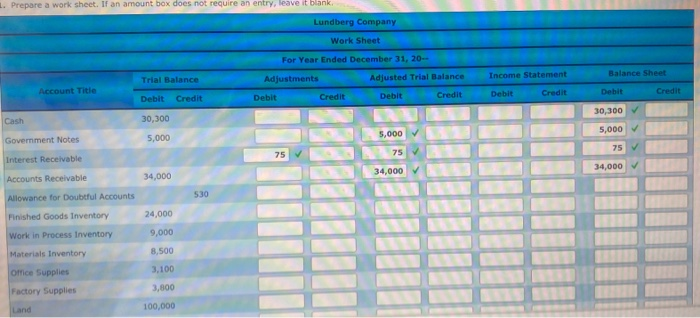

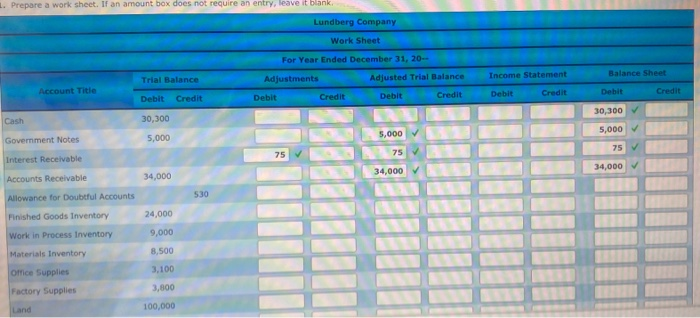

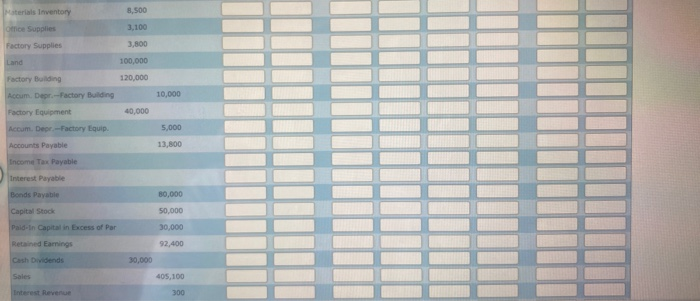

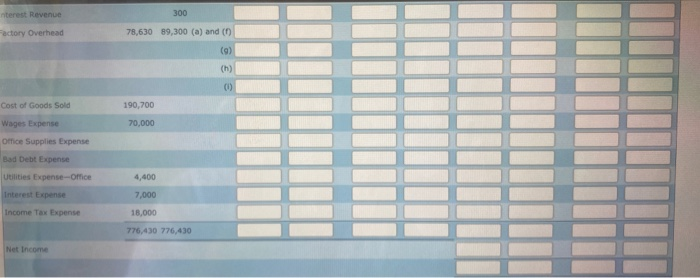

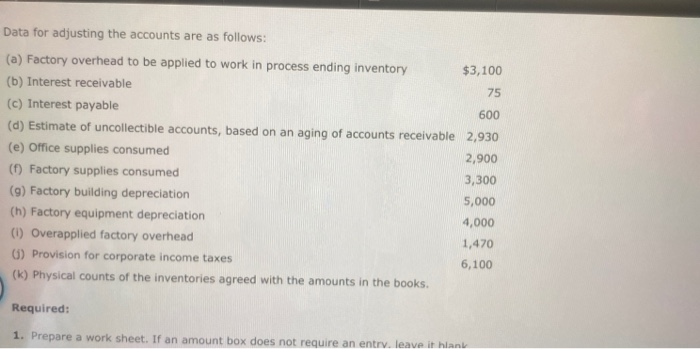

Data for adjusting the accounts are as follows: (a) Factory overhead to be applied to work in process ending inventory $3,100 (b) Interest receivable 75 (c) Interest payable 600 (d) Estimate of uncollectible accounts, based on an aging of accounts receivable 2,930 (e) Office supplies consumed 2,900 (1) Factory supplies consumed 3,300 (9) Factory building depreciation 5,000 (h) Factory equipment depreciation 4,000 (0) Overapplied factory overhead 1,470 6) Provision for corporate income taxes 6,100 (K) Physical counts of the inventories agreed with the amounts in the books. Required: 1. Prepare a work sheet. If an amount box does not require an entry, leave it blank. Lundberg Company Work Sheet For Year Ended December 31, 20-- Trial Balance Adjustments Adjus Account Title Trial Balance Income Statement Debit Credit Debit Credit Debit Credit Debit Credit Cash 30,300 Lundberg Company Trial Balance December 31, 20-- ACCOUNT TITLE DEBIT BALANCE CREDIT BALANCE Cash 30,300 Government Notes 5,000 Interest Receivable Accounts Receivable 34,000 530 24,000 9,000 Allowance for Doubtful Accounts Finished Goods Inventory Work in Process Inventory Materials Inventory Office Supplies Factory Supplies 8,500 3,100 3,800 Land 100,000 120,000 10,000 40,000 Factory Building Accumulated Depreciation-Factory Building Factory Equipment Accumulated Depreciation-Factory Equipment Accounts Payable Income Tax Payable 5,000 13,800 Accounts Payable Income Tax Payable 13,800 Interest Payable Bonds Payable 80,000 Capital Stock 50,000 Paid-In Capital in Excess of Par Retained Earnings 30,000 92,400 Cash Dividends 30,000 Sales 405,100 Interest Revenue 300 Factory Overhead 78,630 89,300 Cost of Goods Sold 190,700 70,000 Wages Expense Office Supplies Expense Bad Debt Expense Utilities Expense-Office 4,400 Interest Expense 7,000 Income Tax Expense 18,000 Calculator eBook DU DEVELAPEISE Utilities Expense-Office 4,400 7,000 Interest Expense Income Tax Expense 18,000 776,430 776,430 Data for adjusting the accounts are as follows: (a) Factory overhead to be applied to work in process ending inventory $3,100 (b) Interest receivable 75 (c) Interest payable 600 (d) Estimate of uncollectible accounts, based on an aging of accounts receivable 2,930 (e) Office supplies consumed 2,900 (1) Factory supplies consumed 3,300 (9) Factory building depreciation 5,000 (h) Factory equipment depreciation 4,000 (0) Overapplied factory overhead 1,470 G) Provision for corporate income taxes 6,100 (k) Physical counts of the inventories agreed with the amounts in the books. Required: 1. Prepare a work sheet. If an amount box does not require an entry, leave it blank 10,000 5,000 13,800 80,000 50,000 30,000 92,400 405,100 300 89,300 (a) and (0) (9) (h) 630 89,300 (a) and (0) (9) (h) (0) 700 000 400 000 000 430 776,430 1. Prepare a work sheet. If an amount box does not require an entry, leave it blank Lundberg Company Work Sheet Trial Balance Balance Sheet For Year Ended December 31, 20- Adjustments Adjusted Trial Balance Debit Credit Debit Credit Income Statement Account Title Debit Credit Debit Credit Debit Credit 30,300 30,300 5,000 5,000 5,000 Government Notes 75 75 Interest Receivable 75 34,000 34,000 Accounts Receivable 34,000 530 Allowance for Doubtful Accounts Finished Goods Inventory Work in Process Inventory 24,000 9,000 Materials Inventory 8,500 3.100 Office Supplies Factory Supplies 3,800 100,000 Land 8,500 Materials Inventory Office Supplies Factory Supplies 3.100 3,800 Land 100,000 120.000 10,000 Factory Building Acoum. Depr.-Factory Building Factory Equipment Accum. Depe-Factory Equip 40,000 5,000 13,800 Accounts Payable Income Tax Payable 80,000 Interest Payable Bonds Payable Capital Stod Paid-in Capital in Excess of Par 50.000 30.000 Retained Earnings 92,400 30,000 Sales 405,100 300 Interest Revenue nterest Revenue 300 Factory Overhead 78,630 89,300 (a) and (0) (9) (h) 00) Cost of Goods Sold 190,700 70,000 Wages Expense Office Supplies Expense Bad Debt Expense Utilities Expense-omice Interest Expense Income Tax Expense 4,400 7,000 18,000 776,430 776,430 Net Income Data for adjusting the accounts are as follows: (a) Factory overhead to be applied to work in process ending inventory $3,100 (b) Interest receivable 75 (c) Interest payable 600 (d) Estimate of uncollectible accounts, based on an aging of accounts receivable 2,930 (e) Office supplies consumed 2,900 (1) Factory supplies consumed 3,300 (9) Factory building depreciation 5,000 (h) Factory equipment depreciation 4,000 (1) Overapplied factory overhead 1,470 G) Provision for corporate income taxes 6,100 (k) Physical counts of the inventories agreed with the amounts in the books. Required: 1. Prepare a work sheet. If an amount box does not require an entry, leave it han Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started