Answered step by step

Verified Expert Solution

Question

1 Approved Answer

the abbreviation are like taxes, social security and stuff your suppose to take the amount they make and multiply it by the abbreviations percents Prepare

the abbreviation are like taxes, social security and stuff your suppose to take the amount they make and multiply it by the abbreviations percents

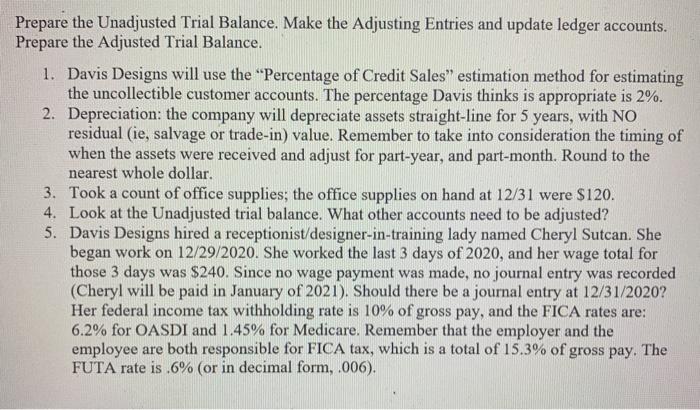

Prepare the Unadjusted Trial Balance. Make the Adjusting Entries and update ledger accounts. Prepare the Adjusted Trial Balance. 1. Davis Designs will use the "Percentage of Credit Sales" estimation method for estimating the uncollectible customer accounts. The percentage Davis thinks is appropriate is 2%. 2. Depreciation: the company will depreciate assets straight-line for 5 years, with NO residual (ie, salvage or trade-in) value. Remember to take into consideration the timing of when the assets were received and adjust for part-year, and part-month. Round to the nearest whole dollar. 3. Took a count of office supplies; the office supplies on hand at 12/31 were $120. 4. Look at the Unadjusted trial balance. What other accounts need to be adjusted? 5. Davis Designs hired a receptionist/designer-in-training lady named Cheryl Sutcan. She began work on 12/29/2020. She worked the last 3 days of 2020, and her wage total for those 3 days was $240. Since no wage payment was made, no journal entry was recorded (Cheryl will be paid in January of 2021). Should there be a journal entry at 12/31/2020? Her federal income tax withholding rate is 10% of gross pay, and the FICA rates are: 6.2% for OASDI and 1.45% for Medicare. Remember that the employer and the employee are both responsible for FICA tax, which is a total of 15.3% of gross pay. The FUTA rate is .6% (or in decimal form, .006). JOURNAL DATE ACCOUNT DEBIT CREDIT Prepare the Unadjusted Trial Balance. Make the Adjusting Entries and update ledger accounts. Prepare the Adjusted Trial Balance. 1. Davis Designs will use the "Percentage of Credit Sales" estimation method for estimating the uncollectible customer accounts. The percentage Davis thinks is appropriate is 2%. 2. Depreciation: the company will depreciate assets straight-line for 5 years, with NO residual (ie, salvage or trade-in) value. Remember to take into consideration the timing of when the assets were received and adjust for part-year, and part-month. Round to the nearest whole dollar. 3. Took a count of office supplies; the office supplies on hand at 12/31 were $120. 4. Look at the Unadjusted trial balance. What other accounts need to be adjusted? 5. Davis Designs hired a receptionist/designer-in-training lady named Cheryl Sutcan. She began work on 12/29/2020. She worked the last 3 days of 2020, and her wage total for those 3 days was $240. Since no wage payment was made, no journal entry was recorded (Cheryl will be paid in January of 2021). Should there be a journal entry at 12/31/2020? Her federal income tax withholding rate is 10% of gross pay, and the FICA rates are: 6.2% for OASDI and 1.45% for Medicare. Remember that the employer and the employee are both responsible for FICA tax, which is a total of 15.3% of gross pay. The FUTA rate is .6% (or in decimal form, .006). JOURNAL DATE ACCOUNT DEBIT CREDIT Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started