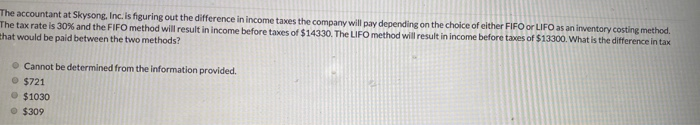

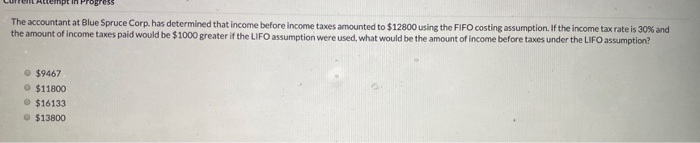

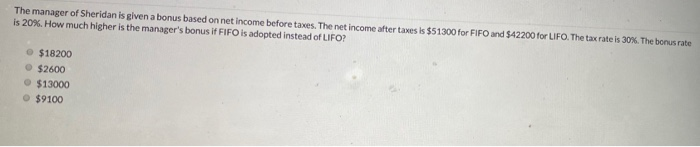

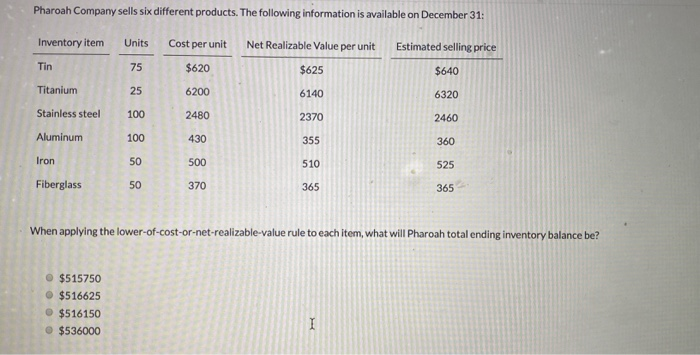

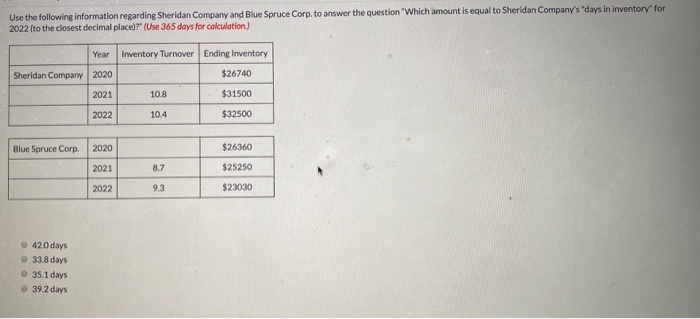

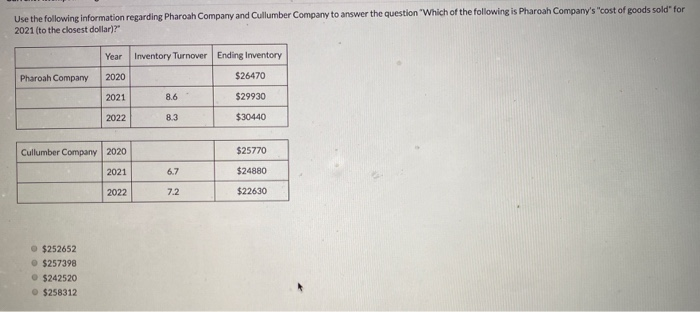

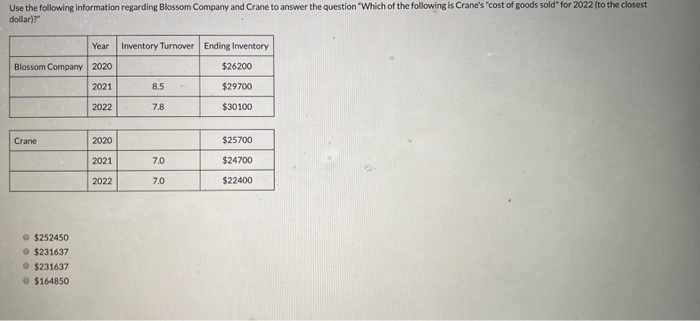

The accountant at Skysong, Inc. is figuring out the difference in income taxes the company will pay depending on the choice of either FIFO or LIFO as an inventory costing method. The tax rate is 30% and the FIFO method will result in income before taxes of $14330. The LIFO method will result in income before taves of $13300. What is the difference in tax chat would be paid between the two methods? Cannot be determined from the information provided. $721 $1030 $309 LU C In Progress The accountant at Blue Spruce Corp. has determined that income before income taxes amounted to $12800 using the FIFO costing assumption. If the income tax rate is 30% and the amount of income taxes paid would be $1000 greater if the LIFO assumption were used, what would be the amount of income before taxes under the LIFO assumption $9467 $11800 $16133 $13800 The manager of Sheridan is given a bonus based on net income before taxes. The net income after taxes is $51300 for FIFO and $42200 for LIFO. The tax rate is 30%. The bonus rate is 20%. How much higher is the manager's bonus if FIFO is adopted instead of LIFO? $18200 $2600 $13000 $9100 Pharoah Company sells six different products. The following information is available on December 31: Inventory item Units Cost per unit Net Realizable Value per unit Tin Estimated selling price $640 6320 2460 Titanium Stainless steel Aluminum Iron 525 Fiberglass 365 365 When applying or-net-realizable-value rule to each item, what will Pharoah total ending inventory balance be? $515750 $516625 $516150 $536000 Use the following information regarding Sheridan Company and Blue Spruce Corp. to answer the question 'Which amount is equal to Sheridan Company's days in inventory for 2022 (to the closest decimal place)?" (Use 365 days for calculation) Year Inventory Turnover Ending Inventory Sheridan Company 2020 $26740 10.8 $31500 2021 2022 10.4 $32500 Blue Spruce Corp. $26360 2020 2021 2022 $25250 9.3 $23030 420 days 33.8 days 35.1 days 39.2 days Use the following information regarding Pharoah Company and Cullumber Company to answer the question "Which of the following is Pharoah Company's "cost of goods sold" for 2021 (to the closest dollar)?" Inventory Turnover Ending Inventory Pharoah Company $26470 Year 2020 2021 2022 $29930 $30440 Cullumber Company 2020 $25770 2021 $24880 2022 72 $22630 $252652 $257398 $242520 $258312 Use the following information regarding Blossom Company and Crane to answer the question "Which of the following is Crane's "cost of goods sold for 2022 (to the closest dollar)? Inventory Turnover Year Blossom Company 2020 2021 Ending Inventory $26200 $29700 2022 7.8 $30100 $25700 2020 2021 2022 $24700 7.0 70 $22400 $252450 $231637 $231637 $164850