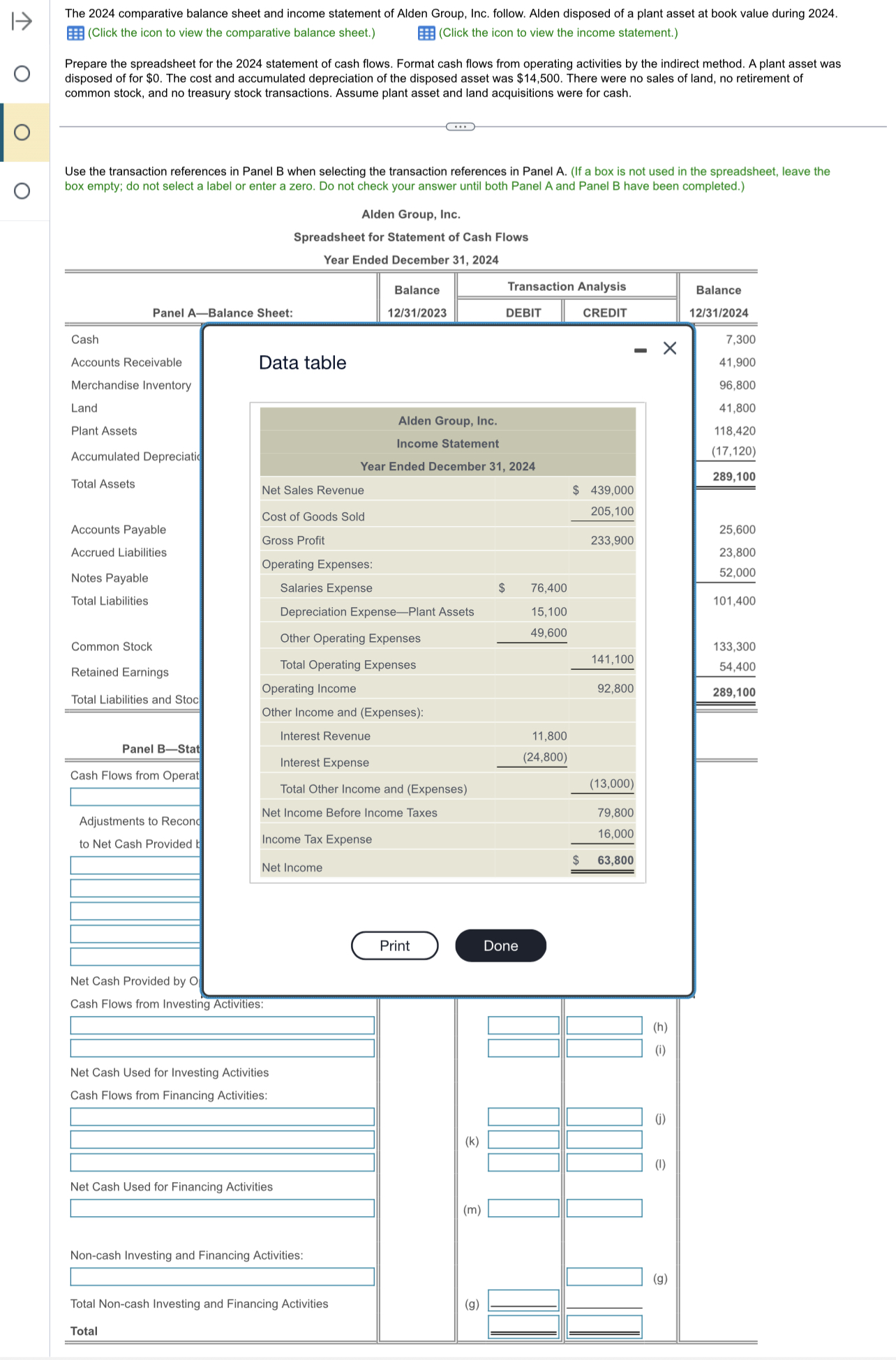

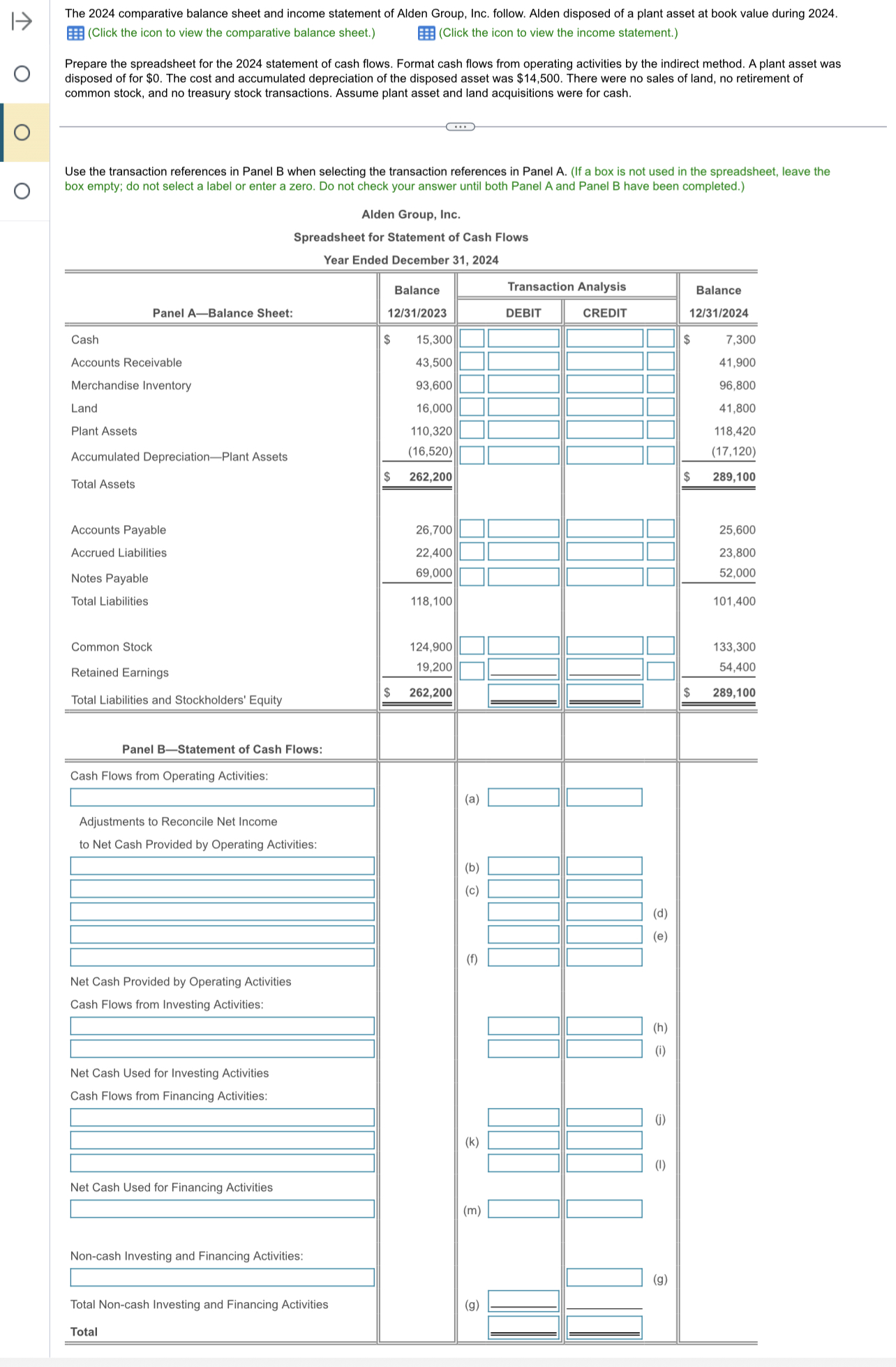

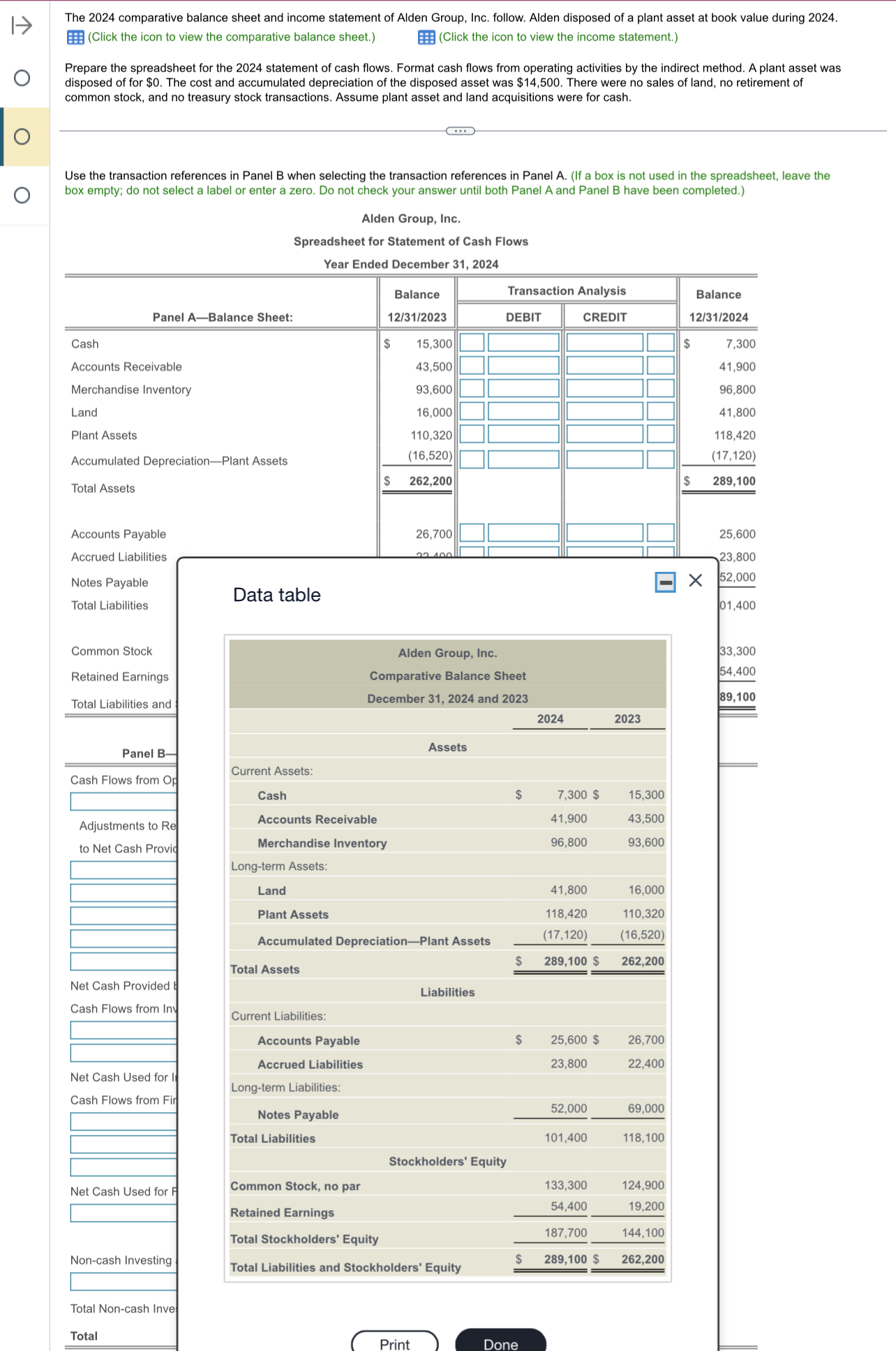

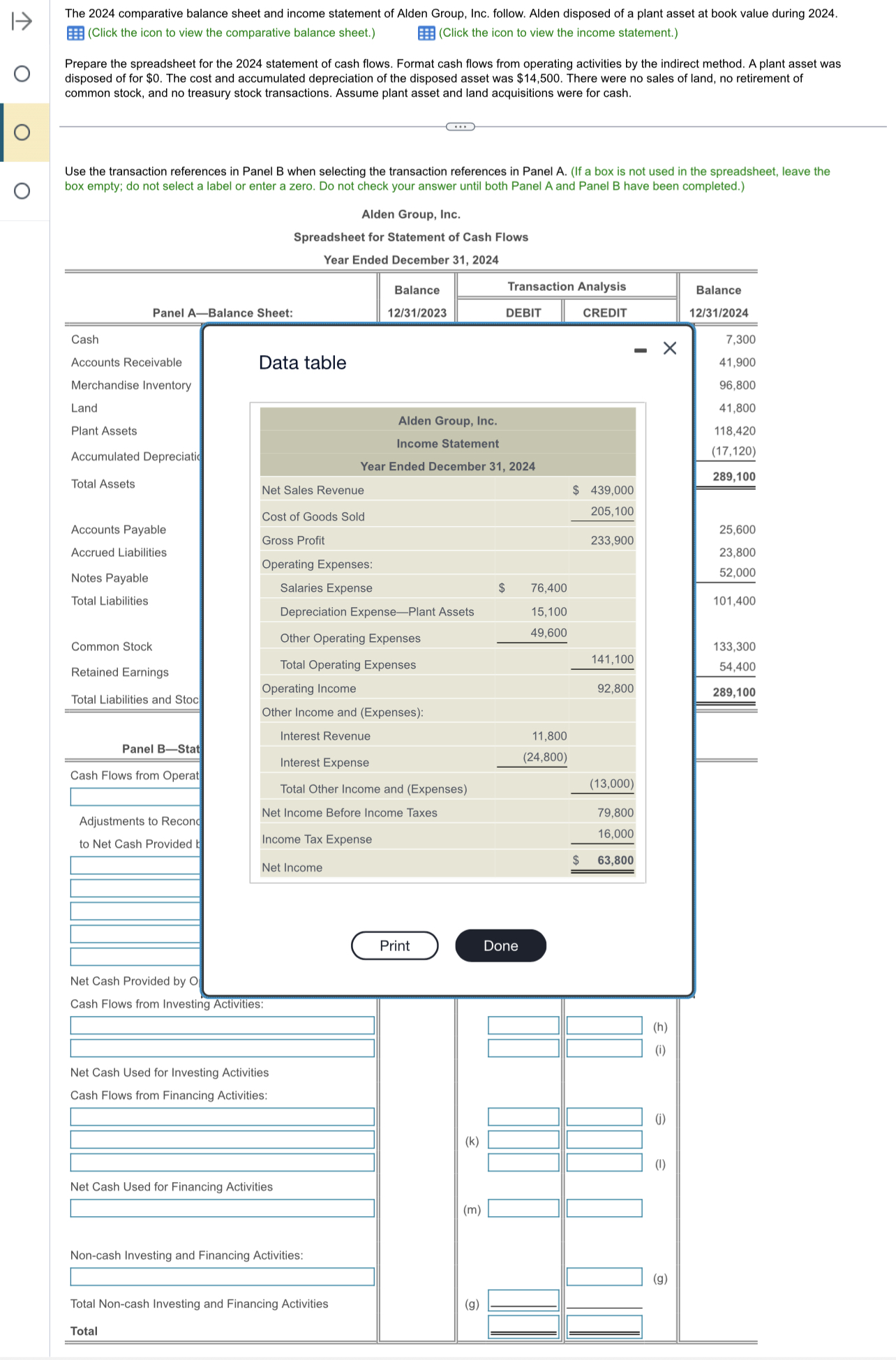

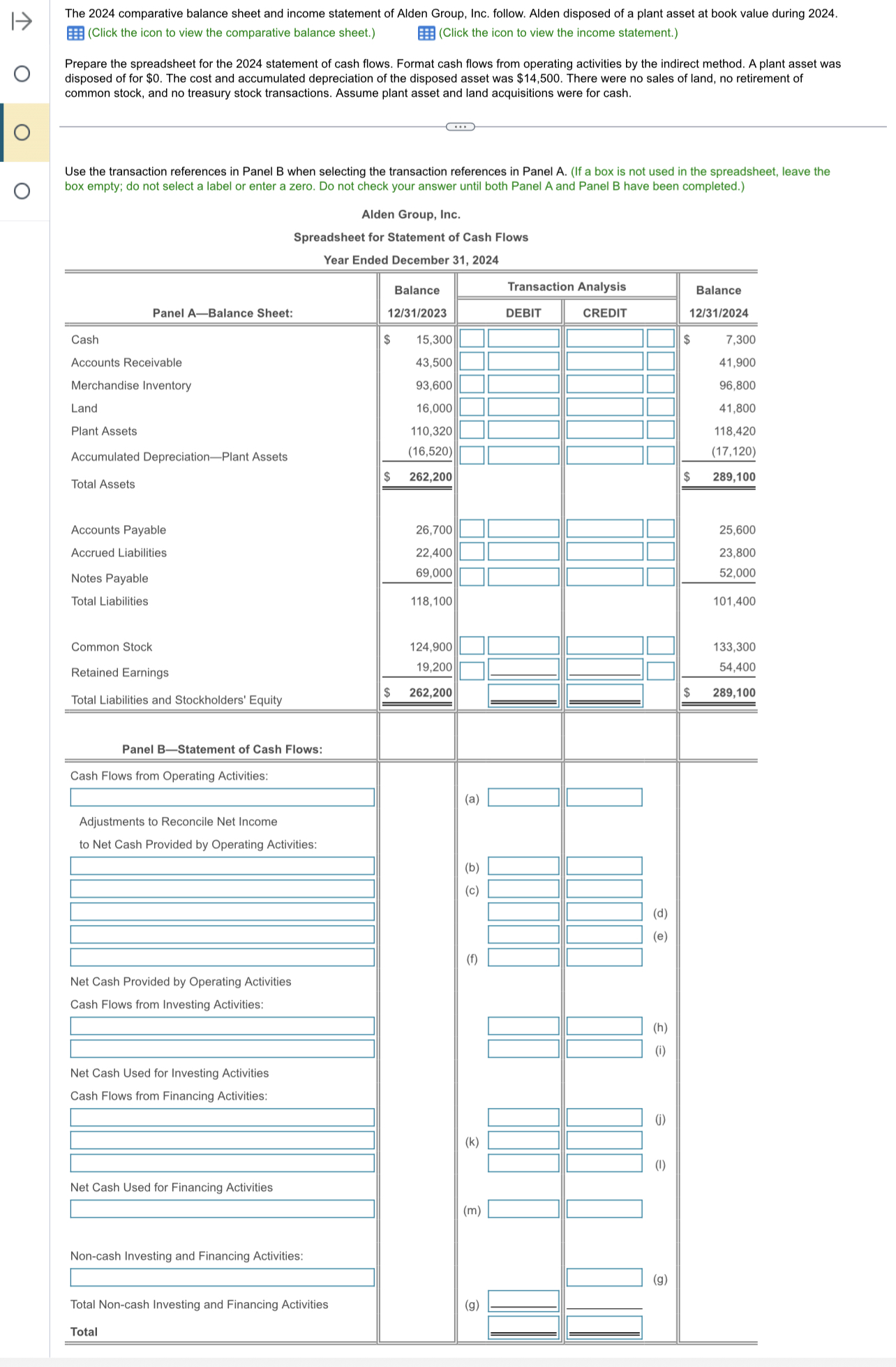

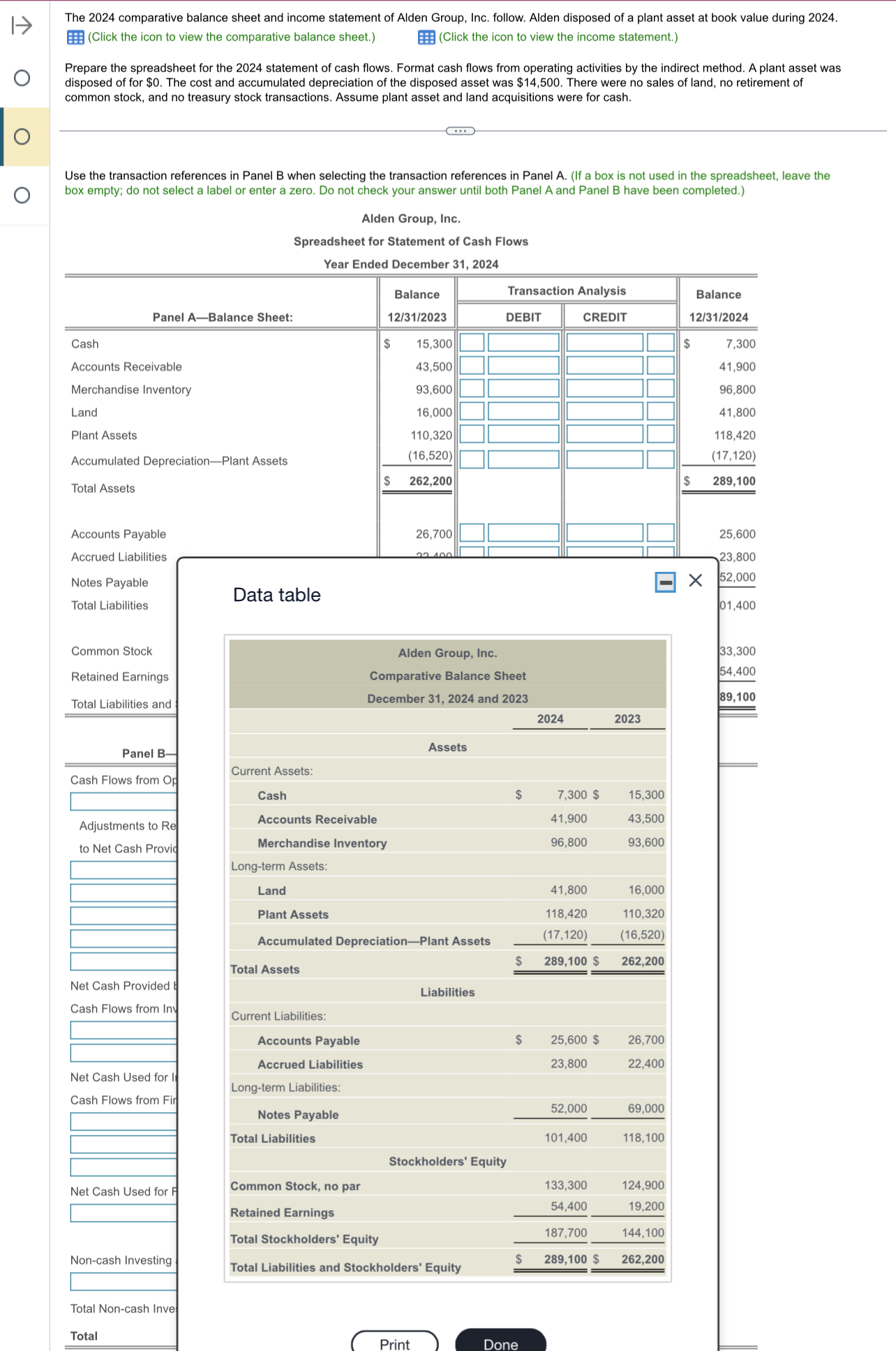

The 2024 comparative balance sheet and income statement of Alden Group, Inc. follow. Alden disposed of a plant asset at book value during 2024. (Click the icon to view the comparative balance sheet. 'Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $14,500. There were no sales of land, notirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. Use the transaction references in Panel B when selecting the transaction references in Panel A. (If a box is not used in the spreadsheet, leave the box empty; do not select a label or enter a zero. Do not check your answer until both Panel A and Panel B have been completed.) Alden Group, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2024 The 2024 comparative balance sheet and income statement of Alden Group, Inc. follow. Alden disposed of a plant asset at book value during 2024. (Click the icon to view the comparative balance sheet. (Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $14,500. There were no sales of land, notirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. leave the The 2024 comparative balance sheet and income statement of Alden Group, Inc. follow. Alden disposed of a plant asset at book value during 2024. (Click the icon to view the comparative balance sheet.) Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $14,500. There were no sales of land, no retirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. Use the transaction references in Panel B when selecting the transaction references in Panel A. (If a box is not used in the spreadsheet, leave the box empty; do not select a label or enter a zero. Do not check your answer until both Panel A and Panel B have been completed.) Alden Group, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2024 The 2024 comparative balance sheet and income statement of Alden Group, Inc. follow. Alden disposed of a plant asset at book value during 2024. (Click the icon to view the comparative balance sheet. 'Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $14,500. There were no sales of land, notirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. Use the transaction references in Panel B when selecting the transaction references in Panel A. (If a box is not used in the spreadsheet, leave the box empty; do not select a label or enter a zero. Do not check your answer until both Panel A and Panel B have been completed.) Alden Group, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2024 The 2024 comparative balance sheet and income statement of Alden Group, Inc. follow. Alden disposed of a plant asset at book value during 2024. (Click the icon to view the comparative balance sheet. (Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $14,500. There were no sales of land, notirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. leave the The 2024 comparative balance sheet and income statement of Alden Group, Inc. follow. Alden disposed of a plant asset at book value during 2024. (Click the icon to view the comparative balance sheet.) Click the icon to view the income statement.) Prepare the spreadsheet for the 2024 statement of cash flows. Format cash flows from operating activities by the indirect method. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $14,500. There were no sales of land, no retirement of common stock, and no treasury stock transactions. Assume plant asset and land acquisitions were for cash. Use the transaction references in Panel B when selecting the transaction references in Panel A. (If a box is not used in the spreadsheet, leave the box empty; do not select a label or enter a zero. Do not check your answer until both Panel A and Panel B have been completed.) Alden Group, Inc. Spreadsheet for Statement of Cash Flows Year Ended December 31, 2024