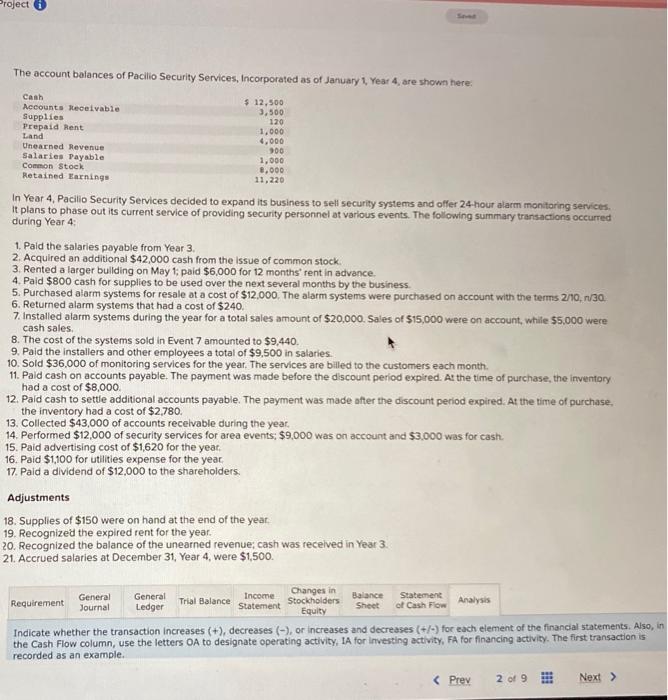

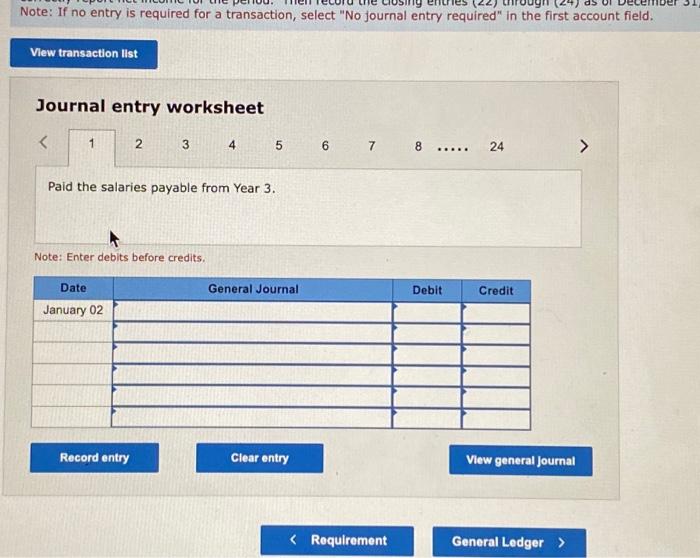

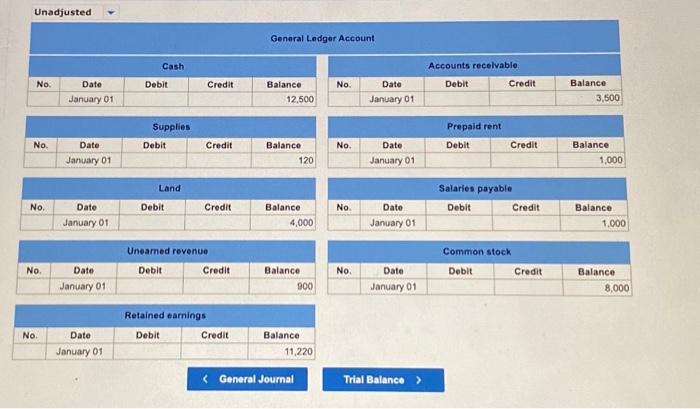

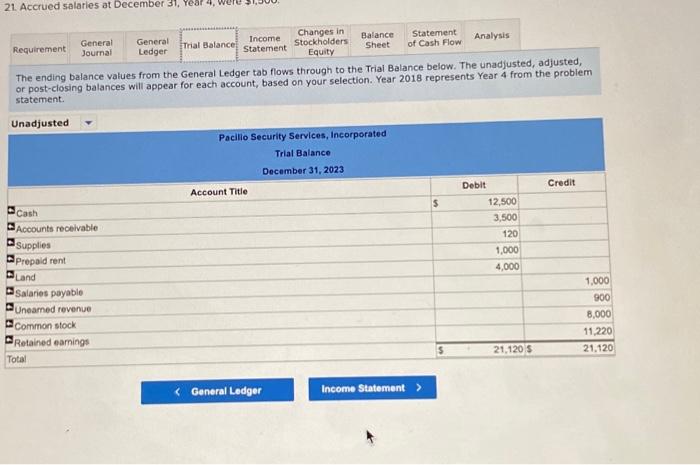

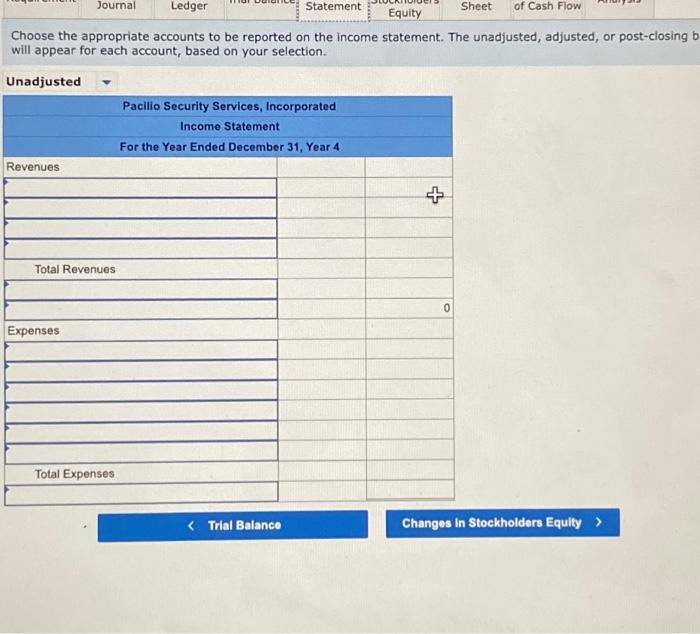

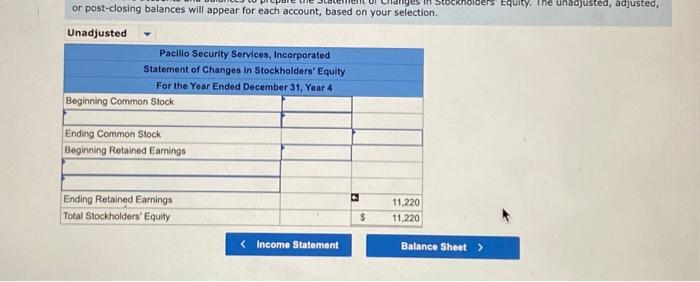

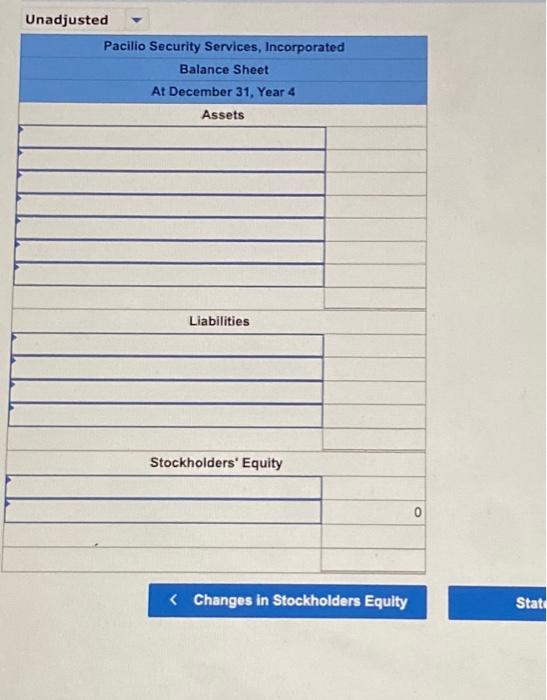

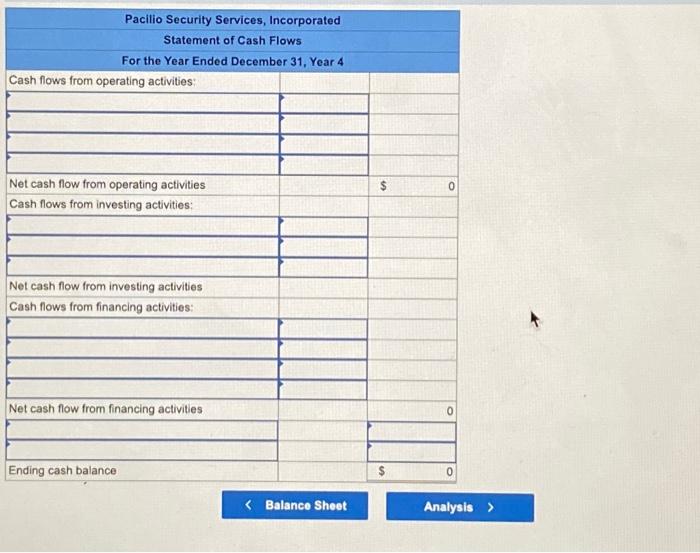

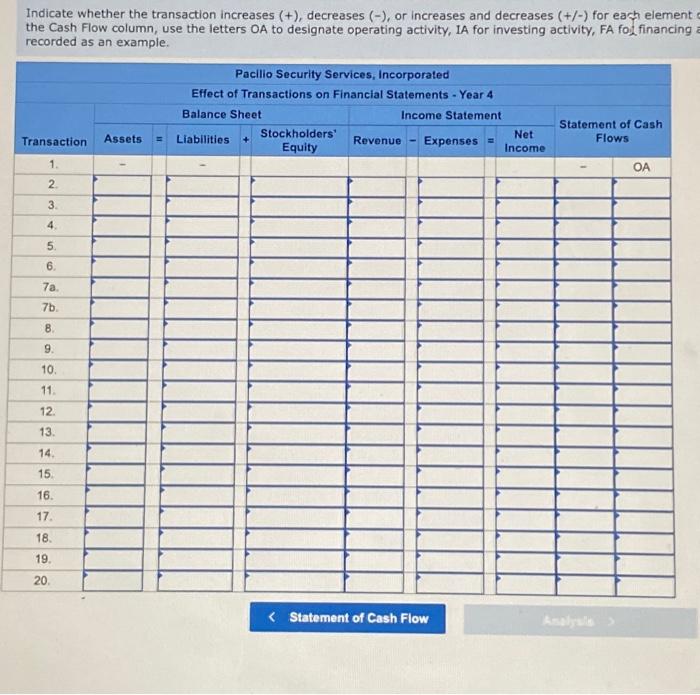

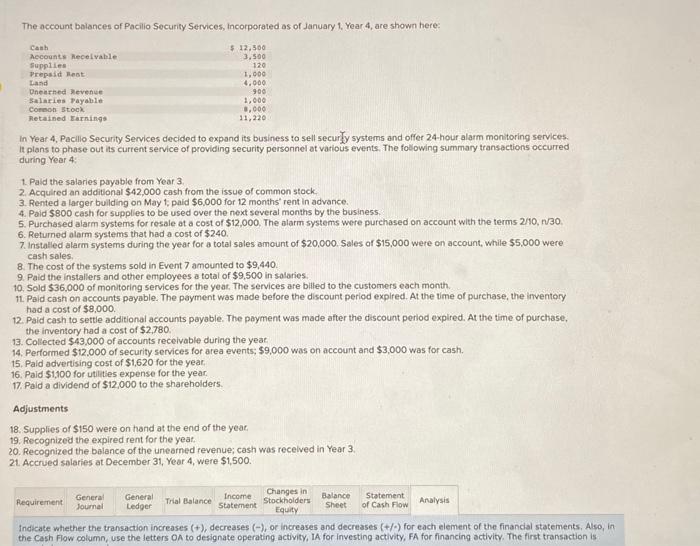

The account balances of Pacilio Security Services, Incorporated as of January 1, Year 4, are shown here: In Year 4, Pacilio Security Services decided to expand its business to sell security systems and offer 24 -hour alarm monitaring services. It plans to phase out its current service of providing security personnel at various events. The following summary transactions occurred during Year 4: 1. Paid the salaries payable from Year 3. 2. Acquired an additional \\( \\$ 42,000 \\) cash from the issue of common stock. 3. Rented a larger buliding on May 1; paid \\( \\$ 6,000 \\) for 12 month' rent in advance. 4. Paid \\( \\$ 800 \\) cash for supplies to be used over the next several months by the business. 5. Purchased alarm systems for resale at a cost of \\( \\$ 12,000 \\). The alarm systems were purchased on account with the terms \\( 2 / 10 \\), n/30. 6. Returned alarm systems that had a cost of \\( \\$ 240 \\). 7. Installed alarm systems during the year for a total sales amount of \\( \\$ 20,000 \\). Sales of \\( \\$ 15,000 \\) were on account, while \\( \\$ 5,000 \\) were cash sales. 8. The cost of the systems sold in Event 7 amounted to \\( \\$ 9,440 \\). 9. Paid the installers and other employees a total of \\( \\$ 9,500 \\) in salaries. 10. Sold \\( \\$ 36,000 \\) of monitoring services for the year. The services are billed to the customers each month. 11. Paid cash on accounts payable. The payment was made before the discount period expired. At the time of purchase, the inventory had a cost of \\( \\$ 8,000 \\). 12. Paid cash to settle additional accounts payable. The payment was made after the discount period expired. At the time of purchase, the inventory had a cost of \\( \\$ 2,780 \\). 13. Collected \\( \\$ 43,000 \\) of accounts recelvable during the year, 14. Performed \\( \\$ 12,000 \\) of security services for area events; \\( \\$ 9,000 \\) was on account and \\( \\$ 3,000 \\) was for cash. 15. Paid advertising cost of \\( \\$ 1,620 \\) for the year. 16. Paid \\( \\$ 1,100 \\) for utilities expense for the year 17. Paid a dividend of \\( \\$ 12,000 \\) to the shareholders. Adjustments 18. Supplies of \\( \\$ 150 \\) were on hand at the end of the year. 19. Recognized the expired rent for the year. 20. Recognized the balance of the unearned revenue; cash was recelved in Year 3 . 21. Accrued salaries at December 31 , Year 4 , were \\( \\$ 1,500 \\). Indicate whether the transaction increases \\( (+) \\), decreases \\( (-) \\), or increases and decreases \\( (+/-) \\) for each element of the financial \\( 5 t a t e m e n t s \\). Also, the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is recorded as an example. Note: If no entry is required for a transaction, select \"No journal entry required\" in the first account field. Journal entry worksheet Note: tncer aeoits Derore credits. General Ledger Account Unadjusted Pacilio Security Services, Incorporated Balance Sheet At December 31, Year 4 Assets Liabilities Stockholders' Equity Changes in Stockholders Equity Stat Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing will appear for each account, based on your selection. The account balances of Pacilio Security Services, incorporated as of January 1, Year 4, are shown here: it plans to phase out its curtent service of providing security personnel at various events. The folowing summary transactions occurred during Year 4 : 1. Paid the salaries payable from Year 3. 2. Acquired an additional \\( \\$ 42,000 \\) cash from the issue of common stock. 3. Rented a larger building on May 1; paid \\( \\$ 6.000 \\) for 12 months' rent in advance. 4. Paid \\( \\$ 800 \\) cash for supplies to be used over the next several months by the business. 5. Purchased alarm systems for resale at a cost of \\( \\$ 12,000 \\). The alarm systems were purchased on account with the terms \\( 2 / 10, n / 30 \\). 6. Returned alarm systems that had a cost of \\( \\$ 240 \\). 7. Installed alarm systems during the year for a total sales amount of \\( \\$ 20,000 \\). Sales of \\( \\$ 15,000 \\) were on account, while \\( \\$ 5,000 \\) were cash sales. 8. The cost of the systems sold in Event 7 amounted to \\( \\$ 9,440 \\). 9. Paid the installers and other employees a total of \\( \\$ 9,500 \\) in salaries: 10. Sold \\( \\$ 36,000 \\) of monitoring services for the yeat. The services are billed to the customers each month. 11. Paid cash on accounts payable. The payment was made before the discount period explred. At the time of purchase, the inventory had a cost of \\( \\$ 8,000 \\). 12. Paid cash to settle additional accounts payable. The payment was made after the discount period expired. At the time of purchase, the inventory had a cost of \\( \\$ 2,780 \\) 13. Collected \\( \\$ 43,000 \\) of accounts receivable during the yeat. 14. Performed \\( \\$ 12,000 \\) of security services for area events; \\( \\$ 9,000 \\) was on account and \\( \\$ 3,000 \\) was for cash. 15. Paid advertising cost of \\( \\$ 1,620 \\) for the year. 16. Paid \\( \\$ 1,100 \\) for utilities expense for the year. 17. Paid a dividend of \\( \\$ 12,000 \\) to the shareholders. Adjustments 18. Supplies of \\( \\$ 150 \\) were on hand at the end of the yeat. 19. Recognized the expired rent for the yeat. 20. Recognized the balance of the unearned revenue; cash was recelved in Year 3. 21. Accrued solaries at December 31, Year 4 , were \\( \\$ 1,500 \\). Indicate whether the transaction increases \\( (+) \\), decreases \\( (-) \\), or increases and decreases \\( (+/-) \\) for each element of the financial statements, Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is: The ending balance values from the General Ledger tab flows through to the Triai Balance below. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Year 2018 represents Year 4 from the problem statement. Unadjusted Indicate whether the transaction increases \\( (+) \\), decreases \\( (-) \\), or increases and decreases \\( (+/-) \\) for each element the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA fol financing