Answered step by step

Verified Expert Solution

Question

1 Approved Answer

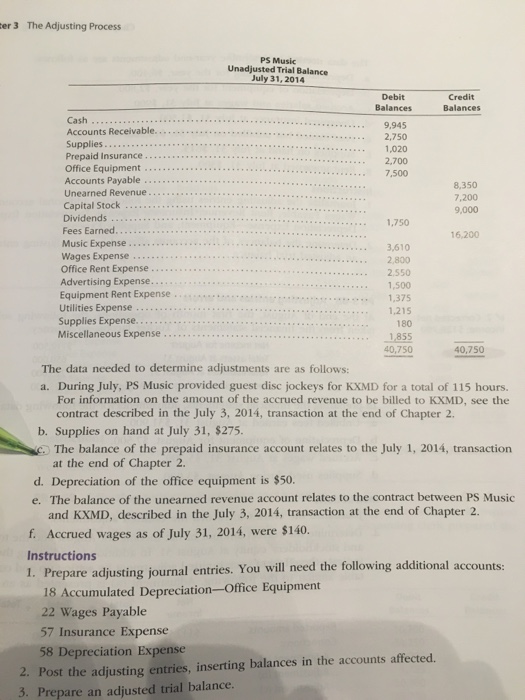

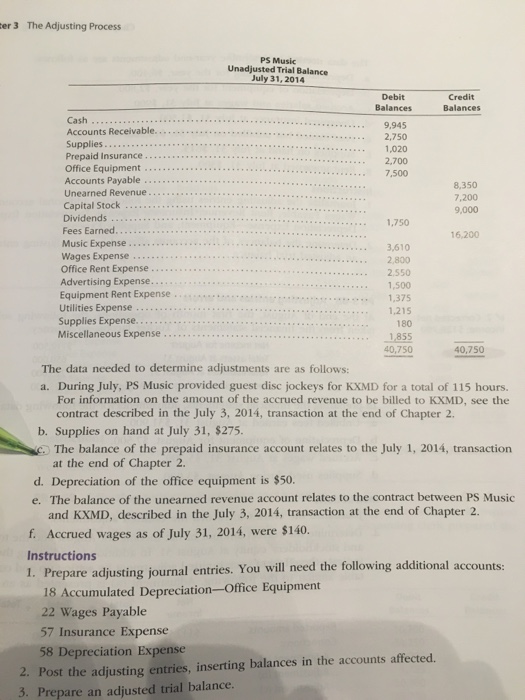

The Adjusting Process The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a

The Adjusting Process The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2014, transaction at the end of Chapter 2. b. Supplies on hand at July 31, $275. c. The balance of the prepaid insurance account relates to the July 1, 2014, transaction at the end of Chapter 2. d. Depreciation of the office equipment is $50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2014, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2014, were $140. Instructions Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation-Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense Post the adjusting entries, inserting balances in the accounts affected. Prepare an adjusted trial balance. The Adjusting Process The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2014, transaction at the end of Chapter 2. b. Supplies on hand at July 31, $275. c. The balance of the prepaid insurance account relates to the July 1, 2014, transaction at the end of Chapter 2. d. Depreciation of the office equipment is $50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2014, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2014, were $140. Instructions Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation-Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense Post the adjusting entries, inserting balances in the accounts affected. Prepare an adjusted trial balance

The Adjusting Process The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2014, transaction at the end of Chapter 2. b. Supplies on hand at July 31, $275. c. The balance of the prepaid insurance account relates to the July 1, 2014, transaction at the end of Chapter 2. d. Depreciation of the office equipment is $50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2014, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2014, were $140. Instructions Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation-Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense Post the adjusting entries, inserting balances in the accounts affected. Prepare an adjusted trial balance. The Adjusting Process The data needed to determine adjustments are as follows: a. During July, PS Music provided guest disc jockeys for KXMD for a total of 115 hours. For information on the amount of the accrued revenue to be billed to KXMD, see the contract described in the July 3, 2014, transaction at the end of Chapter 2. b. Supplies on hand at July 31, $275. c. The balance of the prepaid insurance account relates to the July 1, 2014, transaction at the end of Chapter 2. d. Depreciation of the office equipment is $50. e. The balance of the unearned revenue account relates to the contract between PS Music and KXMD, described in the July 3, 2014, transaction at the end of Chapter 2. f. Accrued wages as of July 31, 2014, were $140. Instructions Prepare adjusting journal entries. You will need the following additional accounts: 18 Accumulated Depreciation-Office Equipment 22 Wages Payable 57 Insurance Expense 58 Depreciation Expense Post the adjusting entries, inserting balances in the accounts affected. Prepare an adjusted trial balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started