Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following transactions occurred during 2021 for the Beehive Honey Corporation: Feb. 1 Borrowed $29,000 from a bank and signed a note. Principal and interest

The following transactions occurred during 2021 for the Beehive Honey Corporation:

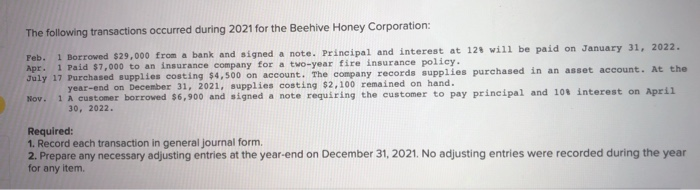

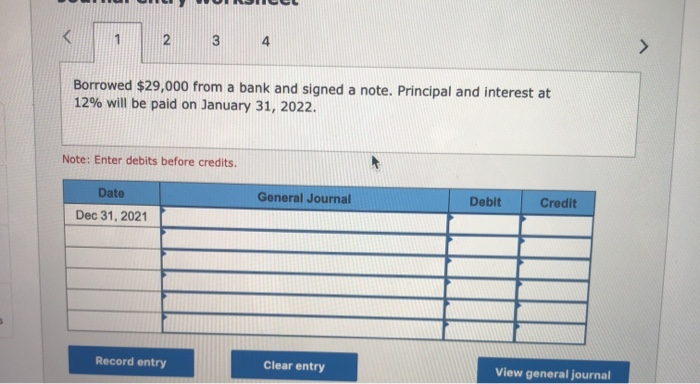

Feb.

1

Borrowed $29,000 from a bank and signed a note. Principal and interest at 12% will be paid on January 31, 2022.

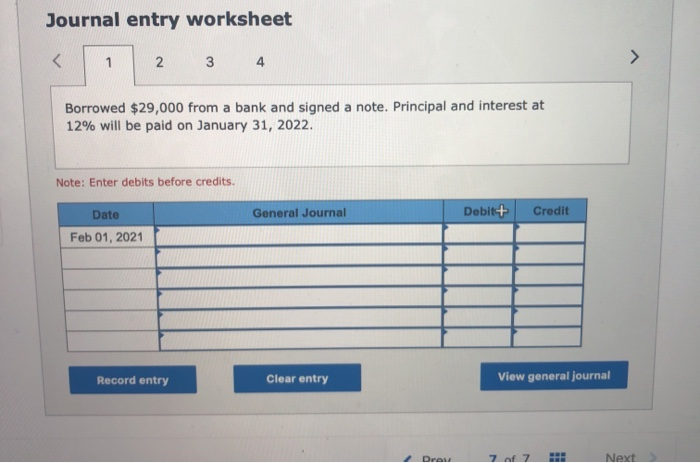

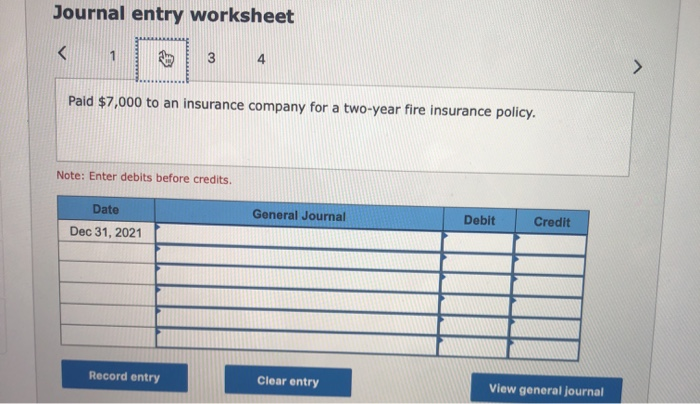

Apr.

1

Paid $7,000 to an insurance company for a two-year fire insurance policy.

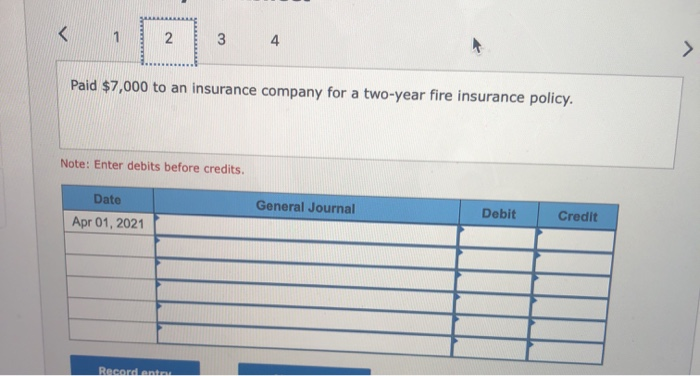

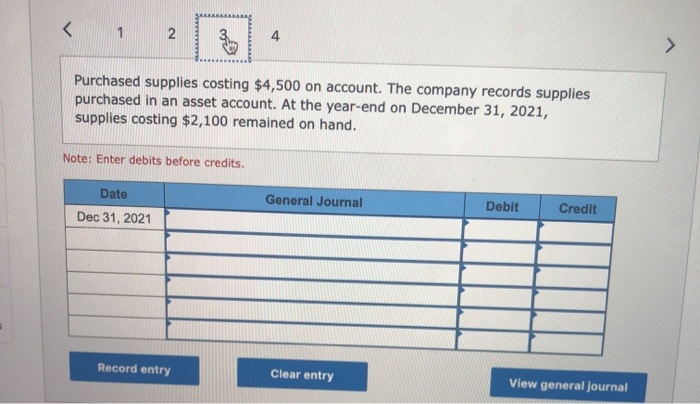

July

17

Purchased supplies costing $4,500 on account. The company records supplies purchased in an asset account. At the year-end on December 31, 2021, supplies costing $2,100 remained on hand.

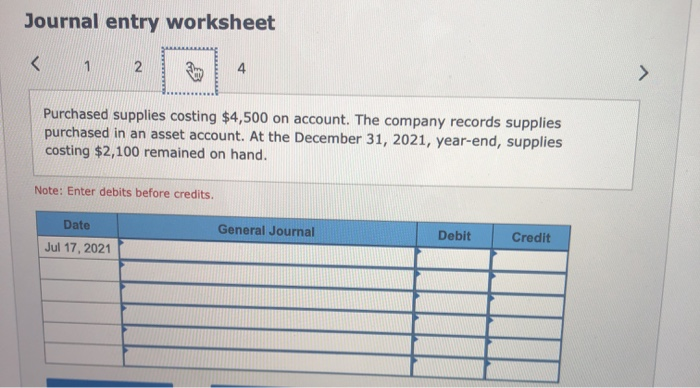

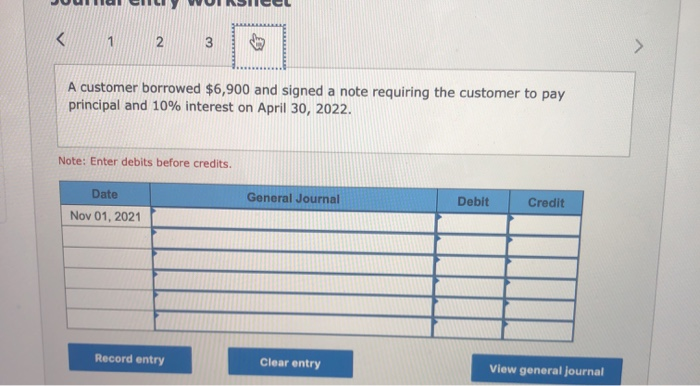

Nov.

1

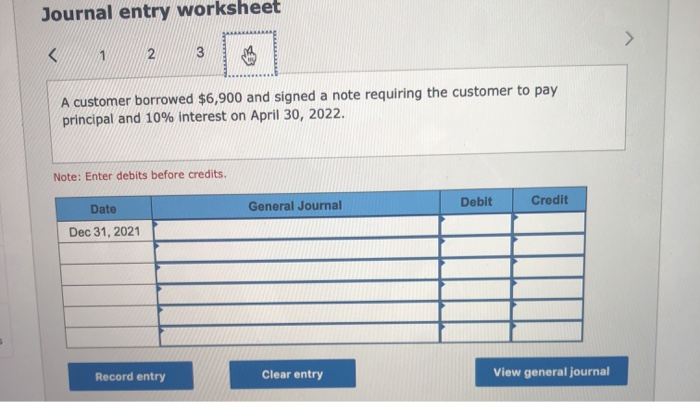

A customer borrowed $6,900 and signed a note requiring the customer to pay principal and 10% interest on April 30, 2022.

Required:

1. Record each transaction in general journal form.

2. Prepare any necessary adjusting entries at the year-end on December 31, 2021. No adjusting entries were recorded during the year for any item.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started