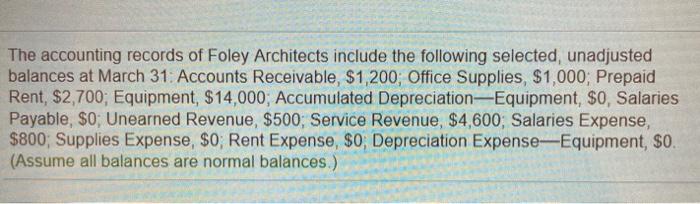

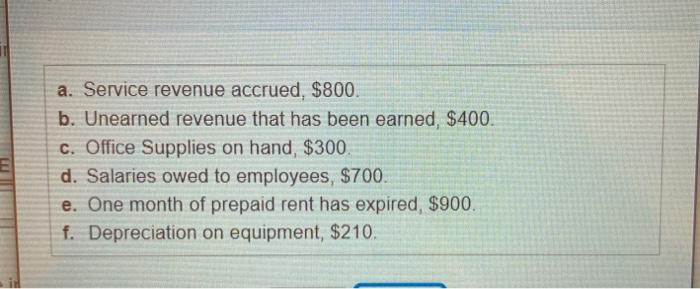

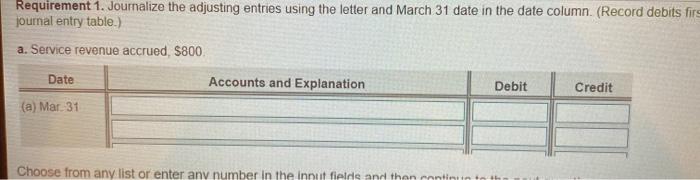

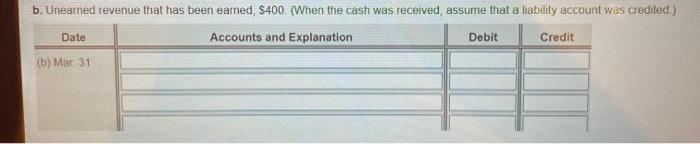

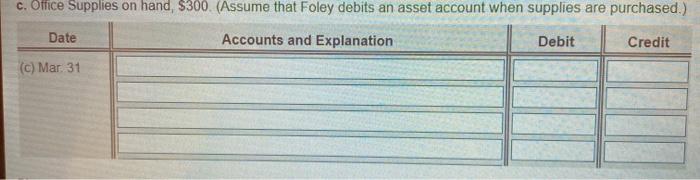

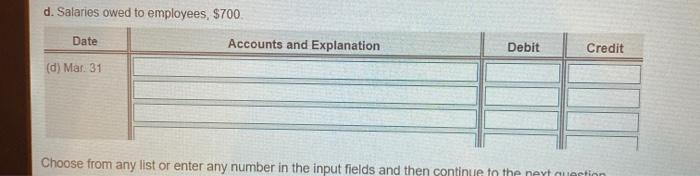

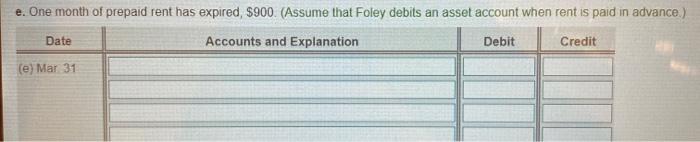

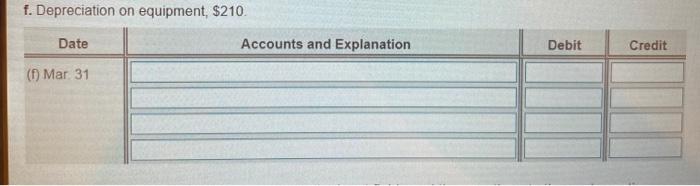

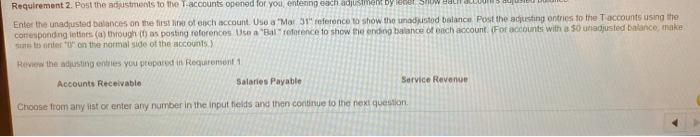

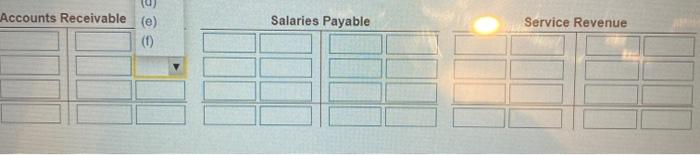

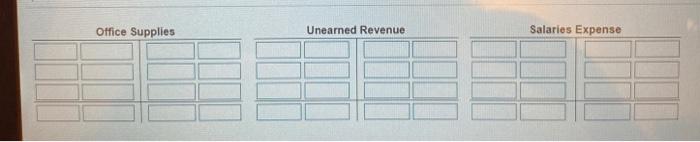

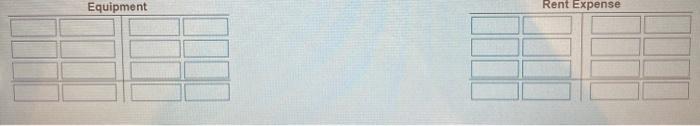

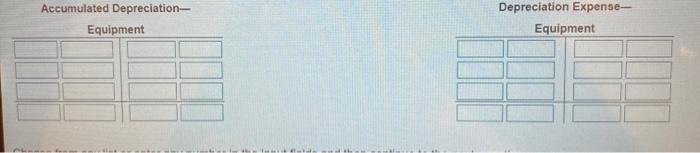

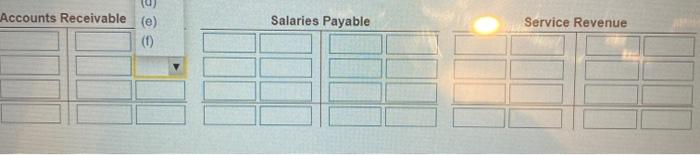

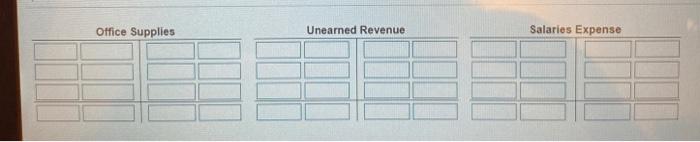

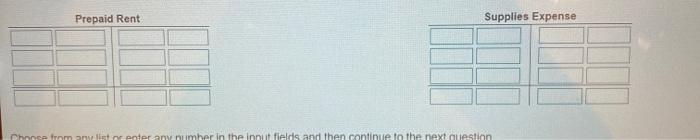

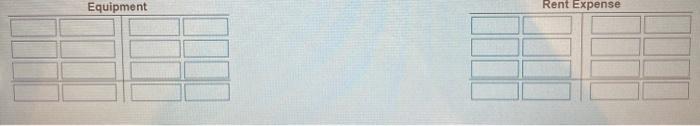

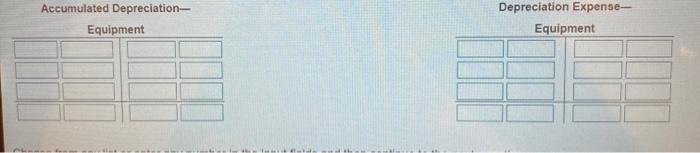

The accounting records of Foley Architects include the following selected, unadjusted balances at March 31: Accounts Receivable, $1,200, Office Supplies, $1,000; Prepaid Rent, $2,700; Equipment, $14,000; Accumulated Depreciation-Equipment, $o, Salaries Payable, $0; Unearned Revenue, $500, Service Revenue, $4,600; Salaries Expense, $800; Supplies Expense, $0, Rent Expense, $0, Depreciation Expense-Equipment, $0. (Assume all balances are normal balances.) E a. Service revenue accrued, $800. b. Unearned revenue that has been earned, $400. c. Office Supplies on hand $300. d. Salaries owed to employees, $700. e. One month of prepaid rent has expired, $900. f. Depreciation on equipment, $210, Requirement 1. Journalize the adjusting entries using the letter and March 31 date in the date column. (Record debits firs journal entry table.) a. Service revenue accrued, $800 Date Accounts and Explanation Debit Credit (a) Mar 31 Choose from any list or enter any number in the innut fields and then continuin to thi b. Unearned revenue that has been earned $400 (When the cash was received assume that a liability account was credited) Date Accounts and Explanation Debit Credit (b) Mar 31 c. Office Supplies on hand, $300. (Assume that Foley debits an asset account when supplies are purchased.) Date Accounts and Explanation Debit Credit (c) Mar 31 d. Salaries owed to employees, $700 Date Accounts and Explanation Debit Credit (d) Mar 31 Choose from any list or enter any number in the input fields and then continue in the neyt question e. One month of prepaid rent has expired, $900. (Assume that Foley debits an asset account when rent is paid in advance.) Date Accounts and Explanation Debit Credit (e) Mar 31 f. Depreciation on equipment, $210 Date Accounts and Explanation Debit Credit (1) Mar 31 Requirement 2. Post the adjustments to the accounts opened for you, entering each adjustment by lener Show Enter the unadjusted balances on the first line of each account. Use a "Mar 31" reference to show the unadjustod balance. Post the adjusting entries to the accounts using the coresponding letters (a) through as posting references Use a "Bal" reference to show the ending balance of ench account. (Fof accounts with a 50 unadjusted balance, make tanter or on the normal side of the accounts Review the distings you prepared in Requirement Accounts Receivable Salaries Payable Service Revenue Choose from any ist of enter any number in the input fields and then continue to the next question Accounts Receivable (e) (0) Salaries Payable Service Revenue Office Supplies Unearned Revenue Salaries Expense Prepaid Rent Supplies Expense Chance from an enter any number in the innuit fields and then continue to the next question Equipment Rent Expense Accumulated Depreciation- Equipment Depreciation Expense- Equipment