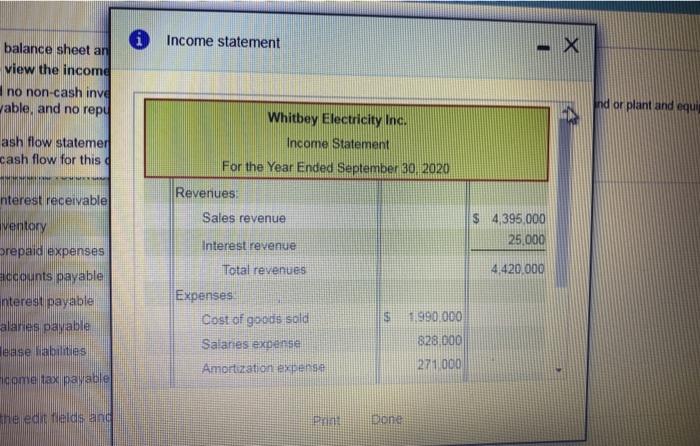

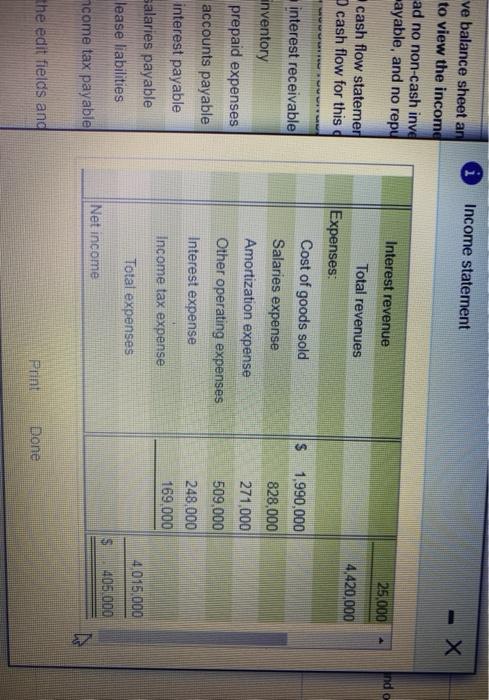

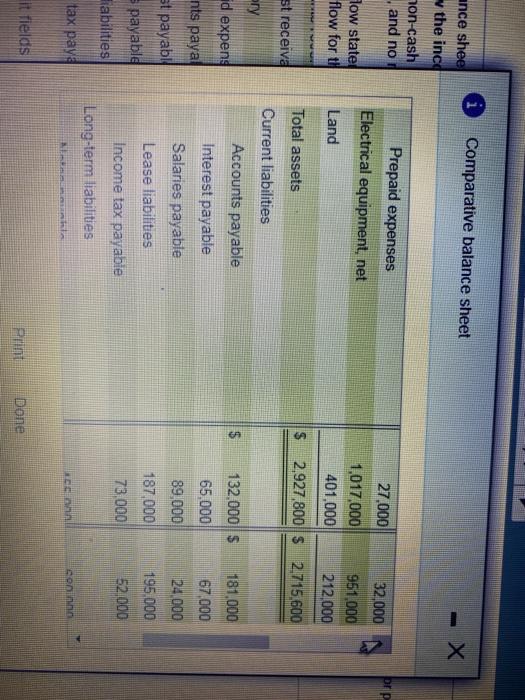

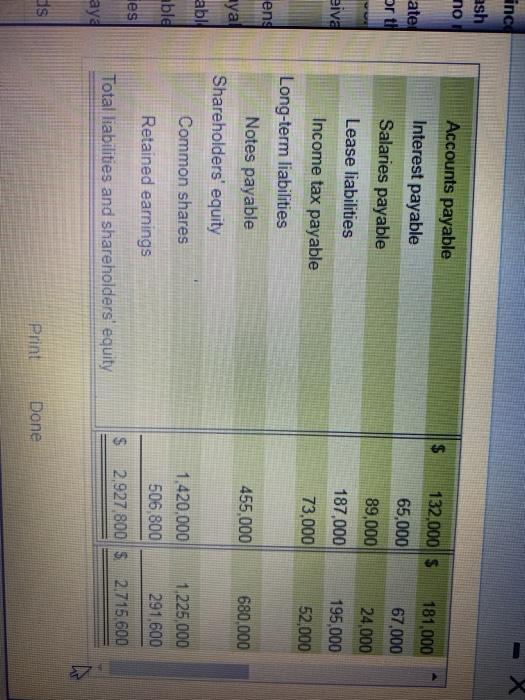

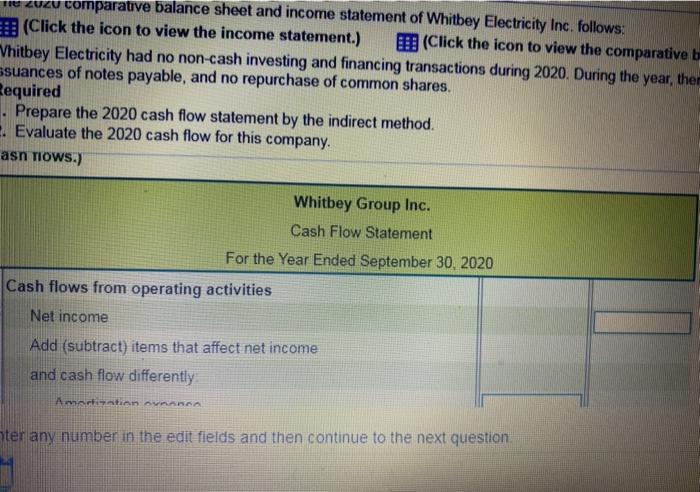

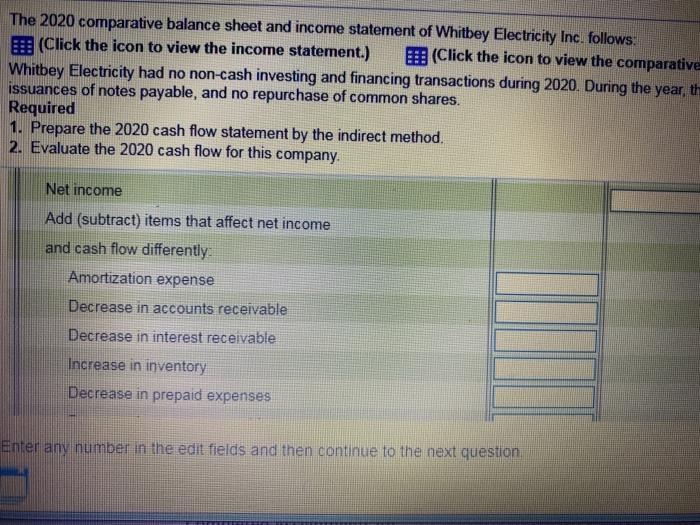

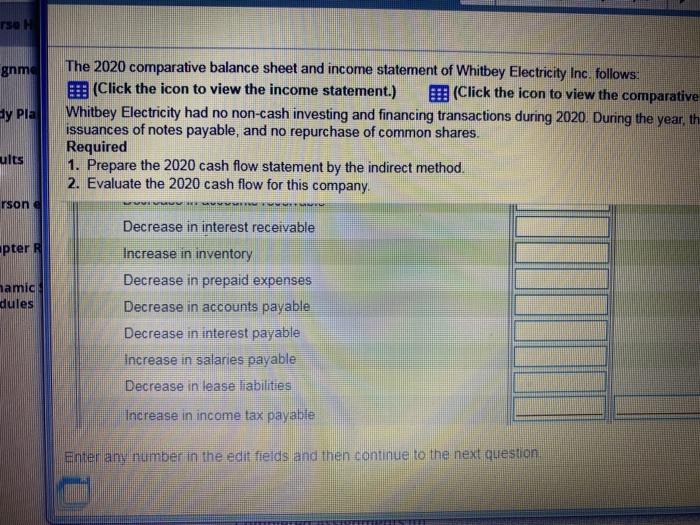

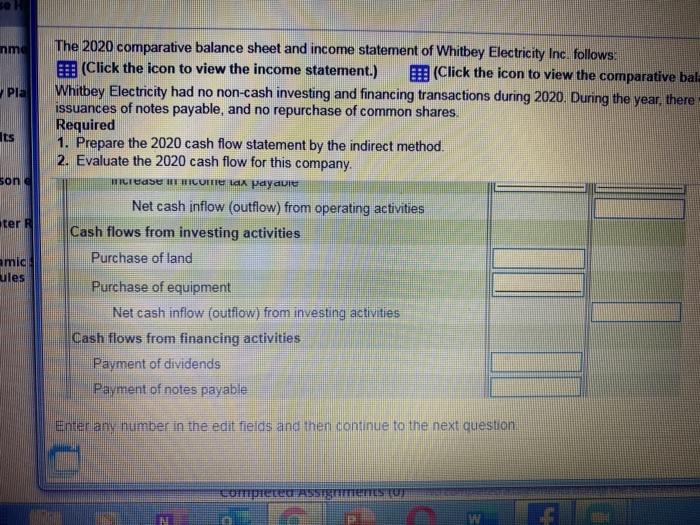

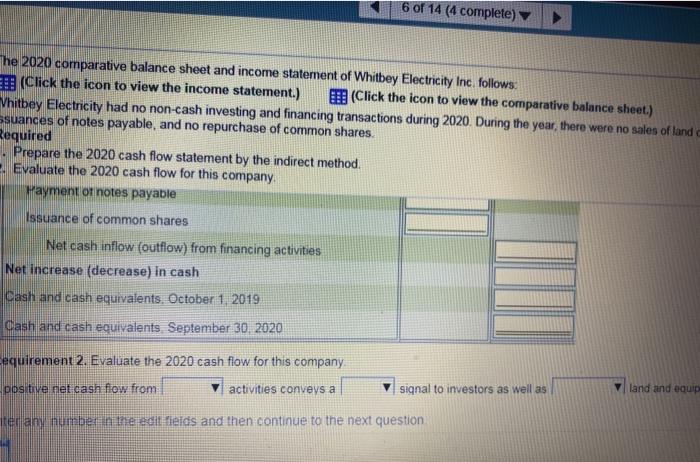

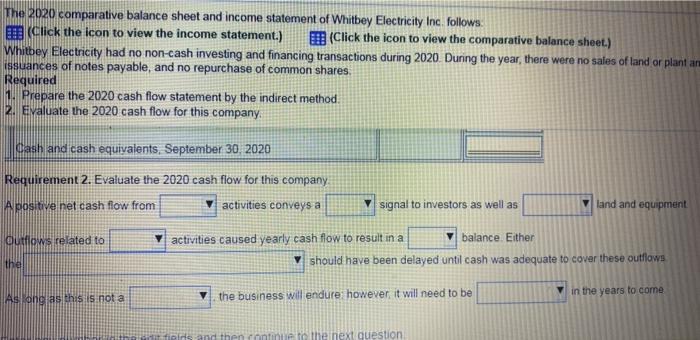

The 2020 comparative balance sheet and income statement of Whitbey Electricity Inc. follows: (Click the icon to view the income statement.) Click the icon to view the comparative balance sheet.) Whitbey Electricity had no non cash investing and financing transactions during 2020. During the year, there were no sales of land or plant and equipment, no issuances of notes payable, and no repurchase of common shares Required 1. Prepare the 2020 cash flow statement by the Indirect method 2. Evaluate the 2020 cash flow for this company Decrease in interest receivable Increase in inventory Decrease in prepaid expenses Decrease in accounts payable Decrease in interest payable Increase in salaries payable Degrease in lease abilities Increase in income tax payable Ented arm limbe 16 the edit fields and then continue to the next question Income statement - X balance sheet an view the income no non-cash inve able, and no repy ind or plant and equip ash flow statemer cash flow for this a Whitbey Electricity Inc. Income Statement For the Year Ended September 30, 2020 Revenues Sales revenue $ 4395,000 25.000 4,420.000 nterest receivable ventory prepaid expenses accounts payable interest pavable alaries pamable ease abilities Interest revenue Total revenues Expenses Cost of goods sold Salanes expense Amortization extens S 1990.000 828 000 271 000 lcome tax payable the eart malas ang Done Income statement - ve balance sheet an to view the income ad no non-cash inve wayable, and no repy Interest revenue 25.000 Indo cash flow statemer cash flow for this 4,420.000 Total revenues Expenses Cost of goods sold Salaries expense Amortization expense Other operating expenses Interest expense $ 1,990,000 828,000 interest receivable inventory prepaid expenses accounts payable interest payable salaries payable lease liabilities 271,000 509,000 248,000 169,000 Income tax expense Total expenses 4.015.000 S 405.000 Net income ncome tax payable the edit fields and Print Done i Comparative balance sheet - X ce shee the inca n-cash and no w state ow for ti Whitbey Electricity Inc. Balance Sheet September 30, 2020 and 2019 2020 receive 2019 Current assets Cash and cash equivalents $ expens 160,000 49,000 $ 429,000 Es paya Accounts receivable 439.000 7.800 10.600 911,000 997.000 payabil payable abilities Interest receivable Inventory Prepaid expenses Electrical equipment net 27,000 32.000 1,017 000 951000 ax pay fields Done i Comparative balance sheet ance shee v the inco non-cash and no Prepaid expenses Electrical equipment, net 27.000 32,000 How state flow for the 1,017,000 401,000 Land 951,000 212,000 Total assets $ 2,927,800 $2,715,600 st receive Current liabilities ary ad expeng $ 132,000 $ 65,000 nts paya 181.000 67,000 24 000 89,000 Accounts payable Interest payable Salanes payable Lease liabilities Income tax payable Long-term liabilities Anunla st payable e payable Liabilities 195.000 187,000 78,000 52 000 tax pay con it fields Done inco ash no $ 181,000 ate arti 67,000 Accounts payable Interest payable Salaries payable Lease liabilities Income tax payable Long-term liabilities Notes payable Shareholders' equity 132,000 $ 65,000 89,000 187,000 24,000 195,000 eive 73,000 52,000 eng 455.000 ayal 680.000 abl Common shares able 1,420,000 506.800 1.225.000 291,600 Retained earnings les $ S 2.927 800 $2.715,600 Total liabilities and shareholders' equity ay dis Print Done The 2020 comparative balance sheet and income statement of Whitbey Electricity Inc. follows: E! (Click the icon to view the income statement.) (Click the icon to view the comparative Whitbey Electricity had no non-cash investing and financing transactions during 2020. During the year, the issuances of notes payable, and no repurchase of common shares. Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the 2020 cash flow for this company. Net income Add (subtract) items that affect net income and cash flow differently: Amortization expense Decrease in accounts receivable Decrease in interest receivable Increase in inventory Decrease in prepaid expenses Enter any number in the edit fields and then continue to the next question TseH gnme Hy Pla The 2020 comparative balance sheet and income statement of Whitbey Electricity Inc. follows: !! (Click the icon to view the income statement.) E!! (Click the icon to view the comparative Whitbey Electricity had no non-cash investing and financing transactions during 2020. During the year, th issuances of notes payable, and no repurchase of common shares. Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the 2020 cash flow for this company. ults rson pter namic dules Decrease in interest receivable Increase in inventory Decrease in prepaid expenses Decrease in accounts payable Decrease in interest payable Increase in salanes payable Decrease in lease liabilities Increase in income tax payable Enter any number in the edit fields and then continue to the next question TS nme Pla Its son The 2020 comparative balance sheet and income statement of Whitbey Electricity Inc. follows: E: (Click the icon to view the income statement.) (Click the icon to view the comparative bal- Whitbey Electricity had no non-cash investing and financing transactions during 2020. During the year, there issuances of notes payable, and no repurchase of common shares Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the 2020 cash flow for this company muras HCOFE tax payable Net cash inflow (outflow) from operating activities Cash flows from investing activities Purchase of land Purchase of equipment Net cash inflow (outflow) from investing activities Cash flows from financing activities Payment of dividends Payment of notes payable ter amic ules Enter any number in the edit fields and then continue to the next question compieLELI ASSETTES TUT ma 6 of 14 (4 complete) The 2020 comparative balance sheet and income statement of Whitbey Electricity Inc follows: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Vhitbey Electricity had no non-cash investing and financing transactions during 2020. During the year, there were no sales of land ssuances of notes payable, and no repurchase of common shares Required Prepare the 2020 cash flow statement by the indirect method . Evaluate the 2020 cash flow for this company Payment of notes payable Issuance of common shares Net cash inflow (outflow) from financing activities Net increase (decrease) in cash Cash and cash equivalents. October 1 2019 Cash and cash equivalents September 30, 2020 equirement 2. Evaluate the 2020 cash flow for this company positive net cash flow from activities conveys a signal to investors as well as land and equip terany number in the edit fields and then continue to the next question The 2020 comparative balance sheet and income statement of Whitbey Electricity Inc. follows: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) Whitbey Electricity had no non-cash investing and financing transactions during 2020. During the year, there were no sales of land or plant an issuances of notes payable, and no repurchase of common shares Required 1. Prepare the 2020 cash flow statement by the indirect method. 2. Evaluate the 2020 cash flow for this company. Cash and cash equivalents, September 30, 2020 Requirement 2. Evaluate the 2020 cash flow for this company A positive net cash flow from activities conveys a signal to investors as well as land and equipment Outflows related to activities caused yearly cash flow to result in a V balance. Either should have been delayed until cash was adequate to cover these outflows the As long as this is not a the business will endure however it will need to be in the years to come it fields and then continue to the next