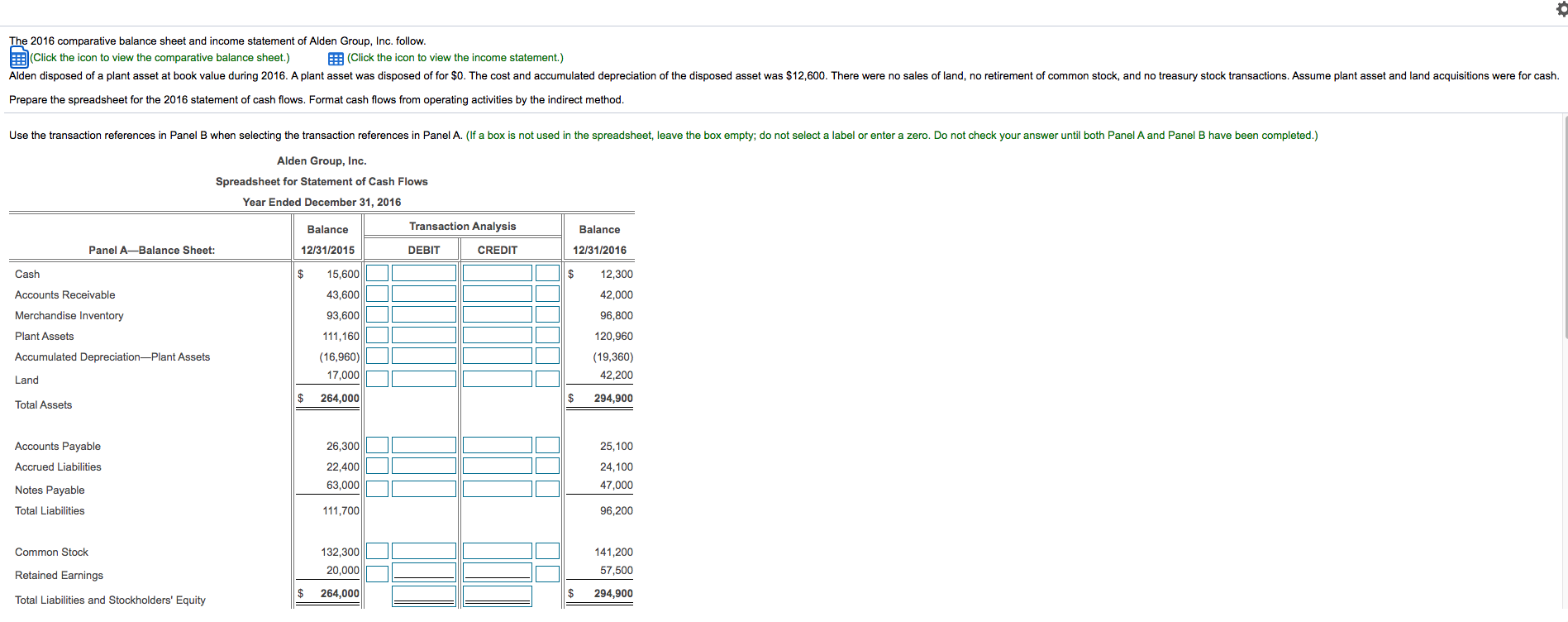

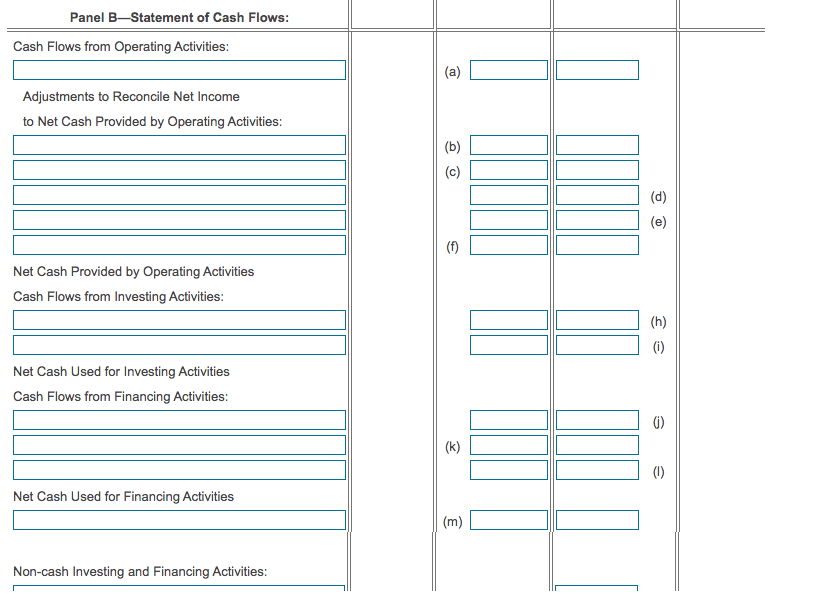

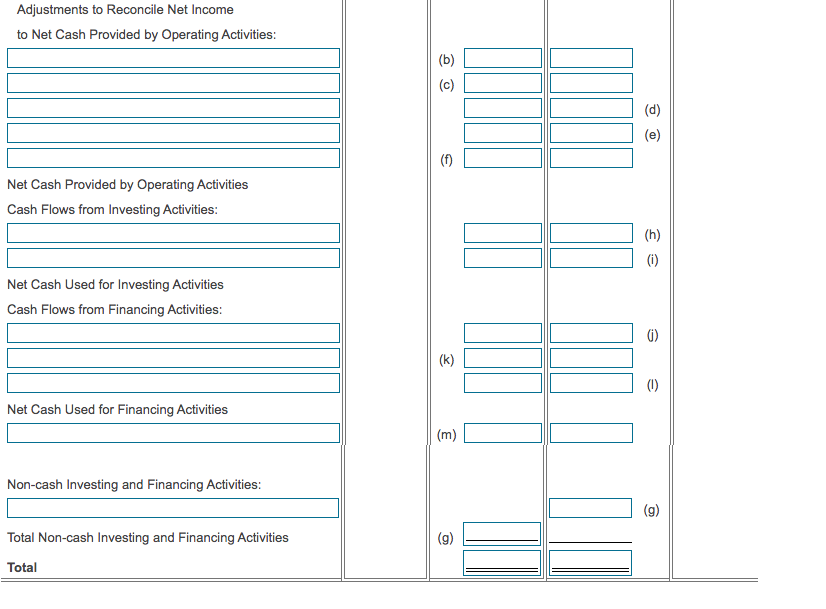

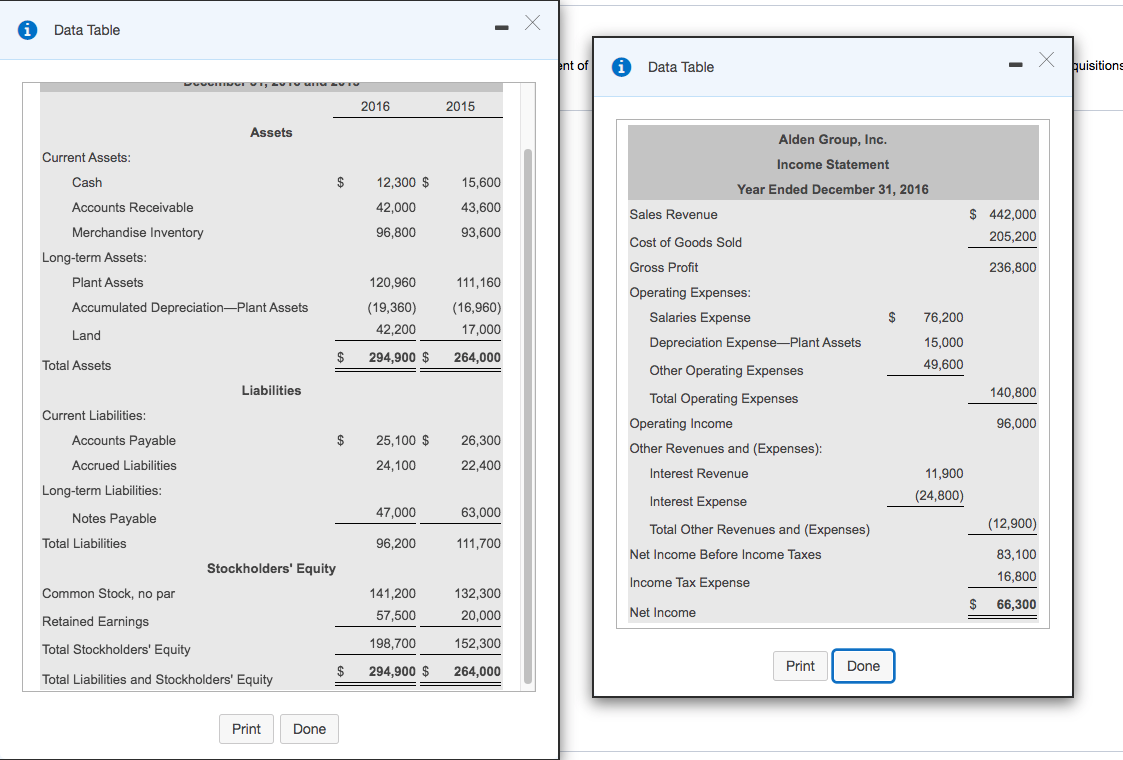

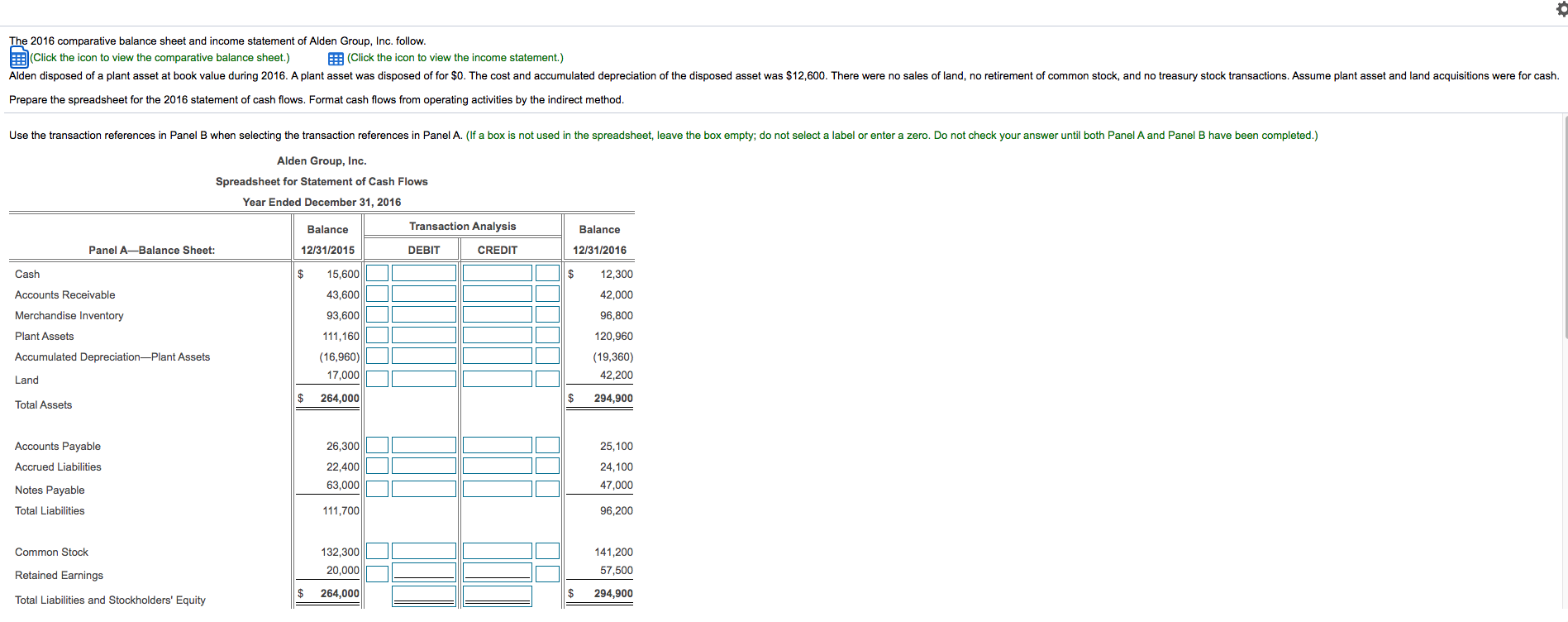

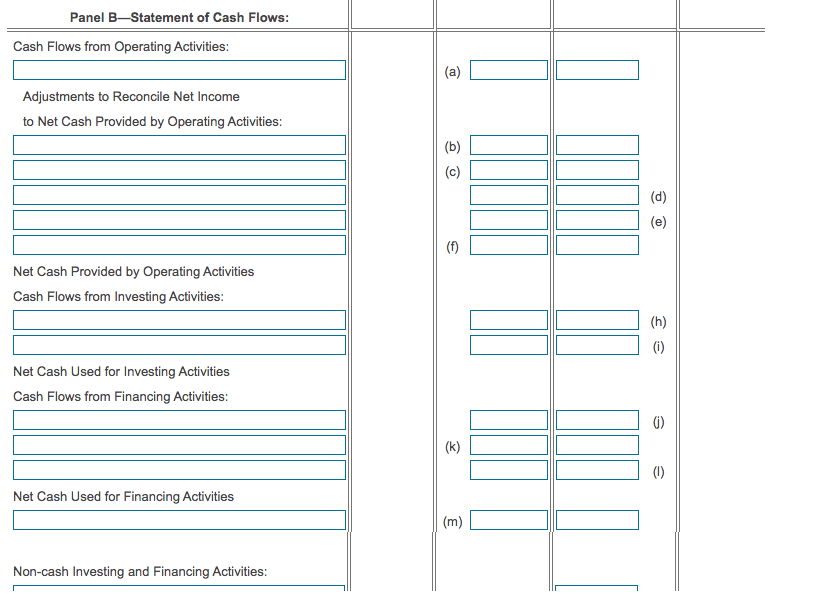

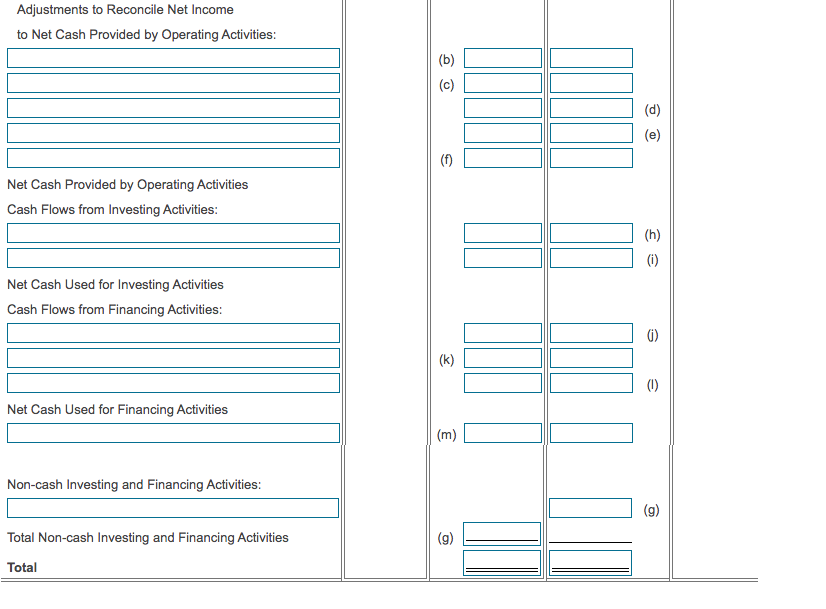

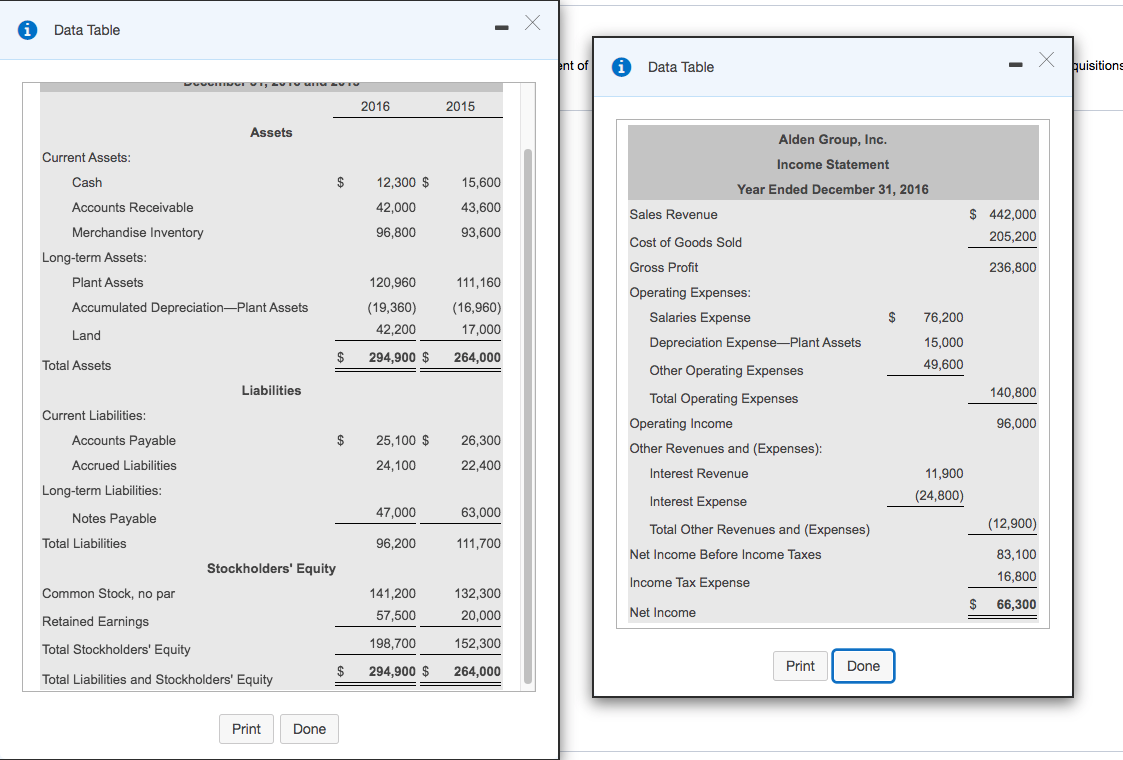

The 2016 comparative balance sheet and income statement of Alden Group, Inc. follow. (Click the icon to view the comparative balance sheet.) 5 Click the icon to view the income statement.) Alden disposed of a plant asset at book value during 2016. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $12,600. There were no sales of land, no retirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. Prepare the spreadsheet for the 2016 statement of cash flows. Format cash flows from operating activities by the indirect method. Use the transaction references in Panel B when selecting the transaction references in Panel A. (If a box is not used in the spreadsheet, leave the box empty; do not select a label or enter a zero. Do not check your answer until both Panel A and Panel B have been completed.) Alden Group, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2016 Balance Transaction Analysis Balance Panel A-Balance Sheet: 12/31/2015 DEBIT CREDIT 12/31/2016 Cash $ 15,600 $ 12,300 Accounts Receivable 43,600 42,000 Merchandise Inventory 93,600 96,800 Plant Assets Accumulated DepreciationPlant Assets 111,160 (16,960) 17,000 120,960 (19,360) 42,200 Land $ 264,000 $ 294,900 Total Assets 26,300 25,100 Accounts Payable Accrued Liabilities 22,400 63,000 24,100 47,000 Notes Payable Total Liabilities 111,700 96,200 Common Stock 132,300 20,000 UU 141,200 57,500 Retained Earnings 264,000 $ 294,900 Total Liabilities and Stockholders' Equity Panel B-Statement of Cash Flows: Cash Flows from Operating Activities: (a) Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: (b) (c) (d) (1) Net Cash Provided by Operating Activities Cash Flows from Investing Activities: (h) (0) Net Cash Used for Investing Activities Cash Flows from Financing Activities: 0) (k) III (1) Net Cash Used for Financing Activities (m) Non-cash Investing and Financing Activities: Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: o (c) (d) (e) (1) Net Cash Provided by Operating Activities Cash Flows from Investing Activities: () Net Cash Used for Investing Activities Cash Flows from Financing Activities: 0) (k) (1) Net Cash Used for Financing Activities (m) Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activities Total i Data Table - ent of Data Table Fuisitions DEUWE GET 2016 2015 Assets Alden Group, Inc. Current Assets: Income Statement Cash $ 12,300 $ 15,600 Year Ended December 31, 2016 42,000 43,600 Sales Revenue 96,800 $ 442,000 205,200 93,600 Accounts Receivable Merchandise Inventory Long-term Assets: Plant Assets Cost of Goods Sold Gross Profit 236,800 120,960 111,160 Accumulated DepreciationPlant Assets (19,360) 42,200 (16,960) 17,000 Operating Expenses: Salaries Expense $ 76,200 Land Depreciation ExpensePlant Assets $ 294,900 $ 264,000 15,000 49,600 Total Assets Other Operating Expenses Liabilities 140,800 96,000 $ Current Liabilities: Accounts Payable Accrued Liabilities Long-term Liabilities: 25,100 $ 24,100 26,300 22,400 Total Operating Expenses Operating Income Other Revenues and (Expenses): Interest Revenue 11,900 (24,800) Interest Expense Notes Payable 47,000 63,000 (12,900) Total Liabilities 96,200 111,700 Total Other Revenues and (Expenses) Net Income Before Income Taxes Stockholders' Equity 83,100 16,800 Income Tax Expense Common Stock, no par 141,200 132,300 20,000 $ 66,300 57,500 Retained Earnings Net Income Total Stockholders' Equity 198,700 152,300 $ 264,000 Print Done 294,900 $ Total Liabilities and Stockholders' Equity Print Done