Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The 1wheel co has just hired a new CEO Noel. The current stock price of 1wheel is $100. The new CEO will have to

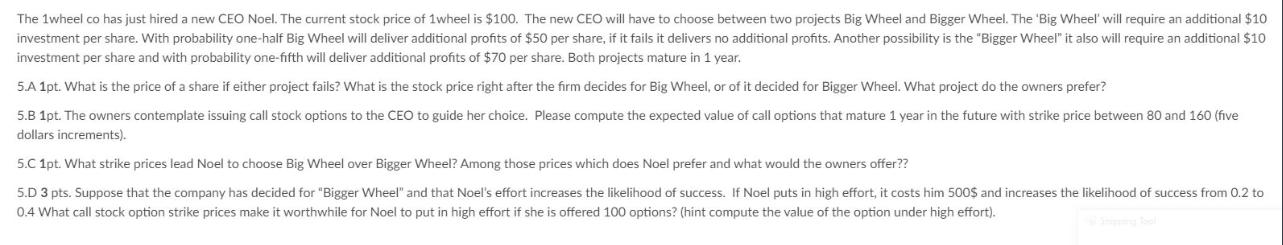

The 1wheel co has just hired a new CEO Noel. The current stock price of 1wheel is $100. The new CEO will have to choose between two projects Big Wheel and Bigger Wheel. The 'Big Wheel' will require an additional $10 investment per share. With probability one-half Big Wheel will deliver additional profits of $50 per share, if it fails it delivers no additional profits. Another possibility is the "Bigger Wheel" it also will require an additional $10 investment per share and with probability one-fifth will deliver additional profits of $70 per share. Both projects mature in 1 year. 5.A 1pt. What is the price of a share if either project fails? What is the stock price right after the firm decides for Big Wheel, or of it decided for Bigger Wheel. What project do the owners prefer? 5.B 1pt. The owners contemplate issuing call stock options to the CEO to guide her choice. Please compute the expected value of call options that mature 1 year in the future with strike price between 80 and 160 (five dollars increments). 5.C 1pt. What strike prices lead Noel to choose Big Wheel over Bigger Wheel? Among those prices which does Noel prefer and what would the owners offer?? 5.D 3 pts. Suppose that the company has decided for "Bigger Wheel" and that Noel's effort increases the likelihood of success. If Noel puts in high effort, it costs him 500$ and increases the likelihood of success from 0.2 to 0.4 What call stock option strike prices make it worthwhile for Noel to put in high effort if she is offered 100 options? (hint compute the value of the option under high effort).

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

5A Share Price and Preferred Project To find the share price after each project we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started