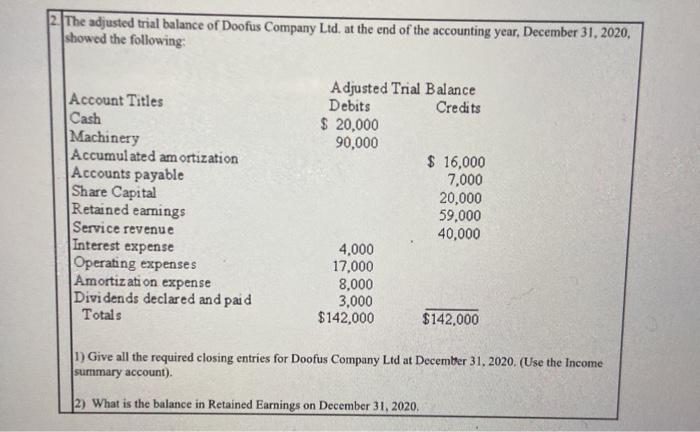

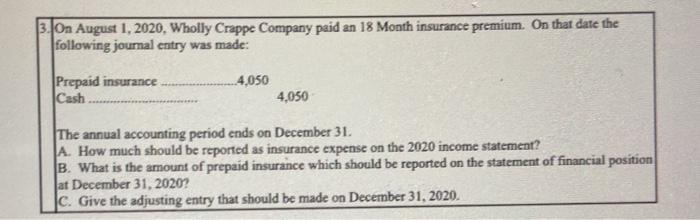

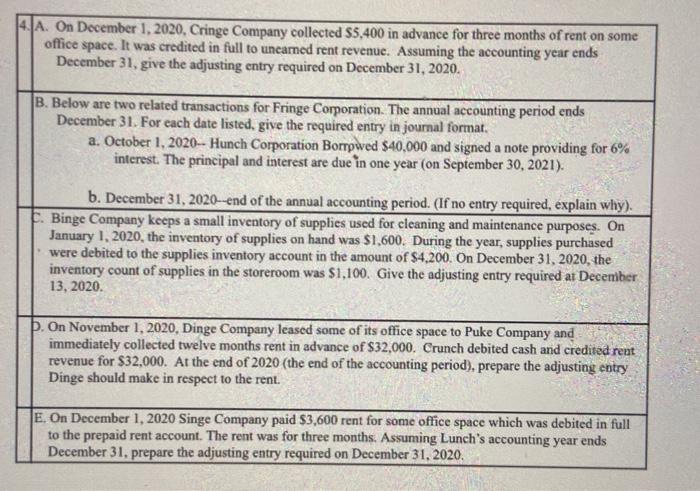

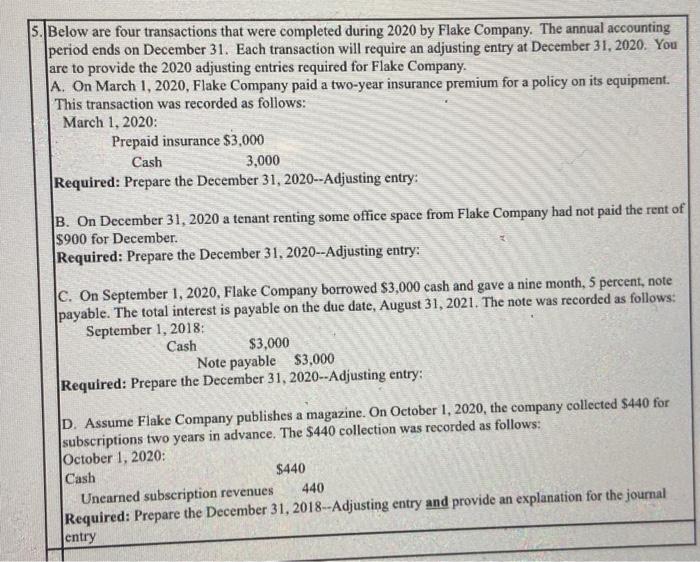

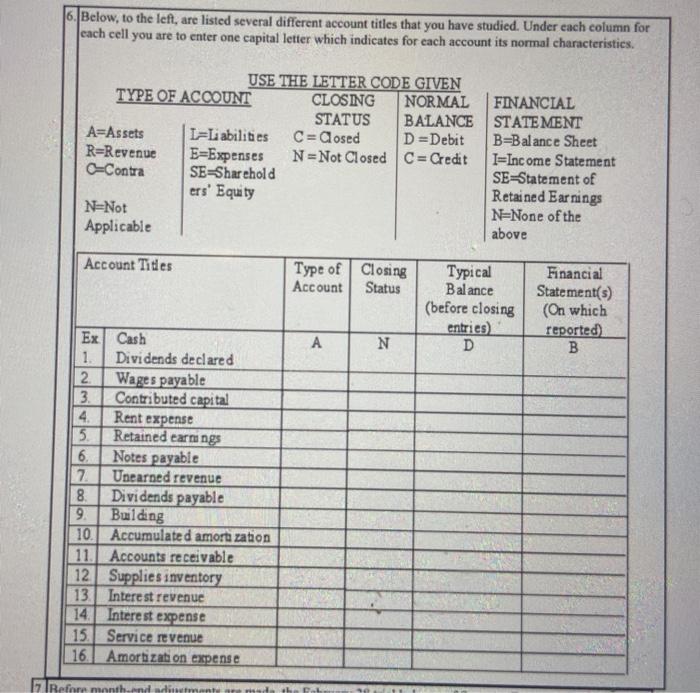

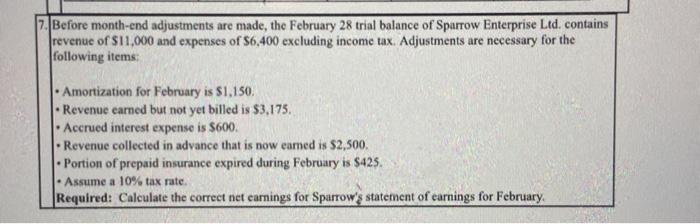

The adjusted trial balance of Doofus Company Ltd. at the end of the accounting year, December 31, 2020, showed the following: Account Titles Cash Machinery Accumulated amortization Accounts payable Share Capital Retained earnings Service revenue Interest expense Operating expenses Amortization expense Dividends declared and paid Totals Adjusted Trial Balance Debits Credits $ 20,000 90,000 $ 16,000 7,000 20,000 59,000 40,000 4,000 17,000 8,000 3,000 $142,000 $142.000 1) Give all the required closing entries for Doofus Company Ltd at December 31, 2020. (Use the Income summary account) 2) What is the balance in Retained Earnings on December 31, 2020, On August 1, 2020, Wholly Crappe Company paid an 18 Month insurance premium. On that date the following journal entry was made: 4,050 Prepaid insurance Cash 4,050 The annual accounting period ends on December 31. A. How much should be reported as insurance expense on the 2020 income statement? B. What is the amount of prepaid insurance which should be reported on the statement of financial position at December 31, 2020? C. Give the adjusting entry that should be made on December 31, 2020. 14. A. On December 1, 2020. Cringe Company collected $5,400 in advance for three months of rent on some office space. It was credited in full to uncared rent revenue. Assuming the accounting year ends December 31, give the adjusting entry required on December 31, 2020. B. Below are two related transactions for Fringe Corporation. The annual accounting period ends December 31. For each date listed, give the required entry in journal format. a. October 1, 2020-- Hunch Corporation Borrowed $40,000 and signed a note providing for 6% interest. The principal and interest are due in one year (on September 30, 2021). b. December 31, 2020--end of the annual accounting period. (If no entry required, explain why). F. Binge Company keeps a small inventory of supplies used for cleaning and maintenance purposes. On January 1, 2020, the inventory of supplies on hand was $1.600. During the year, supplies purchased were debited to the supplies inventory account in the amount of $4,200. On December 31, 2020, the inventory count of supplies in the storeroom was $1,100. Give the adjusting entry required at December 13, 2020 . On November 1, 2020, Dinge Company leased some of its office space to Puke Company and immediately collected twelve months rent in advance of $32,000. Crunch debited cash and credited rent revenue for $32,000. At the end of 2020 (the end of the accounting period), prepare the adjusting entry Dinge should make in respect to the rent. E. On December 1, 2020 Singe Company paid $3,600 rent for some office space which was debited in full to the prepaid rent account. The rent was for three months. Assuming Lunch's accounting year ends December 31, prepare the adjusting entry required on December 31, 2020. 5. Below are four transactions that were completed during 2020 by Flake Company. The annual accounting period ends on December 31. Each transaction will require an adjusting entry at December 31, 2020. You are to provide the 2020 adjusting entries required for Flake Company. A. On March 1, 2020, Flake Company paid a two-year insurance premium for a policy on its equipment. This transaction was recorded as follows: March 1, 2020: Prepaid insurance $3,000 Cash 3,000 Required: Prepare the December 31, 2020--Adjusting entry: B. On December 31, 2020 a tenant renting some office space from Flake Company had not paid the rent of $900 for December Required: Prepare the December 31, 2020--Adjusting entry: C. On September 1, 2020, Flake Company borrowed $3,000 cash and gave a nine month, 5 percent, note payable. The total interest is payable on the due date, August 31, 2021. The note was recorded as follows: September 1, 2018: Cash $3,000 Note payable $3,000 Required: Prepare the December 31, 2020--Adjusting entry: D. Assume Flake Company publishes a magazine. On October 1, 2020, the company collected $440 for subscriptions two years in advance. The $440 collection was recorded as follows: October 1, 2020: Cash $440 Unearned subscription revenues 440 Required: Prepare the December 31, 2018--Adjusting entry and provide an explanation for the journal entry 6.Below, to the left, are listed several different account titles that you have studied. Under each column for each cell you are to enter one capital letter which indicates for each account its normal characteristics. USE THE LETTER CODE GIVEN TYPE OF ACCOUNT CLOSING NORMAL FINANCIAL STATUS BALANCE STATEMENT A=Assets ILi abilities C=Cosed D =Debit B=Balance Sheet R=Revenue E=Expenses N=Not Closed C = Credit I=Income Statement -Contra SE-Sharehold SE=Statement of ers' Equity Retained Earnings N=Not N=None of the Applicable above Account Titles Type of Closing Account Status Typical Balance (before closing entries) D Financial Statement(s) (On which reported) B A N Rent expense JUNWN Ex Cash 1. Dividends declared 2. Wages payable 3. Contributed capital 4 5 Retained carmangs 6. Notes payable Unearned revenue 8. Dividends payable 9 Building 10. Accumulated amorta zation 11. Accounts receivable 12 Supplies inventory 13. Interest revenue 14. Interest expense 15. Service revenue 16. Amortization expense 17 Refore month and dimente 7. Before month-end adjustments are made, the February 28 trial balance of Sparrow Enterprise Ltd. contains revenue of $11,000 and expenses of $6,400 excluding income tax. Adjustments are necessary for the following items: Amortization for February is S1,150. Revenue earned but not yet billed is $3.175. Accrued interest expense is $600. - Revenue collected in advance that is now eamed is $2,500. Portion of prepaid insurance expired during February is $425. - Assume a 10% tax rate. Required: Calculate the correct net earnings for Sparrow's statement of earnings for February