Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Transferring the policy to the ILIT will eliminate the chance that the proceeds will be included in Ryan's gross estate at Ryan's death. If the

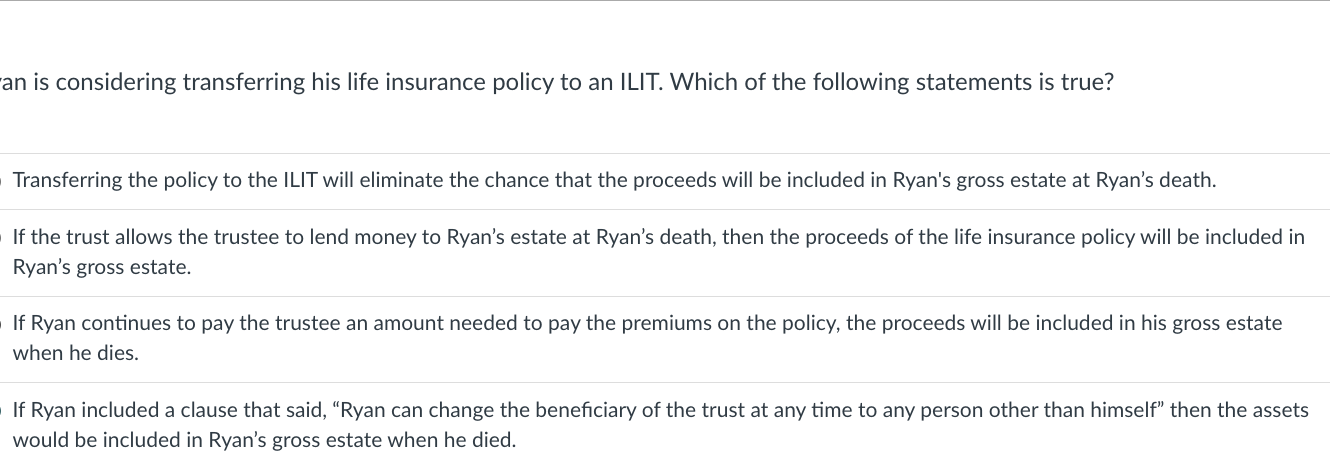

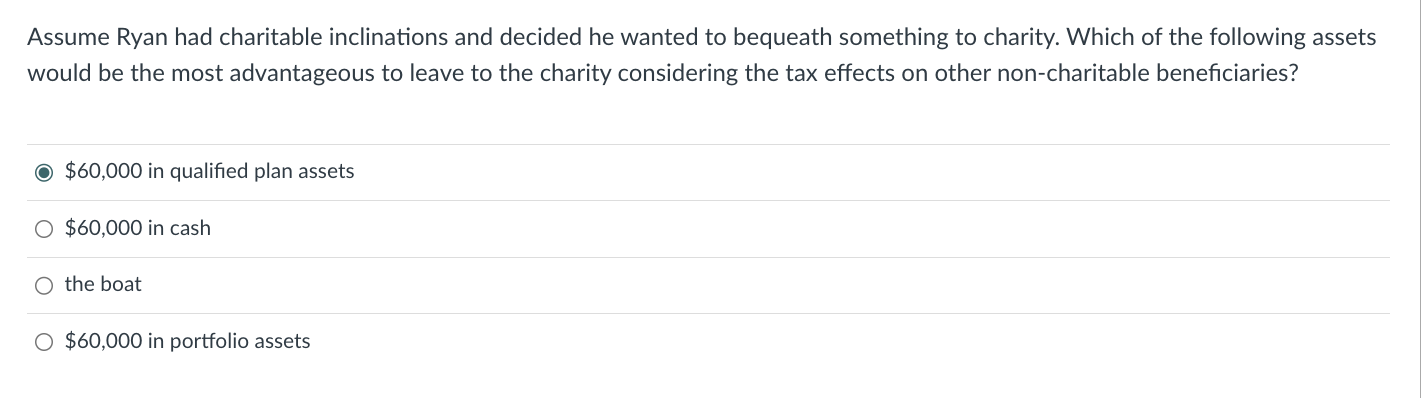

Transferring the policy to the ILIT will eliminate the chance that the proceeds will be included in Ryan's gross estate at Ryan's death. If the trust allows the trustee to lend money to Ryan's estate at Ryan's death, then the proceeds of the life insurance policy will be included in Ryan's gross estate. If Ryan continues to pay the trustee an amount needed to pay the premiums on the policy, the proceeds will be included in his gross estate when he dies. If Ryan included a clause that said, "Ryan can change the beneficiary of the trust at any time to any person other than himself" then the assets would be included in Ryan's gross estate when he died. Assume Ryan had charitable inclinations and decided he wanted to bequeath something to charity. Which of the following assets would be the most advantageous to leave to the charity considering the tax effects on other non-charitable beneficiaries? $60,000 in qualified plan assets $60,000 in cash the boat $60,000 in portfolio assets

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started