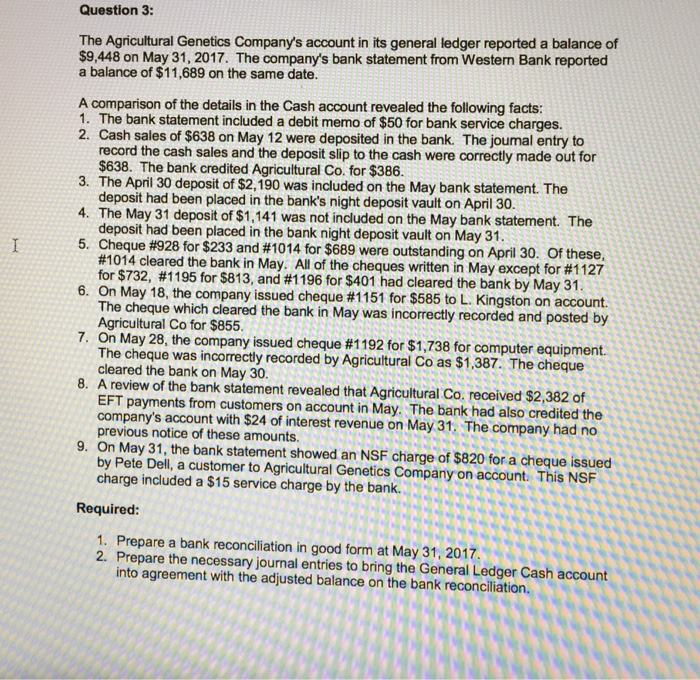

The Agricultural Genetics Company's account in its general ledger reported a balance of $9, 448 on May 31, 2017. The company's bank statement from Western Bank reported a balance of $11, 689 on the same date. A comparison of the details in the Cash account revealed the following facts: The bank statement included a debit memo of $50 for bank service charges. Cash sales of $638 on May 12 were deposited in the bank. The journal entry to record the cash sales and the deposit slip to the cash were correctly made out for $638. The bank credited Agricultural Co. for $386. The April 30 deposit of $2, 190 was included on the May bank statement. The deposit had been placed in the bank's night deposit vault on April 30. The May 31 deposit of $1, 141 was not included on the May bank statement. The deposit had been placed in the bank night deposit vault on May 31. Cheque $928 for $233 and #1014 for $689 were outstanding on April 30. Of these, #1014 cleared the bank in May. All of the cheques written in May except for #1127 for $732, #1195 for $813, and #1196 for $401 had cleared the bank by May 31. On May 18, the company issued cheque #1151 for $585 to L. Kingston on account. The cheque which cleared the bank in May was incorrectly recorded and posted by Agricultural Co for $855. On May 28, the company issued cheque #1192 for $1, 738 for computer equipment. The cheque was incorrectly recorded by Agricultural Co a $1, 738. The cheque cleared the bank on May 30. A review of the bank statement revealed that Agricultural Co. received $2, 382 of EFT payments from customers on account in May. The bank had also credited the company's account with $24 of interest revenue on May 31. The company had no previous notice of these amounts. On May 31, the bank statement showed an NSF charge of $820 for a cheque issued by Pete Dell, a customer to Agricultural Genetics Company on account. This NSF charge included a $15 service charge by the bank. Required: Prepare a bank reconciliation in good form at May 31, 2017. Prepare the necessary journal entries to bring the General Ledger Cash account into agreement with the adjusted balance on the bank reconciliation