Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Alberta Plumbing Company (APC) operates a plumbing repair business, with branches located throughout the province of Alberta. They saw improved performance in the

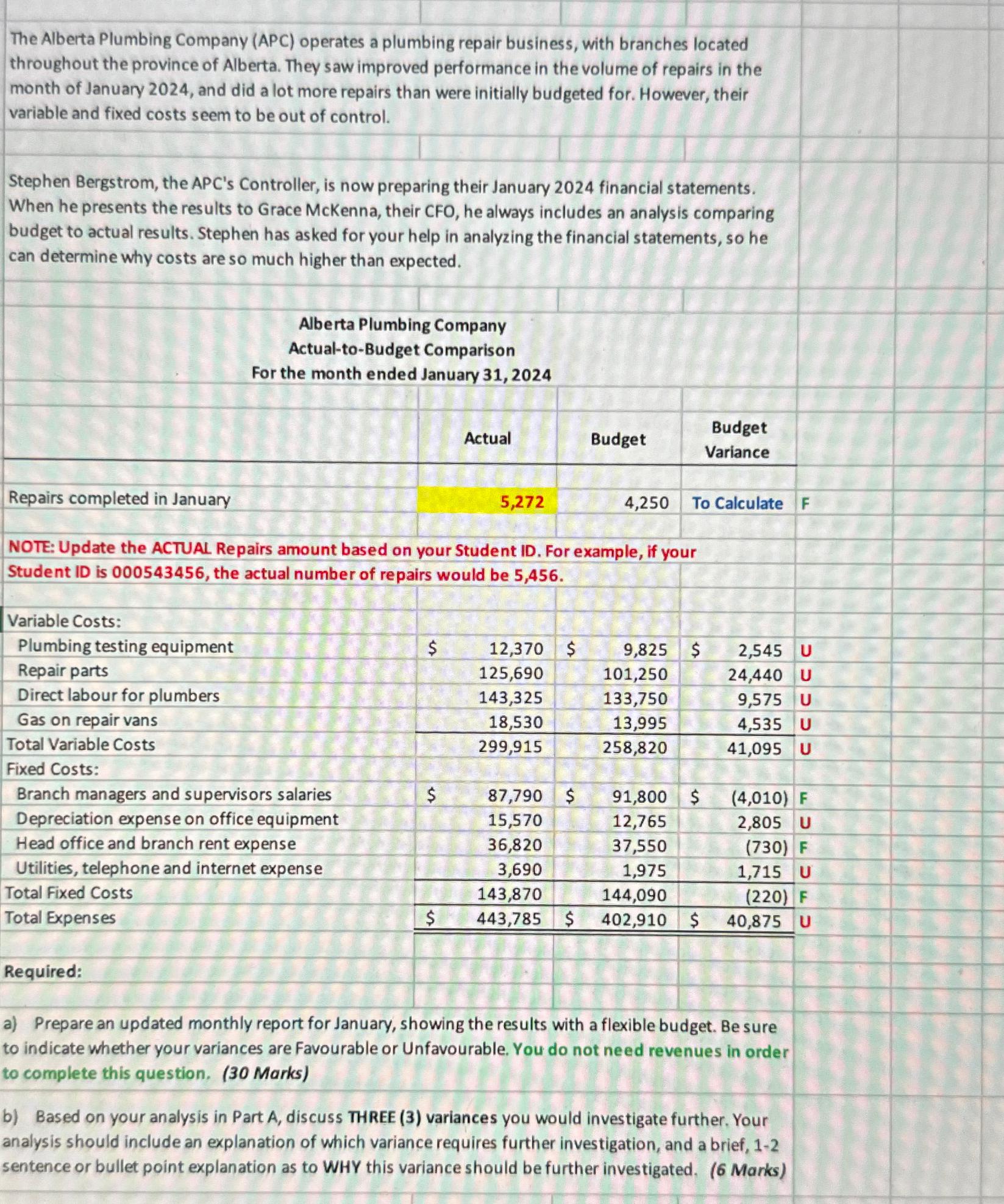

The Alberta Plumbing Company (APC) operates a plumbing repair business, with branches located throughout the province of Alberta. They saw improved performance in the volume of repairs in the month of January 2024, and did a lot more repairs than were initially budgeted for. However, their variable and fixed costs seem to be out of control. Stephen Bergstrom, the APC's Controller, is now preparing their January 2024 financial statements. When he presents the results to Grace McKenna, their CFO, he always includes an analysis comparing budget to actual results. Stephen has asked for your help in analyzing the financial statements, so he can determine why costs are so much higher than expected. Alberta Plumbing Company Actual-to-Budget Comparison For the month ended January 31, 2024 Repairs completed in January Actual Budget Budget Variance 5,272 4,250 To Calculate F NOTE: Update the ACTUAL Repairs amount based on your Student ID. For example, if your Student ID is 000543456, the actual number of repairs would be 5,456. Variable Costs: Plumbing testing equipment $ 12,370 $ 9,825 $ Repair parts 125,690 101,250 2,545 U 24,440 U Direct labour for plumbers 143,325 133,750 9,575 U Gas on repair vans 18,530 13,995 4,535 U Total Variable Costs 299,915 258,820 41,095 U Fixed Costs: Branch managers and supervisors salaries $ 87,790 $ 91,800 $ (4,010) F Depreciation expense on office equipment 15,570 12,765 2,805 U Head office and branch rent expense 36,820 37,550 (730) F Utilities, telephone and internet expense 3,690 1,975 1,715 U Total Fixed Costs 143,870 144,090 (220) F Total Expenses $ 443,785 $ 402,910 $ 40,875 U Required: a) Prepare an updated monthly report for January, showing the results with a flexible budget. Be sure to indicate whether your variances are Favourable or Unfavourable. You do not need revenues in order to complete this question. (30 Marks) b) Based on your analysis in Part A, discuss THREE (3) variances you would investigate further. Your analysis should include an explanation of which variance requires further investigation, and a brief, 1-2 sentence or bullet point explanation as to WHY this variance should be further investigated. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started