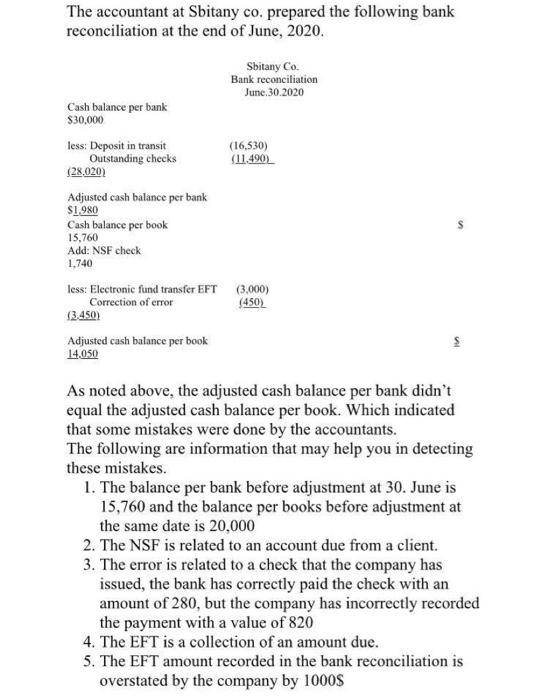

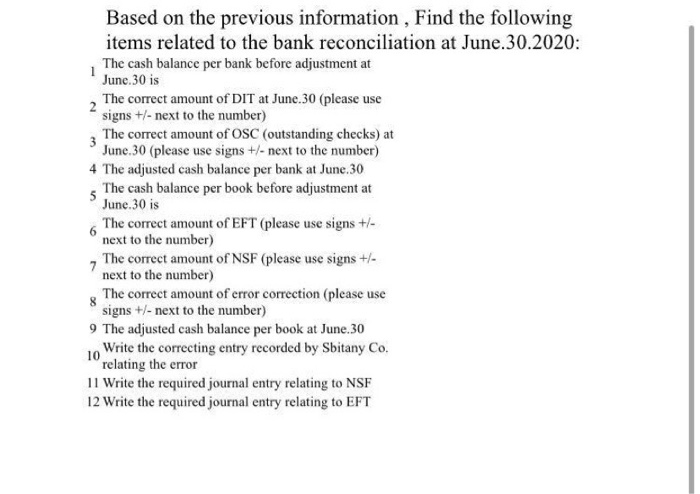

The accountant at Sbitany co. prepared the following bank reconciliation at the end of June, 2020. Sbitany Co. Bank reconciliation June 30.2020 Cash balance per bank $30,000 less: Deposit in transit (16,530) Outstanding checks (11.490) (28,020) Adjusted cash balance per bank $1,980 Cash balance per book 15,760 Add: NSF check 1,740 less: Electronic fund transfer EFT (3,000) Correction of error (450) (3.450) Adjusted cash balance per book 14.050 As noted above, the adjusted cash balance per bank didn't equal the adjusted cash balance per book. Which indicated that some mistakes were done by the accountants. The following are information that may help you in detecting these mistakes. 1. The balance per bank before adjustment at 30. June is 15,760 and the balance per books before adjustment at the same date is 20,000 2. The NSF is related to an account due from a client. 3. The error is related to a check that the company has issued, the bank has correctly paid the check with an amount of 280, but the company has incorrectly recorded the payment with a value of 820 4. The EFT is a collection of an amount due. 5. The EFT amount recorded in the bank reconciliation is overstated by the company by 1000$ Based on the previous information , Find the following items related to the bank reconciliation at June 30.2020: The cash balance per bank before adjustment at June 30 is 2 The correct amount of DIT at June.30 (please use signs +/- next to the number) The correct amount of OSC (outstanding checks) at 3 June 30 (please use signs +/- next to the number) 4 The adjusted cash balance per bank at June 30 The cash balance per book before adjustment at June 30 is 6 The correct amount of EFT (please use signs +/- next to the number) 7 The correct amount of NSF (please use signs +/- next to the number) The correct amount of error correction (please use 8 signs +/- next to the number) 9 The adjusted cash balance per book at June 30 10 Write the correcting entry recorded by Sbitany Co. relating the error 11 Write the required journal entry relating to NSF 12 Write the required journal entry relating to EFT