Answered step by step

Verified Expert Solution

Question

1 Approved Answer

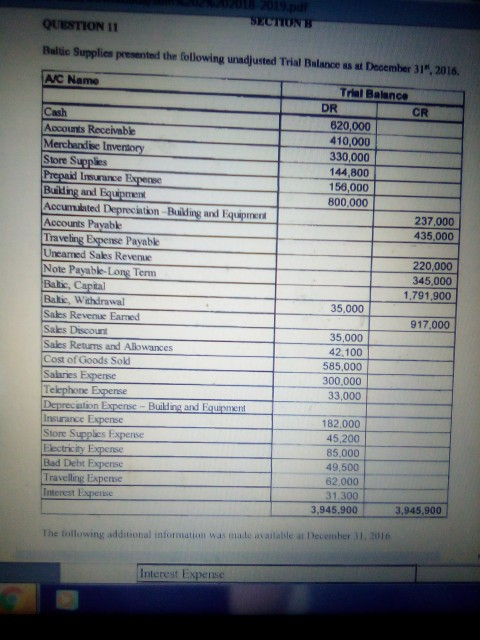

That's 1 question Question 2 QUESTION 11 Baltic Supplies presented the following unadjusted Trial Balance as a Deoember 31, 2016. AC Name Trial Balance DR

That's 1 question

Question 2

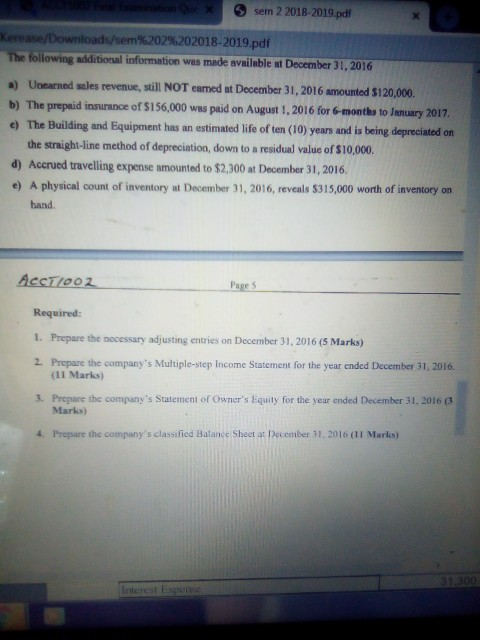

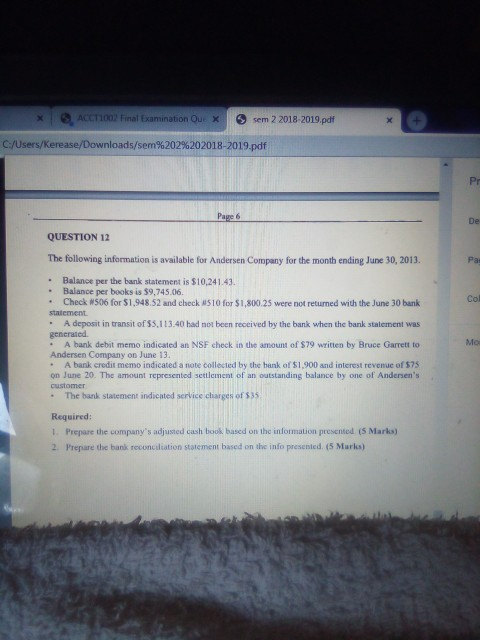

QUESTION 11 Baltic Supplies presented the following unadjusted Trial Balance as a Deoember 31, 2016. AC Name Trial Balance DR CR 620,000 410,000 330,000 144,800 156,000 800,000 237,000 435,000 220,000 345 000 1.791,900 Cash Accounts Receivable Merchandise Inventory Store Supplies Prepaid Insurance Expense Building and Equipment Accumulated Depreciation Building and Equipment Accounts Payable Traveling Expense Payable Uneamed Sales Revenue Note Payable-Long Term Baltic, Capital Baltic, Withdrawal Sales Revenue Eamed Sales Discount Sales Returns and Allowances Cost of Goods Sold Salaries Expense Telephone Expense Depreciation Expense - Building and Forment Insurance pense Store Supplies Expense Electricity Expense Bad Debt Expense Travelling Expere Interest Expense 35,000 917,000 35,000 42.100 585,000 300.000 33,000 182,000 45,200 85.000 49,500 62,000 31 300 3,945,900 3.945,900 The following additional information was made available December Interest Expense sem 2 2018-2019.pdf Lerase/Downloads/sem%202%202018-2019.pdf The following additional information was made available at December 31, 2016 ) Unearned sales revenue, still NOT eamed at December 31, 2016 amounted $120,000, b) The prepaid insurance of S156,000 was paid on August 1, 2016 for 6 months to January 2017. c) The Building and Equipment has an estimated life of ten (10) years and is being depreciated on the straight-line method of depreciation, down to a residual value of $10,000 ) Accrued travelling expense amounted to $2,300 at December 31, 2016, e) A physical count of inventory at December 31, 2016, reveals 8315,000 worth of inventory on hand ACCT/002 Required: 1. Prepare the necessary adjusting entries on December 31, 2016 (5 Marks) 2. Prepare the company's Multiple-step Income Statement for the year ended December 31, 2016 (11 Marks) 3. Prepare the company's Statement of Owner's Equity for the year ended December 31, 2016 (3 Marks) 4. Prepare the company's classified Balance Sheet at December 31, 2016 (11 Maries) * ACCT102 Final Examination Ou sem 2 2018-2019.pdf C:/Users/Kerease/Downloads/sem%202%202018-2019.pdf QUESTION 12 The following information is available for Andersen Company for the month ending June 30, 2013 Balance per the bank statement is $10,241.43. Balance per books is 59,745.06. Check 506 for $1.948.52 and check 510 for $1,800.25 were not returned with the June 30 bank statement A deposit in transit of 55,113.40 had not been received by the bank when the bank statement was generated A bank debit memo indicated an NSF check in the amount of 579 written by Bruce Garrett to Andersen Company on June 13 A bank credit memo indicated a note collected by the bank of $1,900 and interest revenue of $75 on June 20. The amount represented settlement of an outstanding balance by one of Andersen's customer . The bank statement indicated service charges of 535 Required: 1. Prepare the company's adjusted cash book based on the information presented (5 Marks) 2. Prepare the bank reconciliation statement based on the info presented. (5 Mark) QUESTION 11 Baltic Supplies presented the following unadjusted Trial Balance as a Deoember 31, 2016. AC Name Trial Balance DR CR 620,000 410,000 330,000 144,800 156,000 800,000 237,000 435,000 220,000 345 000 1.791,900 Cash Accounts Receivable Merchandise Inventory Store Supplies Prepaid Insurance Expense Building and Equipment Accumulated Depreciation Building and Equipment Accounts Payable Traveling Expense Payable Uneamed Sales Revenue Note Payable-Long Term Baltic, Capital Baltic, Withdrawal Sales Revenue Eamed Sales Discount Sales Returns and Allowances Cost of Goods Sold Salaries Expense Telephone Expense Depreciation Expense - Building and Forment Insurance pense Store Supplies Expense Electricity Expense Bad Debt Expense Travelling Expere Interest Expense 35,000 917,000 35,000 42.100 585,000 300.000 33,000 182,000 45,200 85.000 49,500 62,000 31 300 3,945,900 3.945,900 The following additional information was made available December Interest Expense sem 2 2018-2019.pdf Lerase/Downloads/sem%202%202018-2019.pdf The following additional information was made available at December 31, 2016 ) Unearned sales revenue, still NOT eamed at December 31, 2016 amounted $120,000, b) The prepaid insurance of S156,000 was paid on August 1, 2016 for 6 months to January 2017. c) The Building and Equipment has an estimated life of ten (10) years and is being depreciated on the straight-line method of depreciation, down to a residual value of $10,000 ) Accrued travelling expense amounted to $2,300 at December 31, 2016, e) A physical count of inventory at December 31, 2016, reveals 8315,000 worth of inventory on hand ACCT/002 Required: 1. Prepare the necessary adjusting entries on December 31, 2016 (5 Marks) 2. Prepare the company's Multiple-step Income Statement for the year ended December 31, 2016 (11 Marks) 3. Prepare the company's Statement of Owner's Equity for the year ended December 31, 2016 (3 Marks) 4. Prepare the company's classified Balance Sheet at December 31, 2016 (11 Maries) * ACCT102 Final Examination Ou sem 2 2018-2019.pdf C:/Users/Kerease/Downloads/sem%202%202018-2019.pdf QUESTION 12 The following information is available for Andersen Company for the month ending June 30, 2013 Balance per the bank statement is $10,241.43. Balance per books is 59,745.06. Check 506 for $1.948.52 and check 510 for $1,800.25 were not returned with the June 30 bank statement A deposit in transit of 55,113.40 had not been received by the bank when the bank statement was generated A bank debit memo indicated an NSF check in the amount of 579 written by Bruce Garrett to Andersen Company on June 13 A bank credit memo indicated a note collected by the bank of $1,900 and interest revenue of $75 on June 20. The amount represented settlement of an outstanding balance by one of Andersen's customer . The bank statement indicated service charges of 535 Required: 1. Prepare the company's adjusted cash book based on the information presented (5 Marks) 2. Prepare the bank reconciliation statement based on the info presented. (5 Mark)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started