Answered step by step

Verified Expert Solution

Question

1 Approved Answer

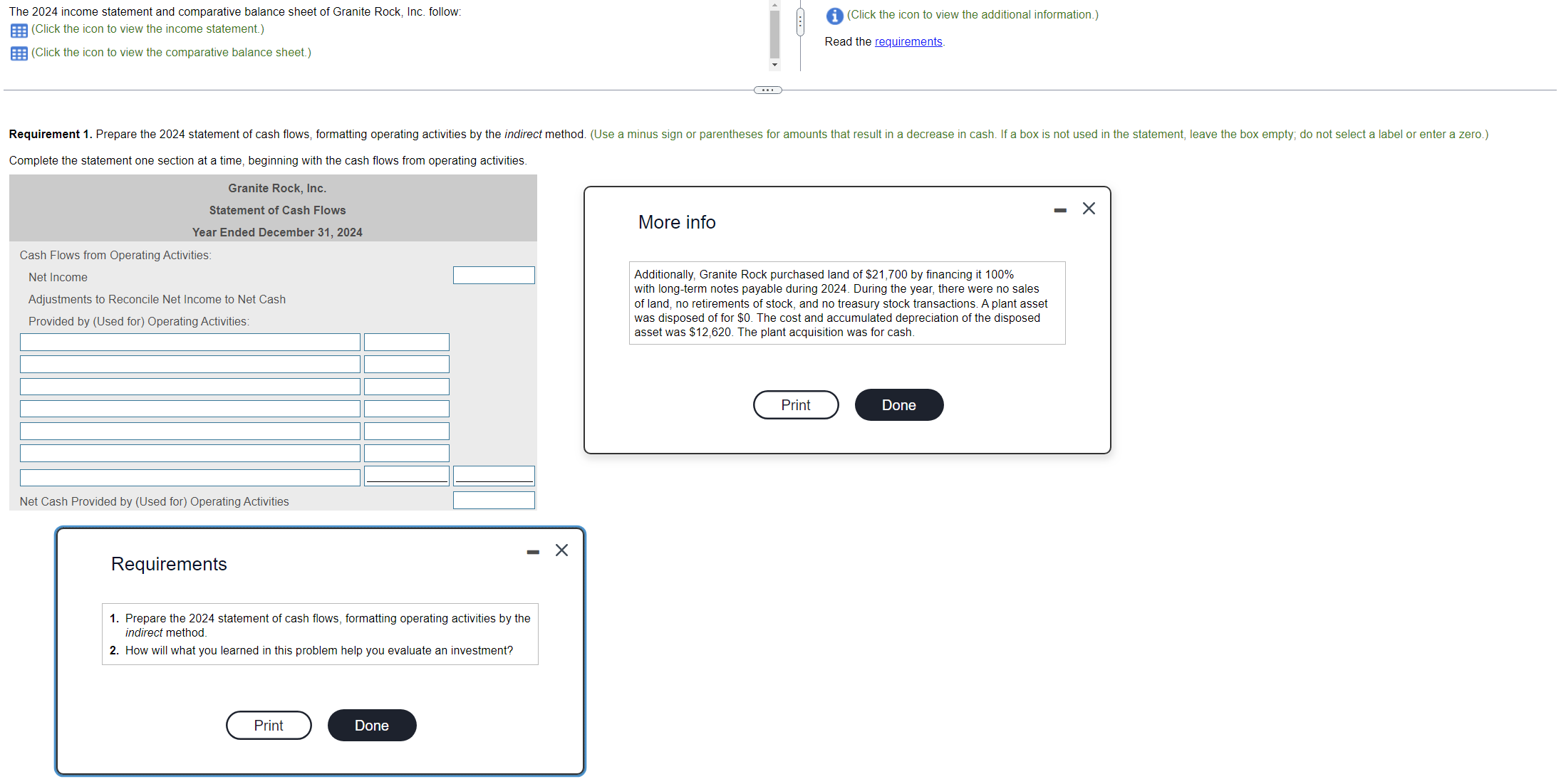

The 2024 income statement and comparative balance sheet of Granite Rock, Inc. follow: (Click the icon to view the income statement.) (Click the icon to

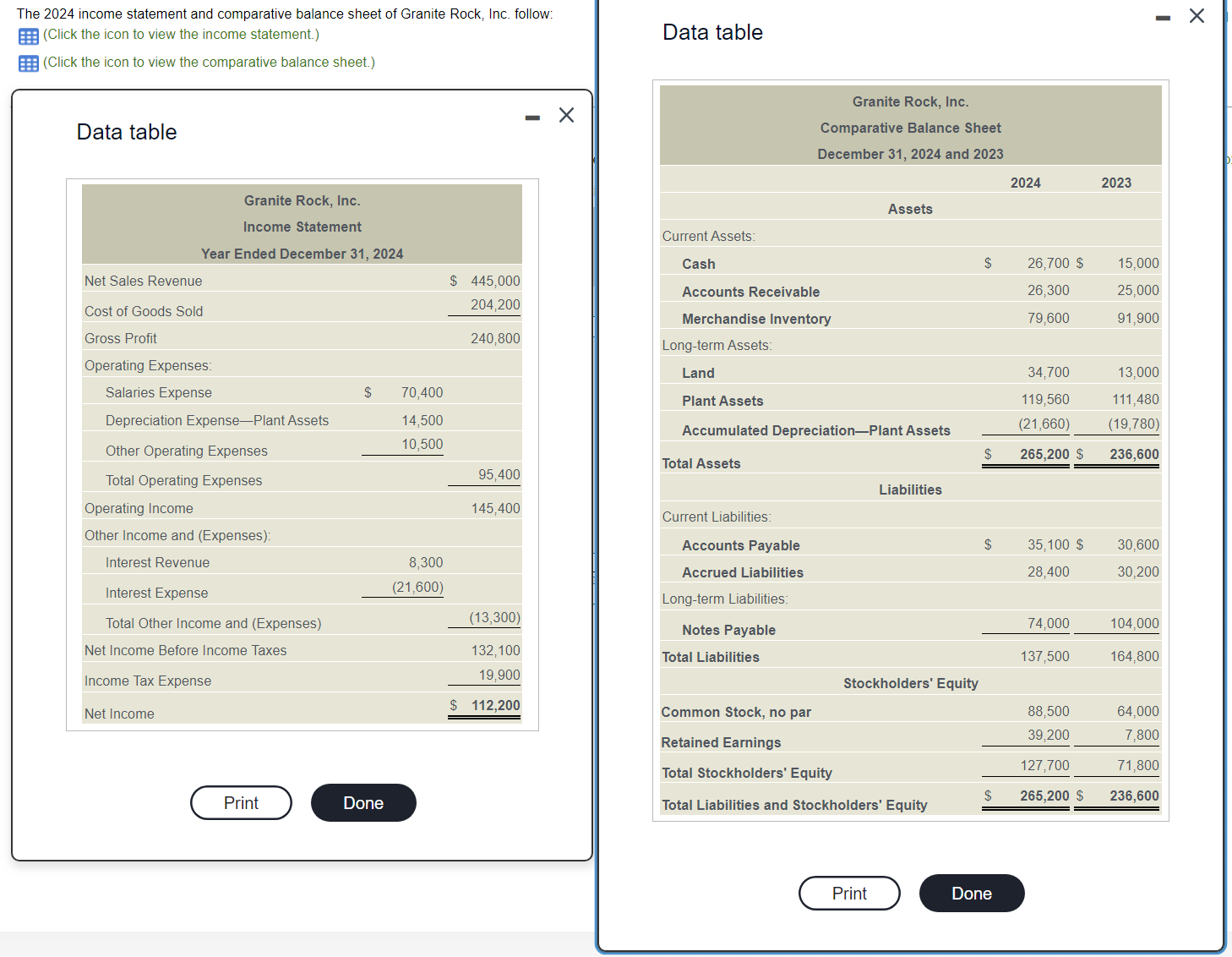

The 2024 income statement and comparative balance sheet of Granite Rock, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) (i) (Click the icon to view the additional information.) Read the requirements. Complete the statement one section at a time, beginning with the cash flows from operating activities. Requirements More info Additionally, Granite Rock purchased land of $21,700 by financing it 100% with long-term notes payable during 2024. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $12,620. The plant acquisition was for cash. 1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment? The 2024 income statement and comparative balance sheet of Granite Rock, Inc. follow: (Click the icon to view the income statement.) Data table (Click the icon to view the comparative balance sheet.) Data table

The 2024 income statement and comparative balance sheet of Granite Rock, Inc. follow: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) (i) (Click the icon to view the additional information.) Read the requirements. Complete the statement one section at a time, beginning with the cash flows from operating activities. Requirements More info Additionally, Granite Rock purchased land of $21,700 by financing it 100% with long-term notes payable during 2024. During the year, there were no sales of land, no retirements of stock, and no treasury stock transactions. A plant asset was disposed of for $0. The cost and accumulated depreciation of the disposed asset was $12,620. The plant acquisition was for cash. 1. Prepare the 2024 statement of cash flows, formatting operating activities by the indirect method. 2. How will what you learned in this problem help you evaluate an investment? The 2024 income statement and comparative balance sheet of Granite Rock, Inc. follow: (Click the icon to view the income statement.) Data table (Click the icon to view the comparative balance sheet.) Data table Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started